3.0 KiB

3-Day High / Low Bot

This strategy was taken from chapter 2 of High Probability ETF Trading (2009) by Larry Connors.

Rules

Long Trades

- The ETF (e.g., SPY) is above its 200-day moving average.

- The ETF closes below its 5-day moving average.

- The ETF must make a lower high and lower low for 3 consecutive days.

- Enter a long if the above conditions are met.

- Aggressive Version (optional): Enter a second long if price closes lower than the initial entry at any point during the trade.

- Exit when the ETF closes above its 5-day moving average.

Short Trades

The inverse of the long trade rules, but stated explicitly:

- The ETF (e.g., SPY) is below its 200-day moving average.

- The ETF closes above its 5-day moving average.

- The ETF must make a higher high and higher low for 3 consecutive days.

- Enter a short if the above conditions are met.

- Aggressive Version (optional): Enter a second short if price closes higher than the initial entry at any point during the trade.

- Exit when the ETF closes below its 5-day moving average.

NOTE: The strategy will work on any asset, not just ETFs.

Parameters

Consecutive Days: The number of days in a row in which higher highs / lows or lower highs / lows must be made. (Default: 3)

Long-Term Trend Period: The period to use in the long-term trend calculation as measured using a simple moving average. (Default: 200)

Short-Term Trend Period: The period to use in the short-term trend calculation as measured using a simple moving average. (Default: 5)

Enable Long Trades: Whether to allow going long in the strategy. (Default: true)

Enable Short Trades: Whether to allow going short in the strategy. (Default: true)

Enable Aggressive Entries: Whether to allow for entering a second trade when price initially moves against the first. (Default: true)

