2.0 KiB

VIX Stretches

This strategy was taken from chapter 12 of Short Term Trading Strategies That Work (2008) by Larry Connors.

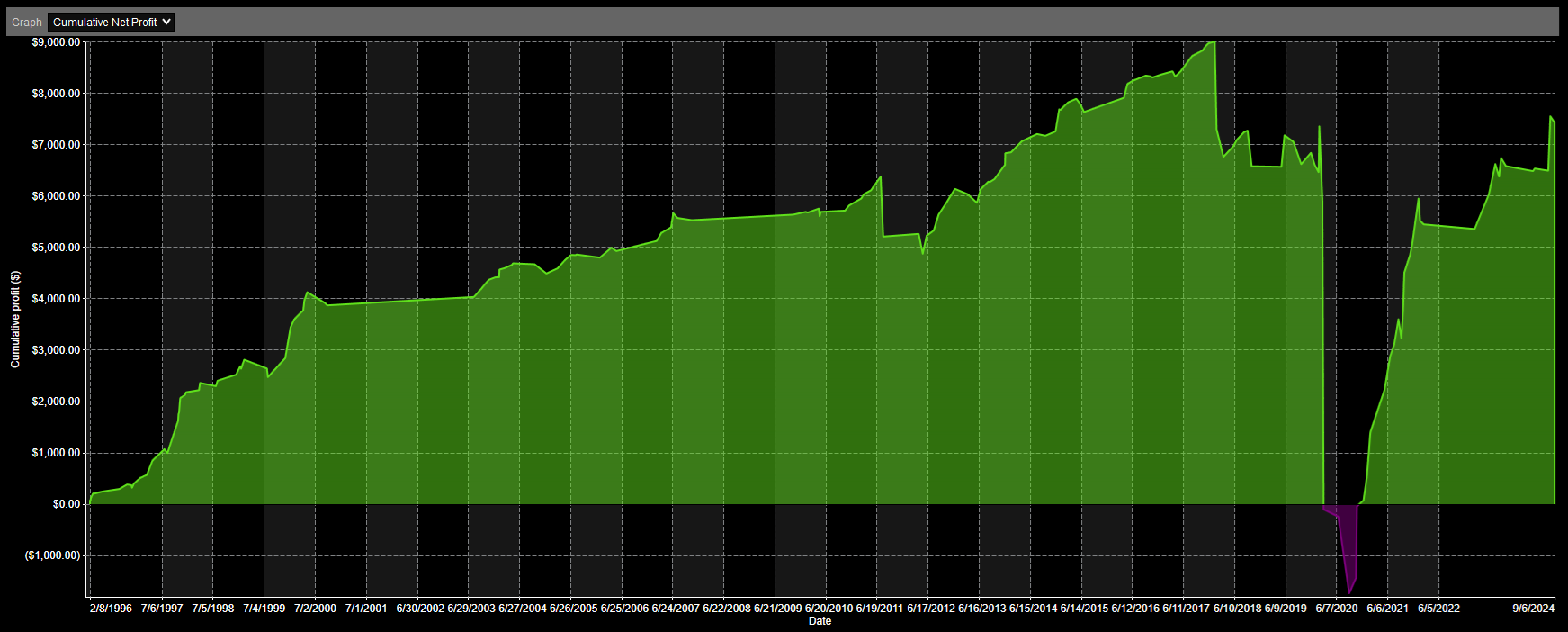

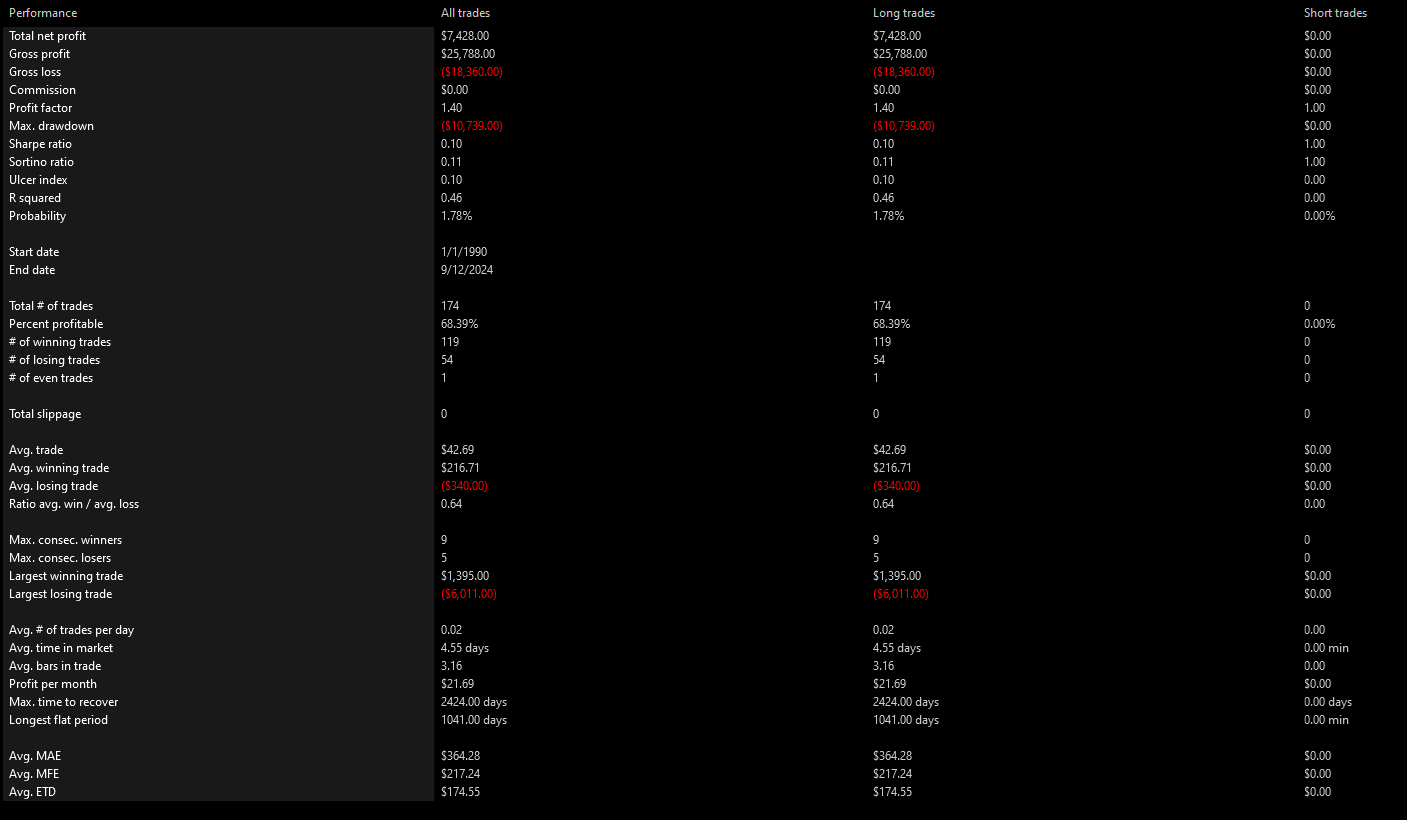

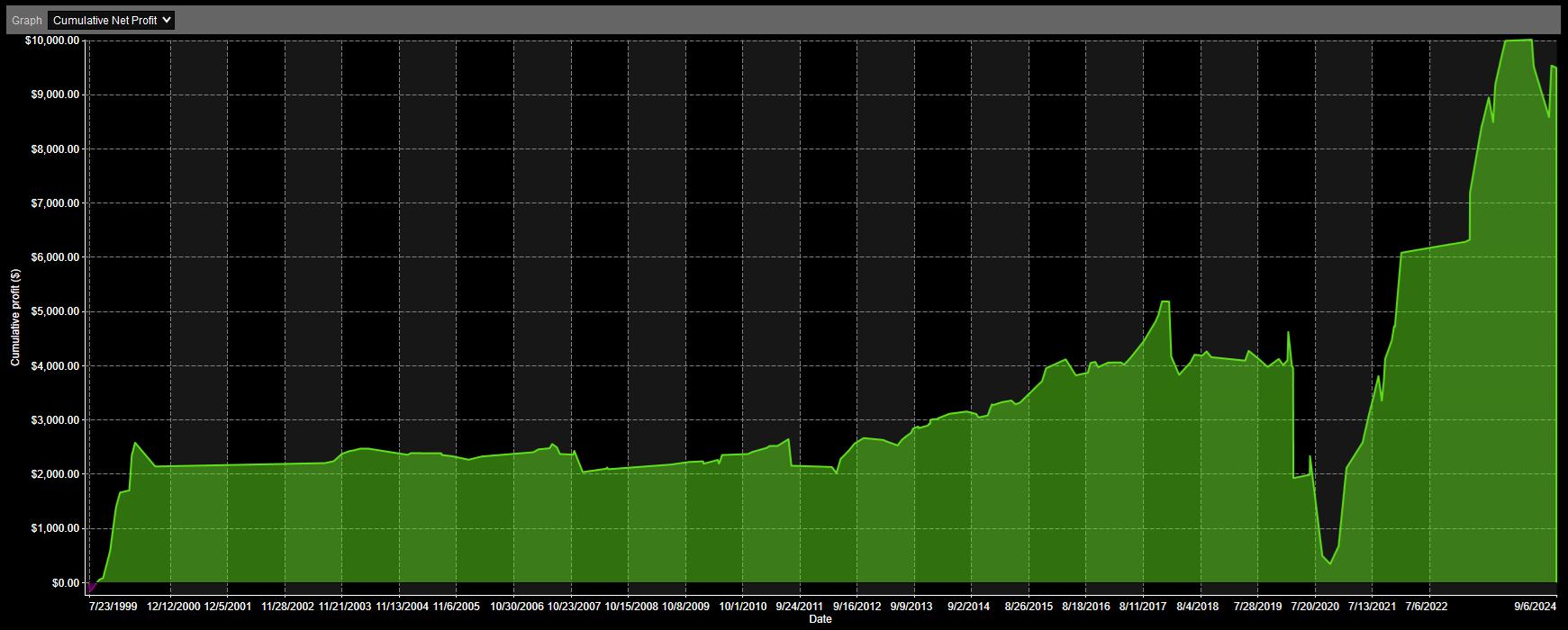

