2.0 KiB

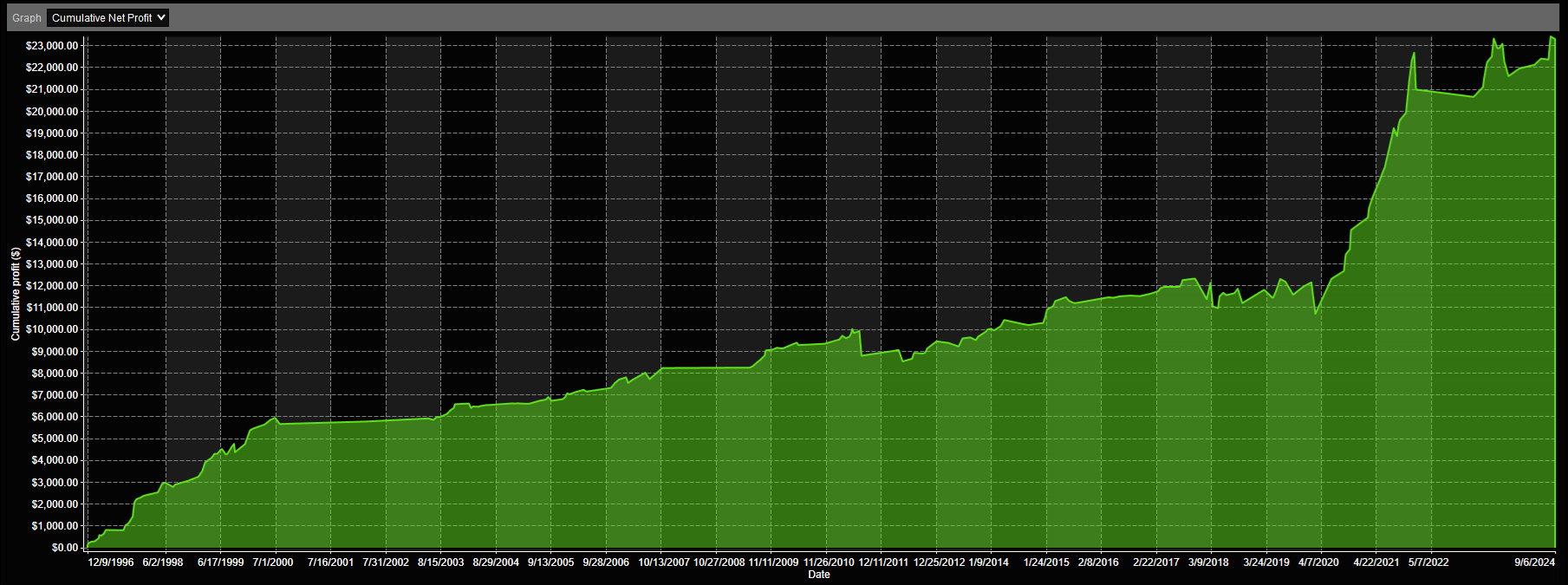

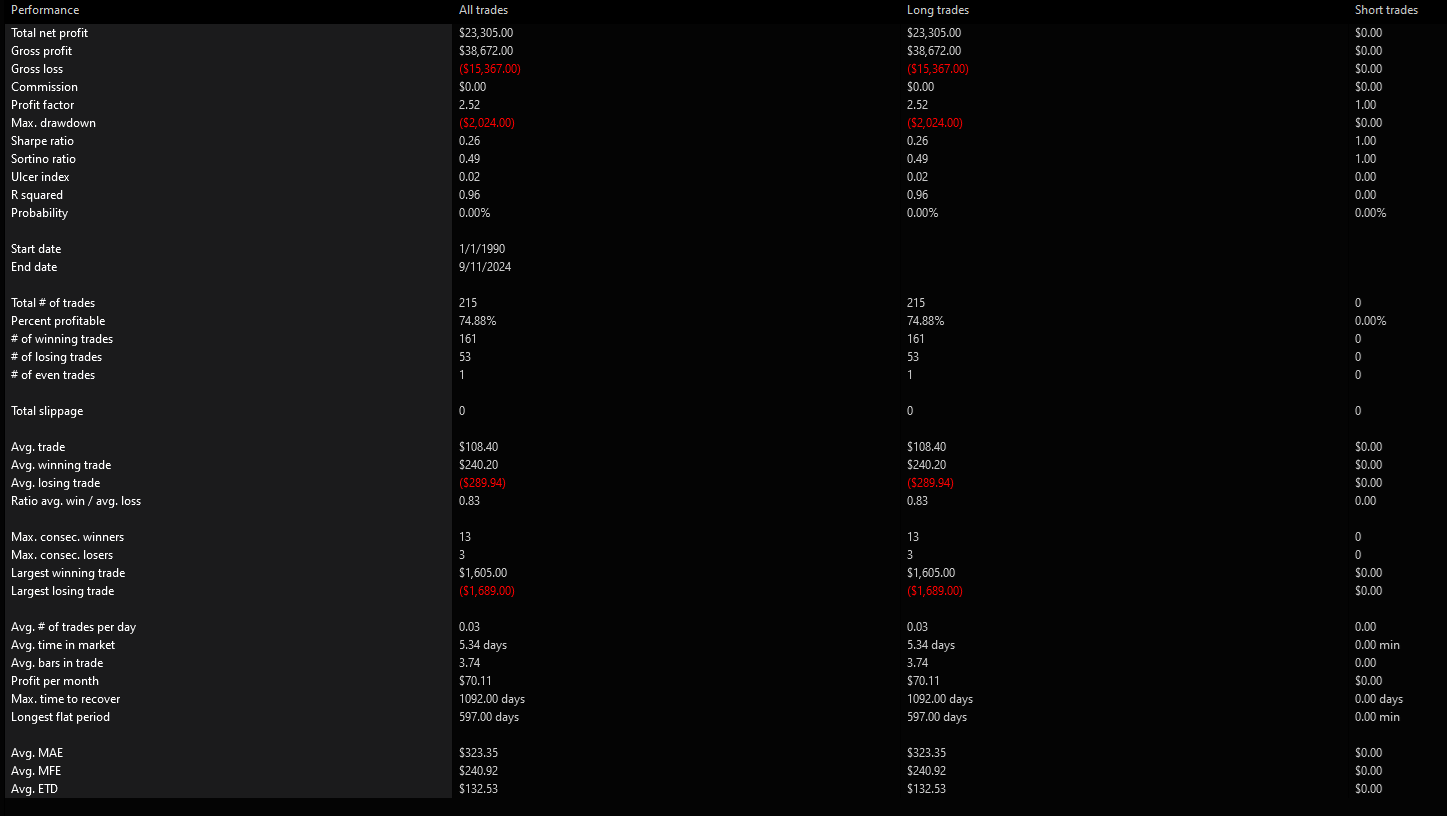

Cumulative RSI

This strategy was taken from chapter 9 of Short Term Trading Strategies That Work (2008) by Larry Connors.

It is based on the Cumulative RSI indicator described in the book.

Rules

- The asset (e.g., SPY) is above its 200-day moving average.

- If the 2-day cumulative 2-period RSI is below 35, enter a long position.

- Exit the position when the 2-period RSI is above 65.