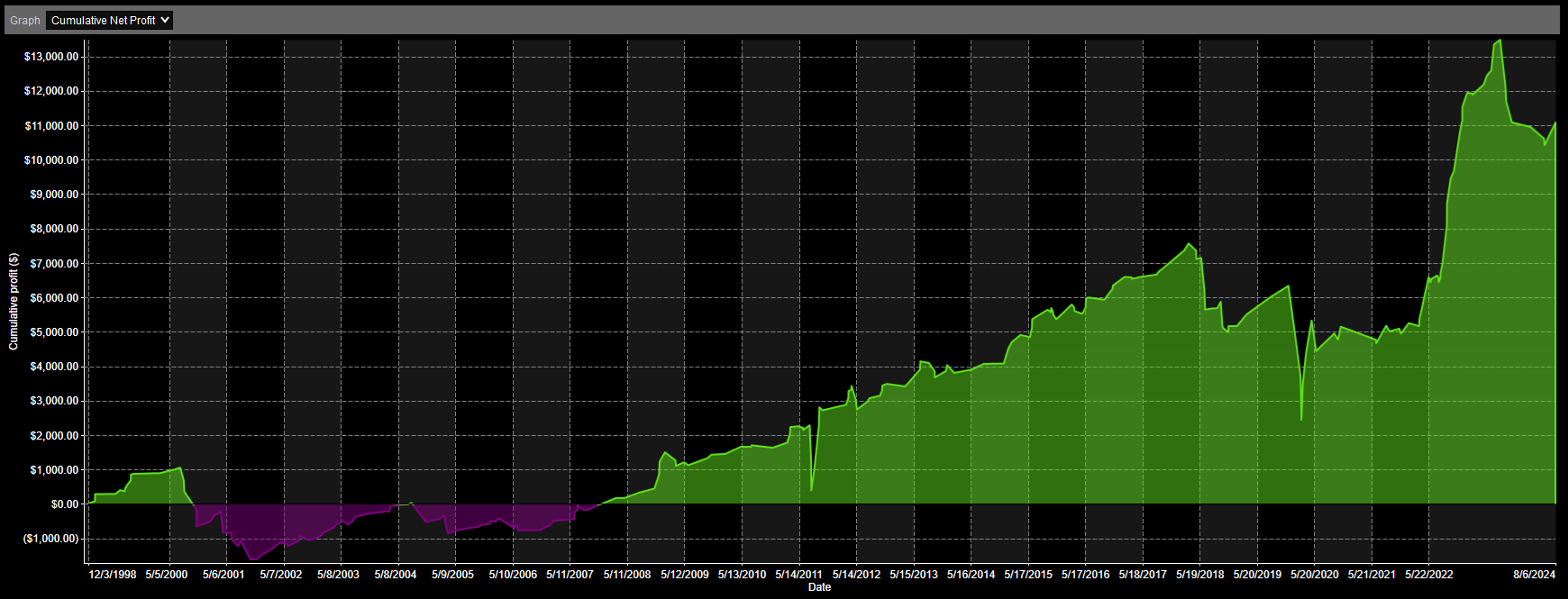

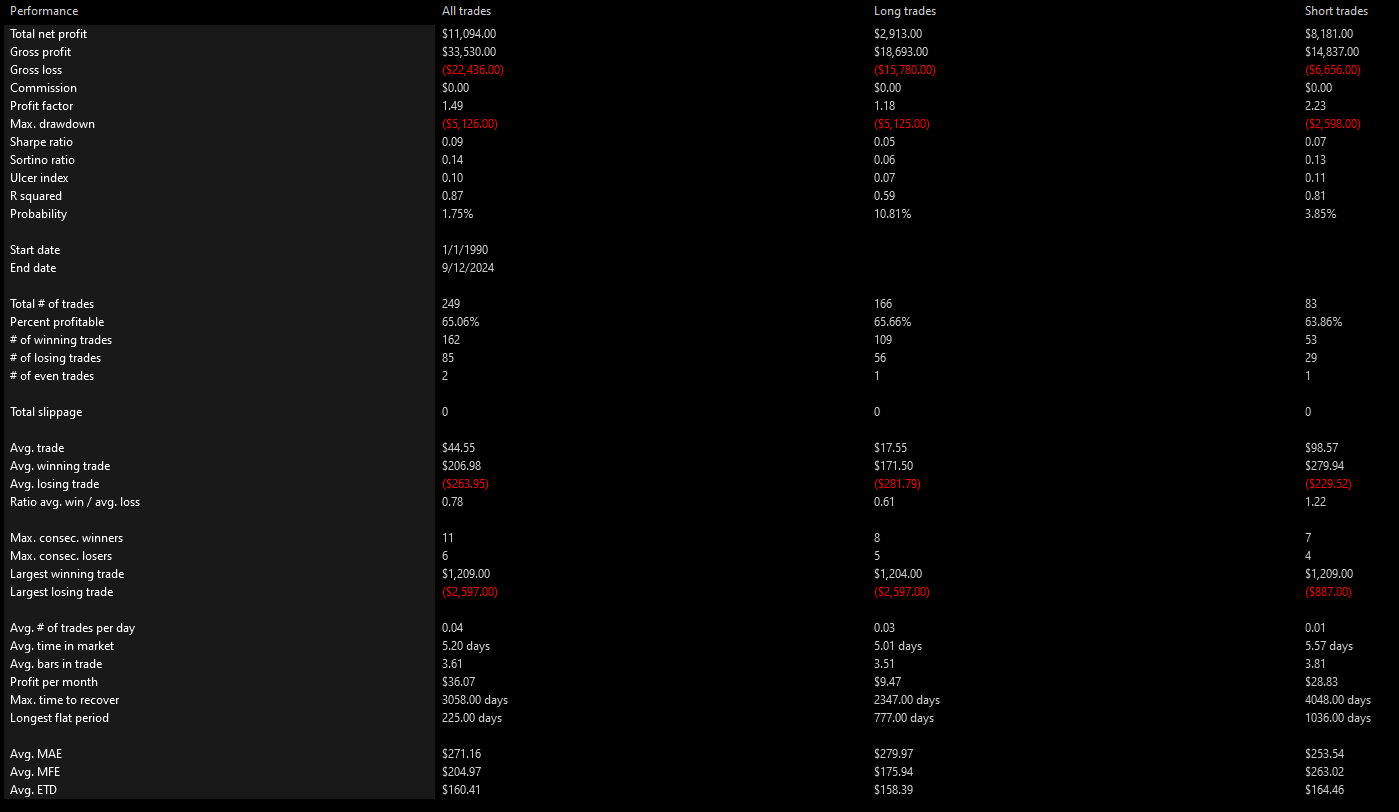

