57 lines

1.9 KiB

Markdown

57 lines

1.9 KiB

Markdown

# IBS + RSI

|

|

|

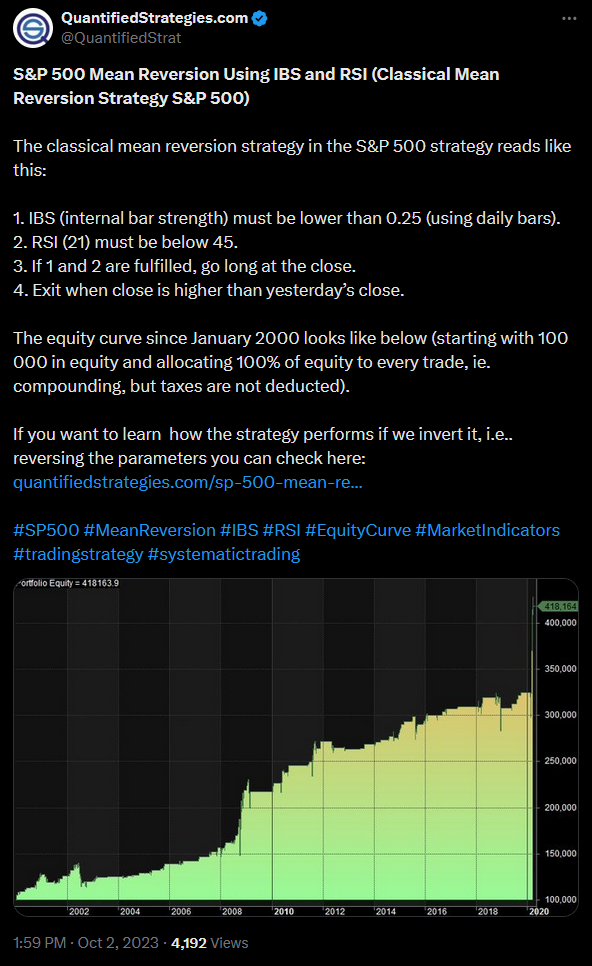

|

This is a mean reversion strategy based on the [IBS (Internal Bar Strength)](https://moshferatu.dev/moshferatu/ninjatrader/src/branch/main/indicators/internal-bar-strength) and RSI (Relative Strength Index) indicators.

|

|

|

|

The strategy was inspired by the following:

|

|

|

|

[](https://x.com/QuantifiedStrat/status/1708949863084535856)