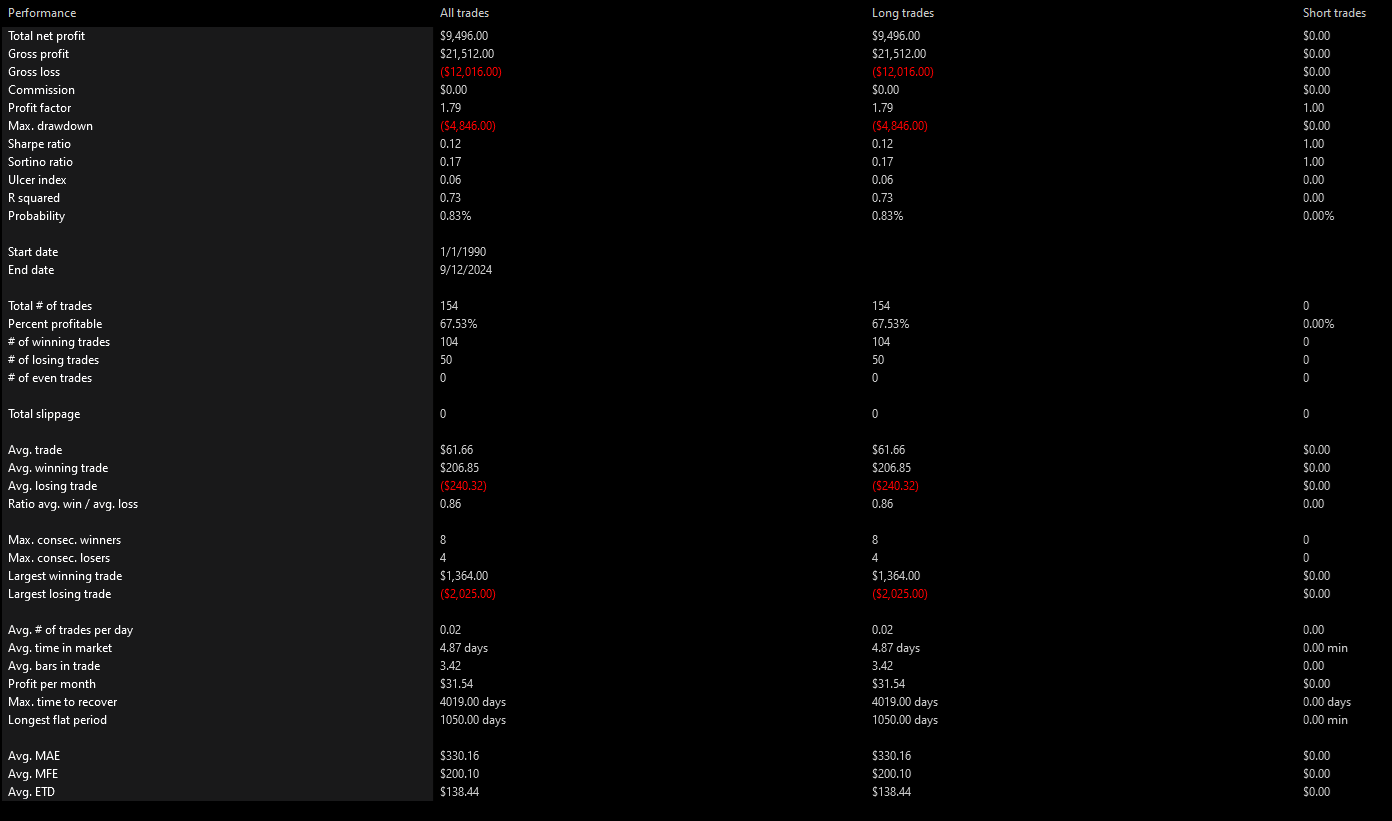

I would advise against trading this strategy as is, however.