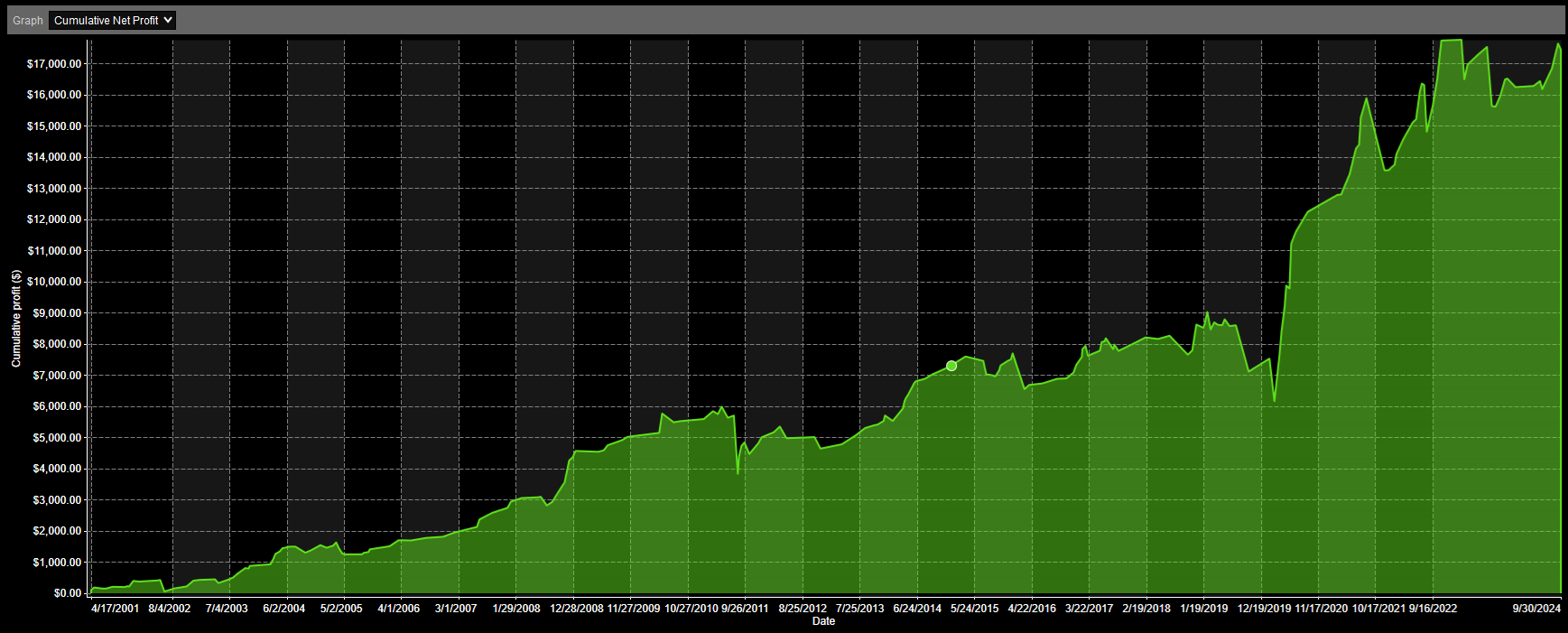

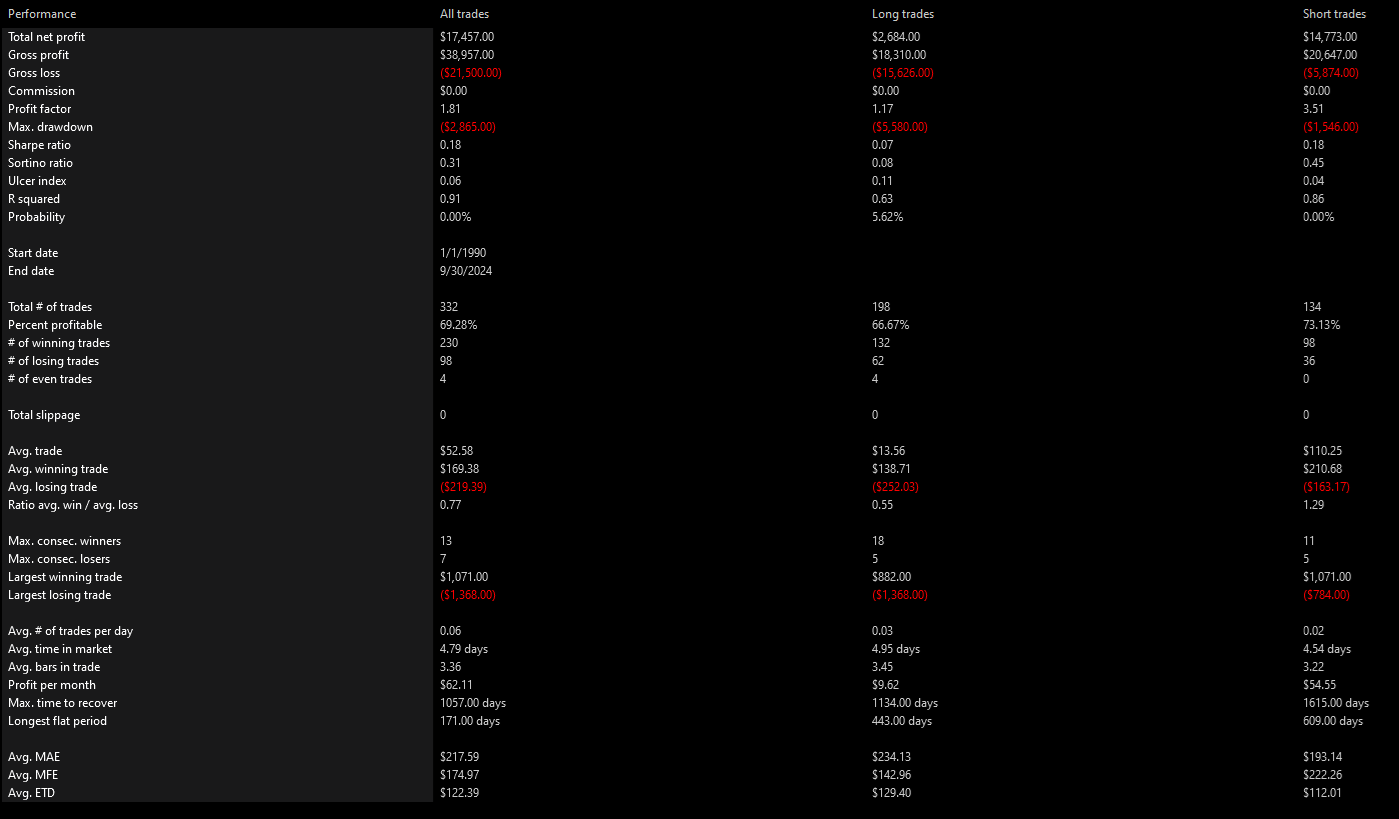