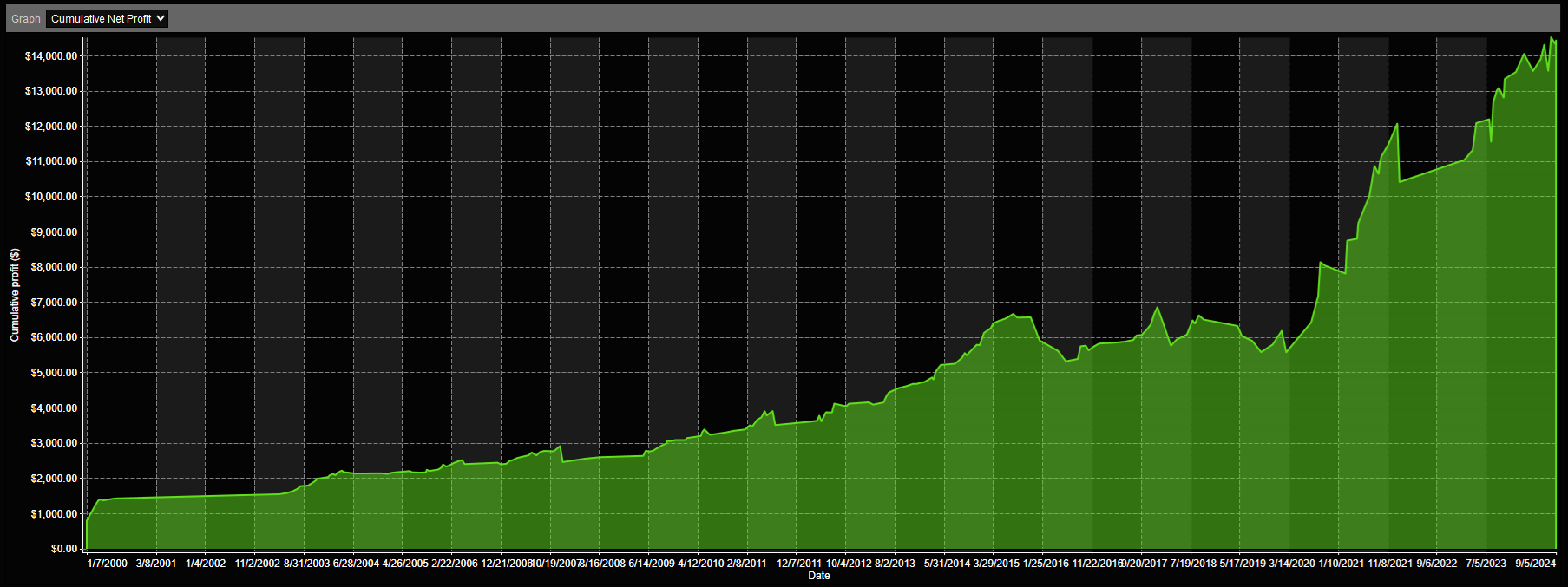

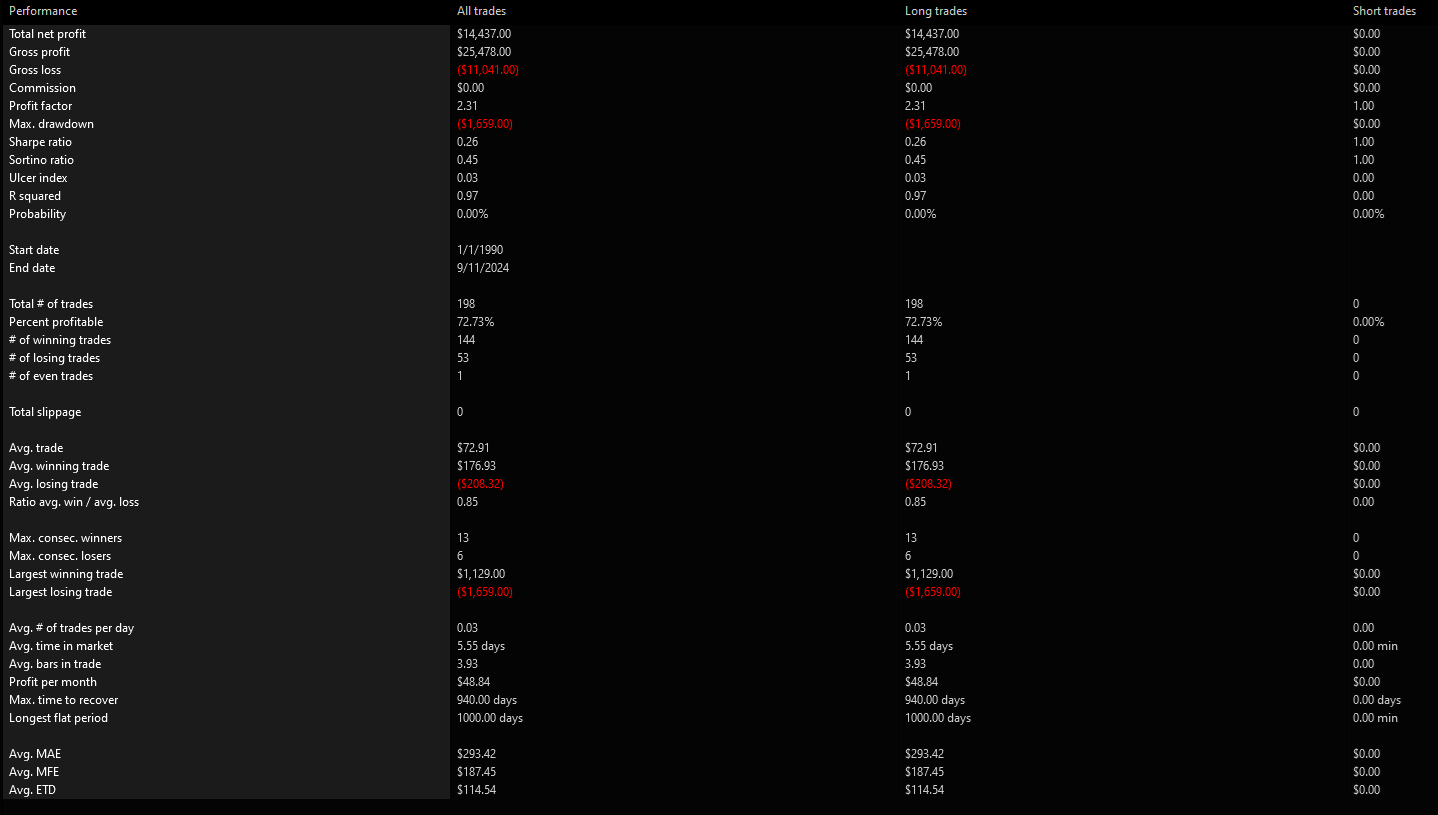

An alternate set of rules is provided in chapter 12 as follows (differences bolded):

- The asset (e.g., SPY) is above its 200-day moving average.

- If the 2-day cumulative 3-period RSI is below 45, enter a long position.

- Exit the position when the 2-period RSI is above 65.

Parameters

Cumulative RSI Period: The period to use in the RSI calculation. (Default: 2)

Cumulative RSI Smoothing: The smoothing to use in the RSI calculation. (Default: 1, no smoothing)

Cumulative Period: The number of RSI values to add up. (Default: 2)

RSI Period: The period of the RSI used to exit trades. (Default: 2)

RSI Smoothing: The smoothing of the RSI used to exit trades. (Default: 1)

SMA Period: The period used to calculate the long term trend as measured using a simple moving average. (Default: 200)

Entry Threshold: The Cumulative RSI threshold below which a trade is entered. (Default: 35)

Exit Threshold: The RSI threshold above which a trade is exited. (Default: 65)