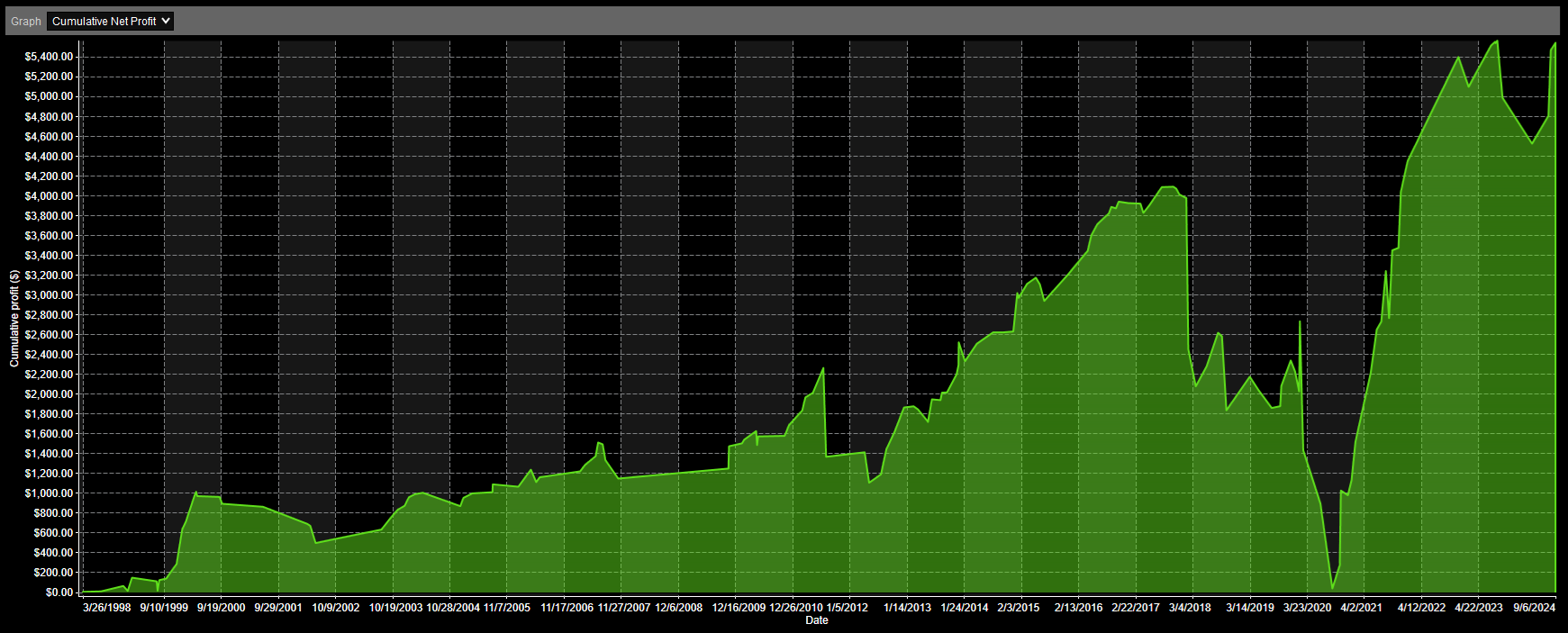

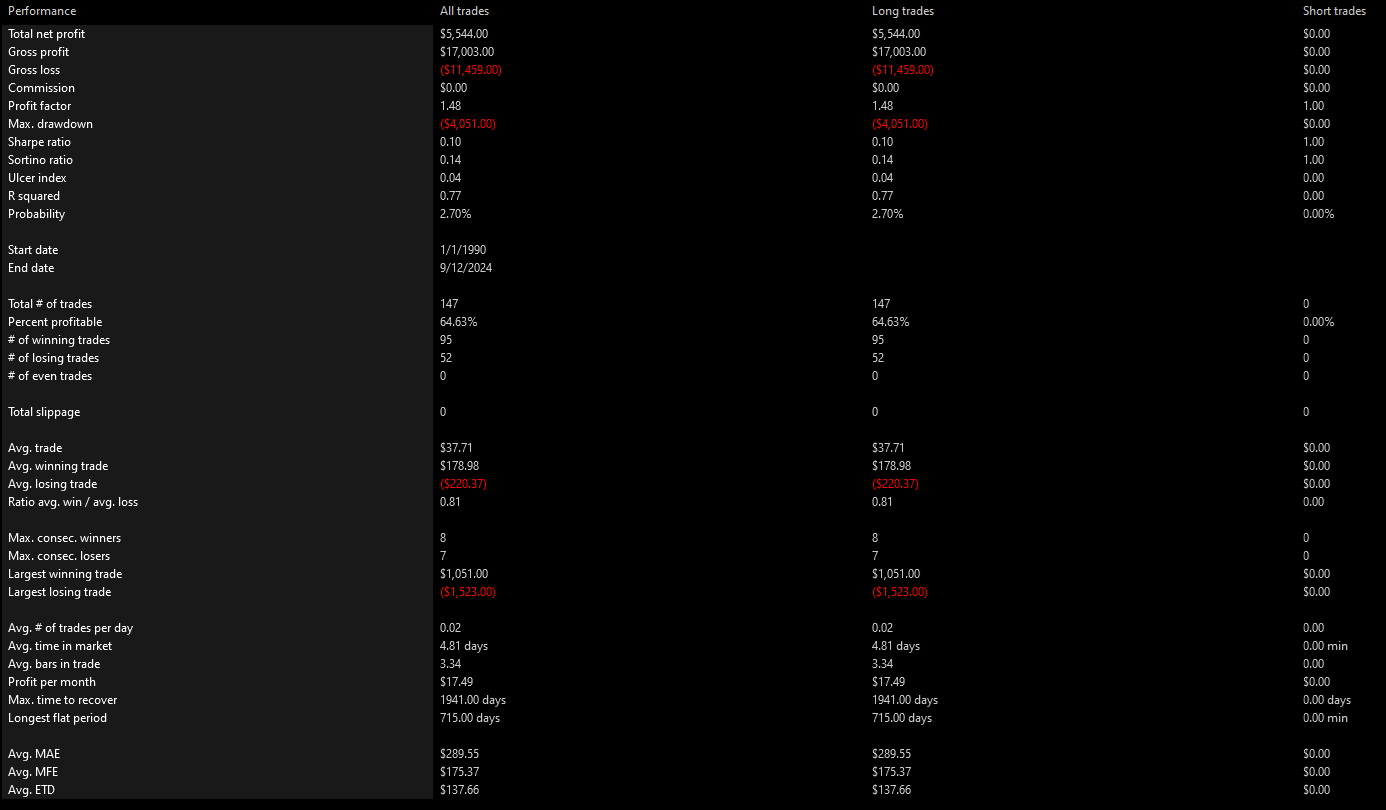

Refer to the backtest results in order to understand why.

Rules

- The asset (e.g., SPY) is above its 200-day moving average.

- If VIX is stretched 5% or more above its 10-day moving average for 3 or more days, enter a long trade.

- Exit the trade when the 2-period RSI closes at or above 65.

Parameters

Long-Term Trend Period: The period of the long-term trend as measured using a simple moving average. (Default: 200)

VIX Moving Average Period: The period use to calculate the simple moving average of VIX. (Default: 10)

VIX Threshold Percentage: The percentage above the simple moving average that VIX has to be in order to enter a trade. (Default: 5)

VIX Stretch Days: The minimum number of days required for VIX to be stretched above its moving average. (Default: 3)

RSI Period: The period of the RSI calculation used to exit trades. (Default: 2)

RSI Smoothing: The smoothing of the RSI calculation used to exit trades. (Default: 1)

RSI Exit Threshold: The value of the RSI calculation at or above which to exit trades. (Default: 65)