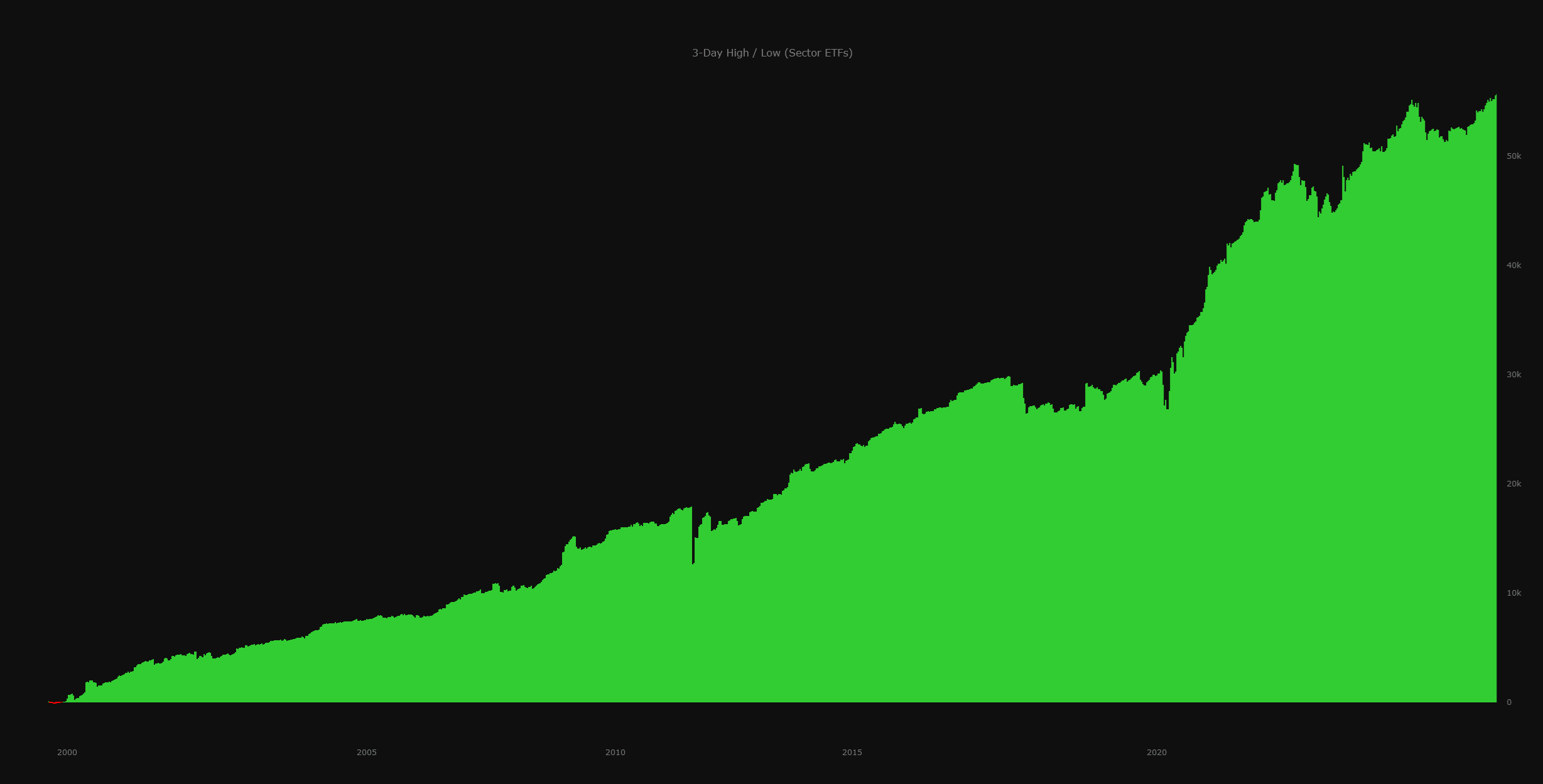

Backtest Results

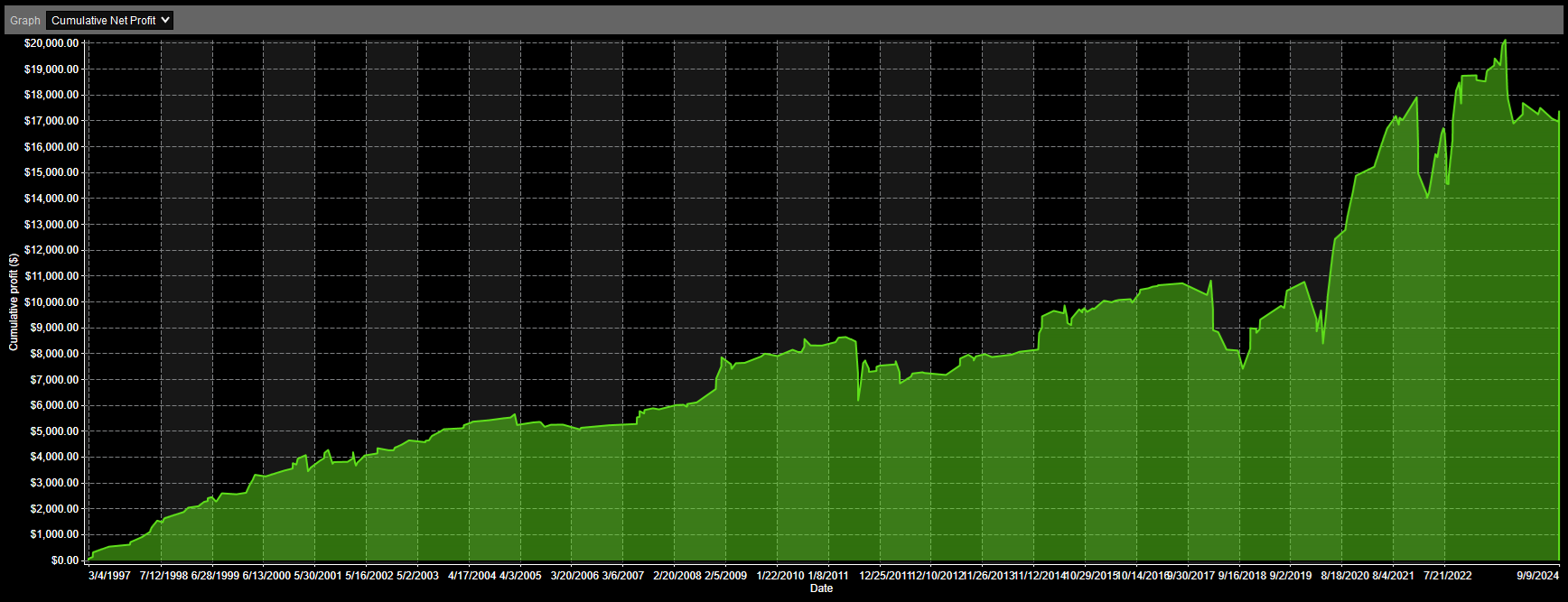

SPY

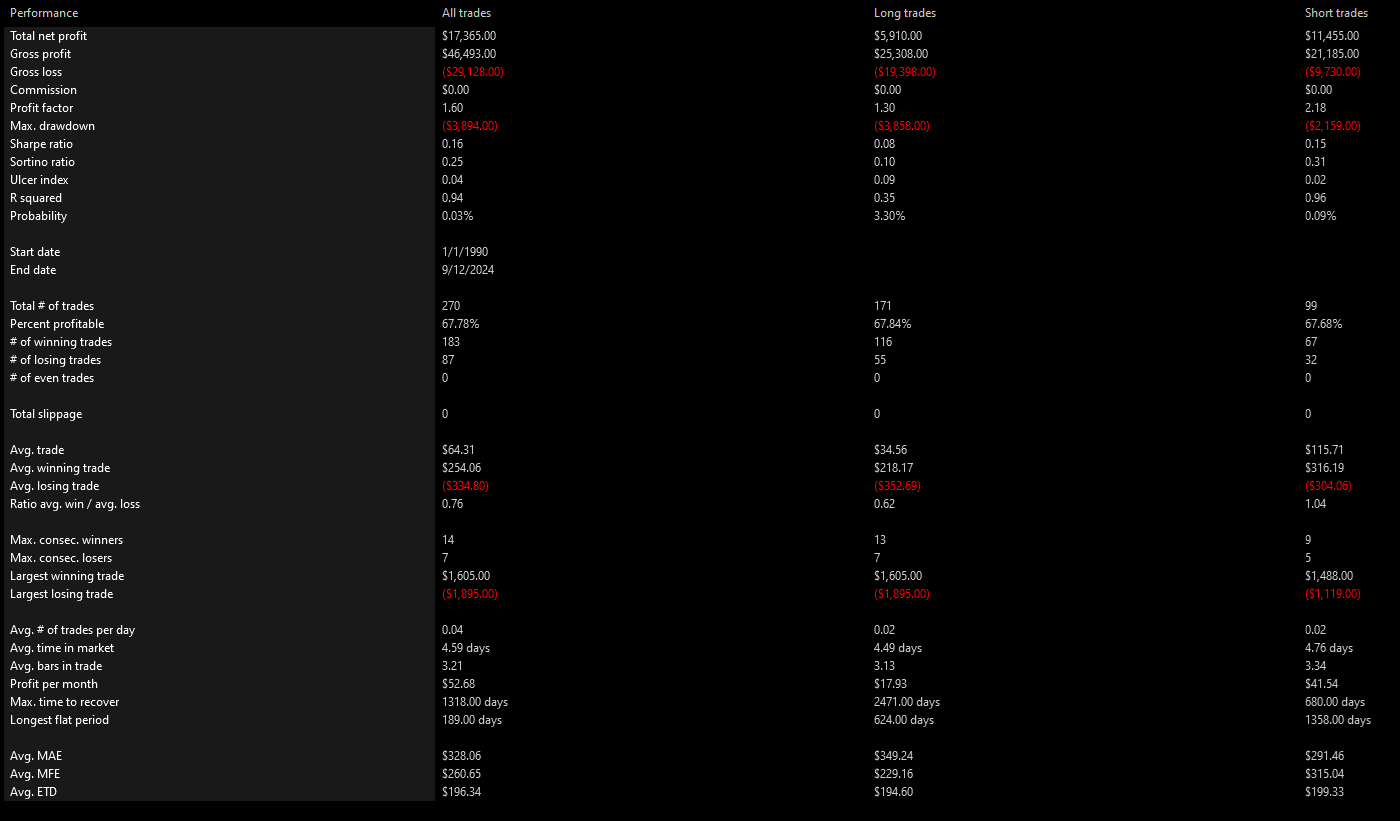

QQQ

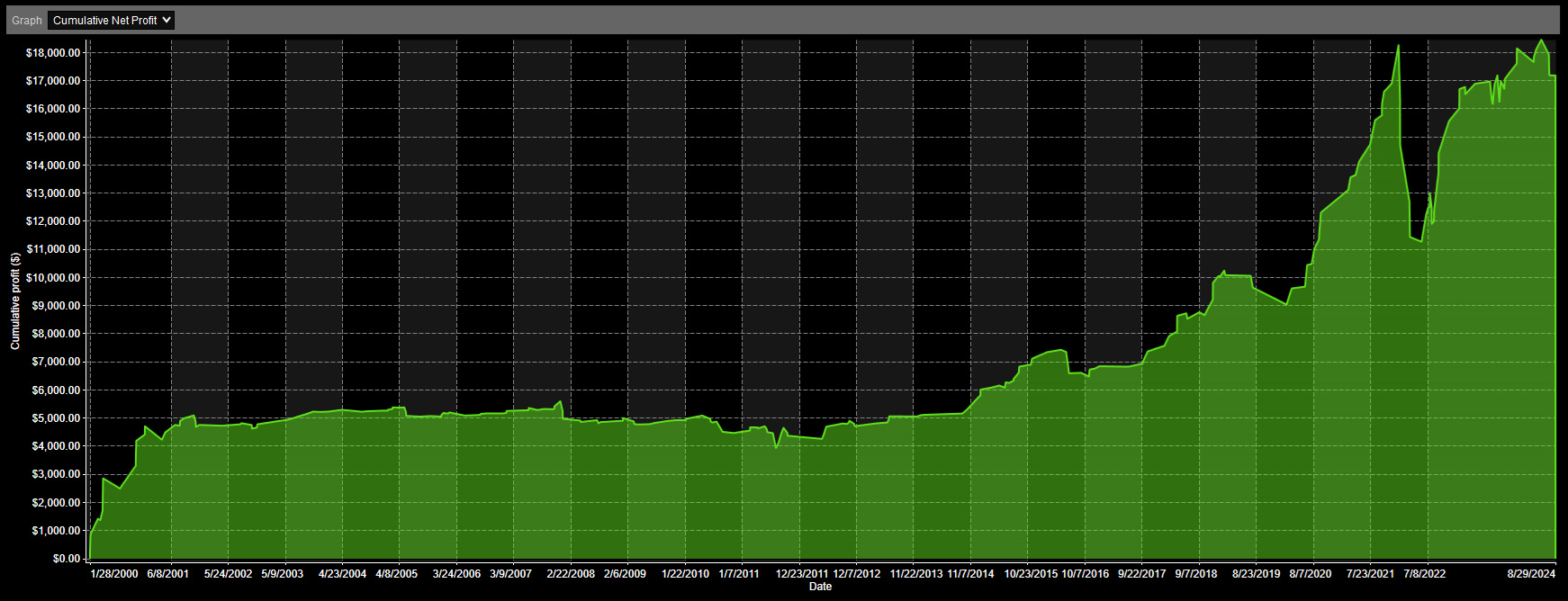

DIA

IWM

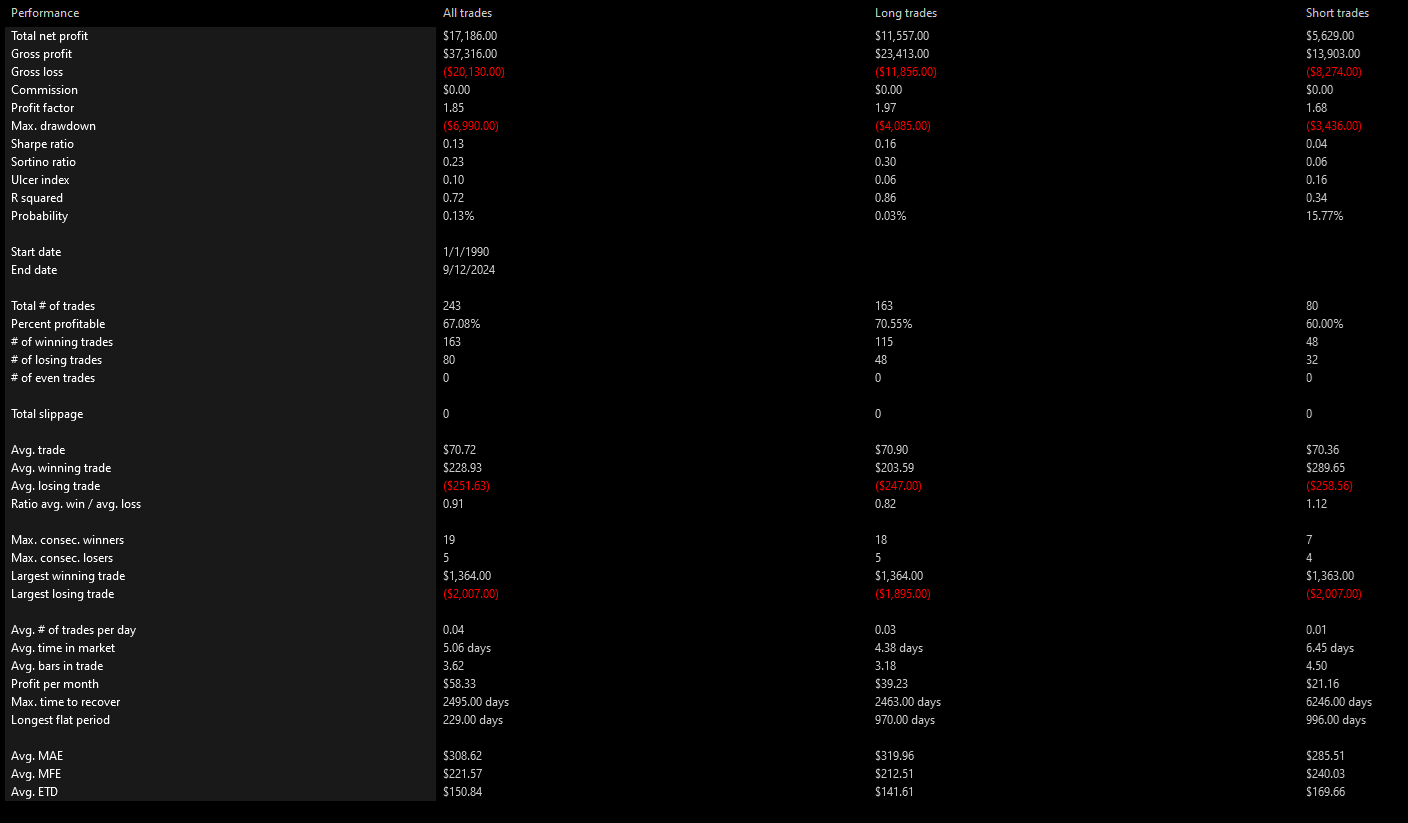

Sector ETFs

This backtest is an aggregation of the results of the following sector ETFs:

XLB, XLC, XLE, XLF, XLI, XLK, XLP, XLU, XLV, XLY