|

|

|

|

## Rules

|

|

|

|

1. The asset's (e.g., SPY) IBS must be < 0.25.

|

|

2. If the 21-period RSI is < 45, enter a long trade.

|

|

3. Exit the trade when the current day's close is higher than the previous day's close.

|

|

|

|

## Parameters

|

|

|

|

**RSI Period**: The period used in the RSI calculation. (Default: 21)

|

|

|

|

**IBS Threshold**: The IBS value below which a long trade can be entered. (Default: 0.25)

|

|

|

|

**RSI Threshold**: The RSI value below which a long trade can be entered. (Default: 45.0)

|

|

|

|

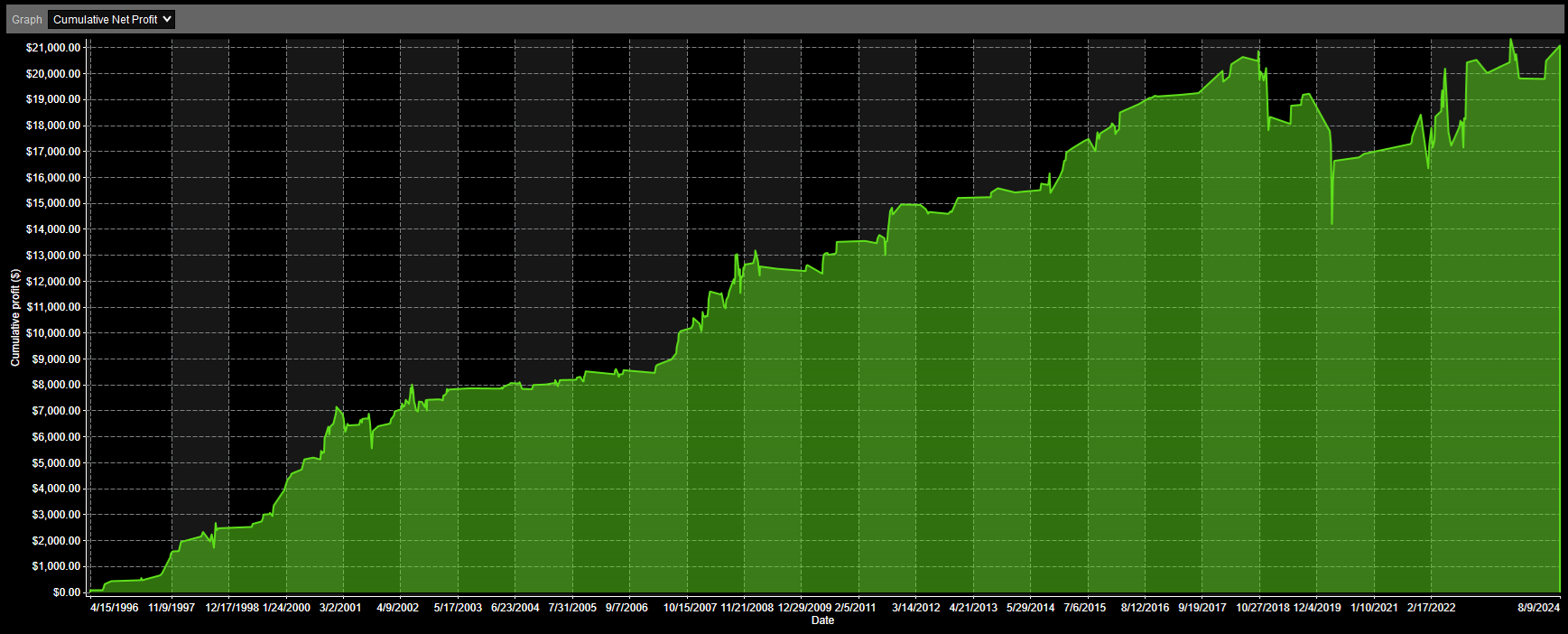

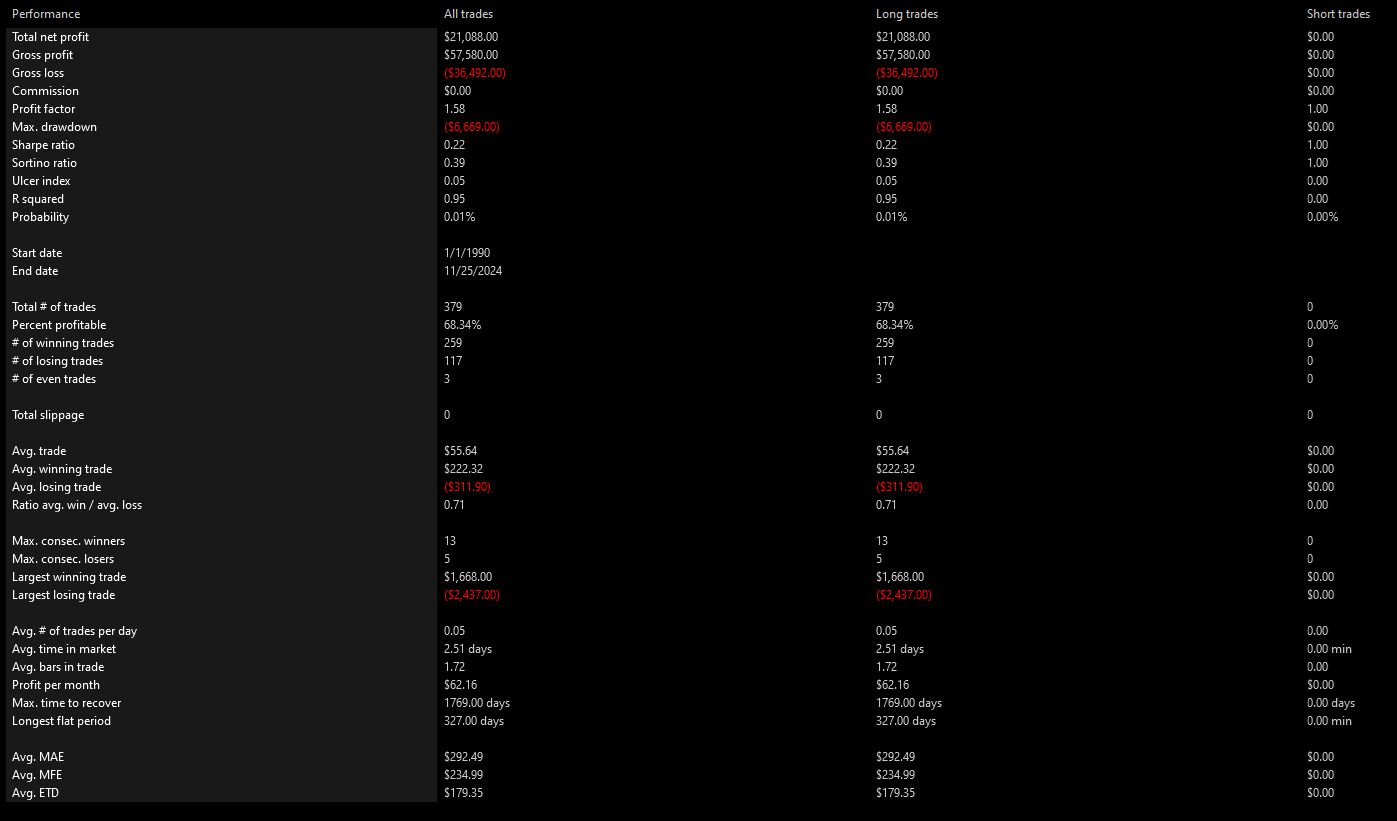

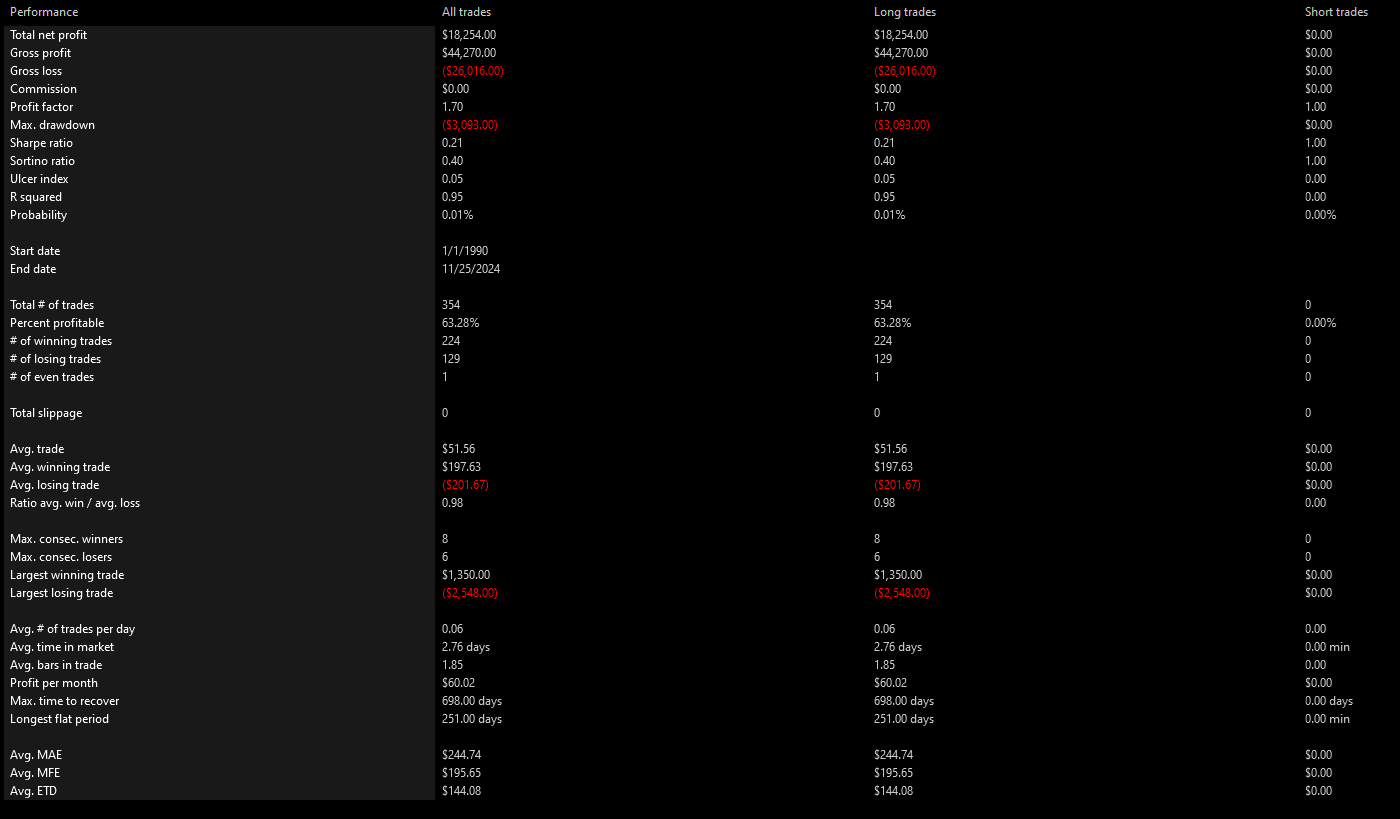

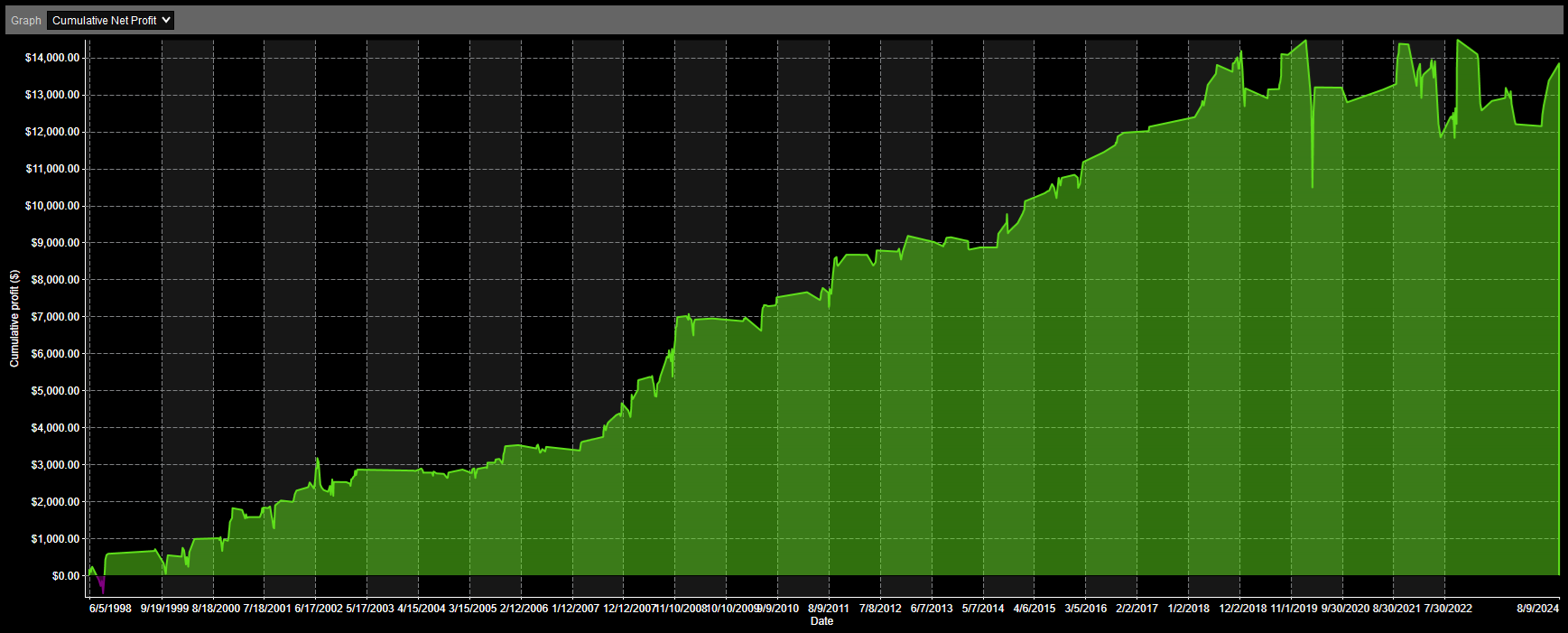

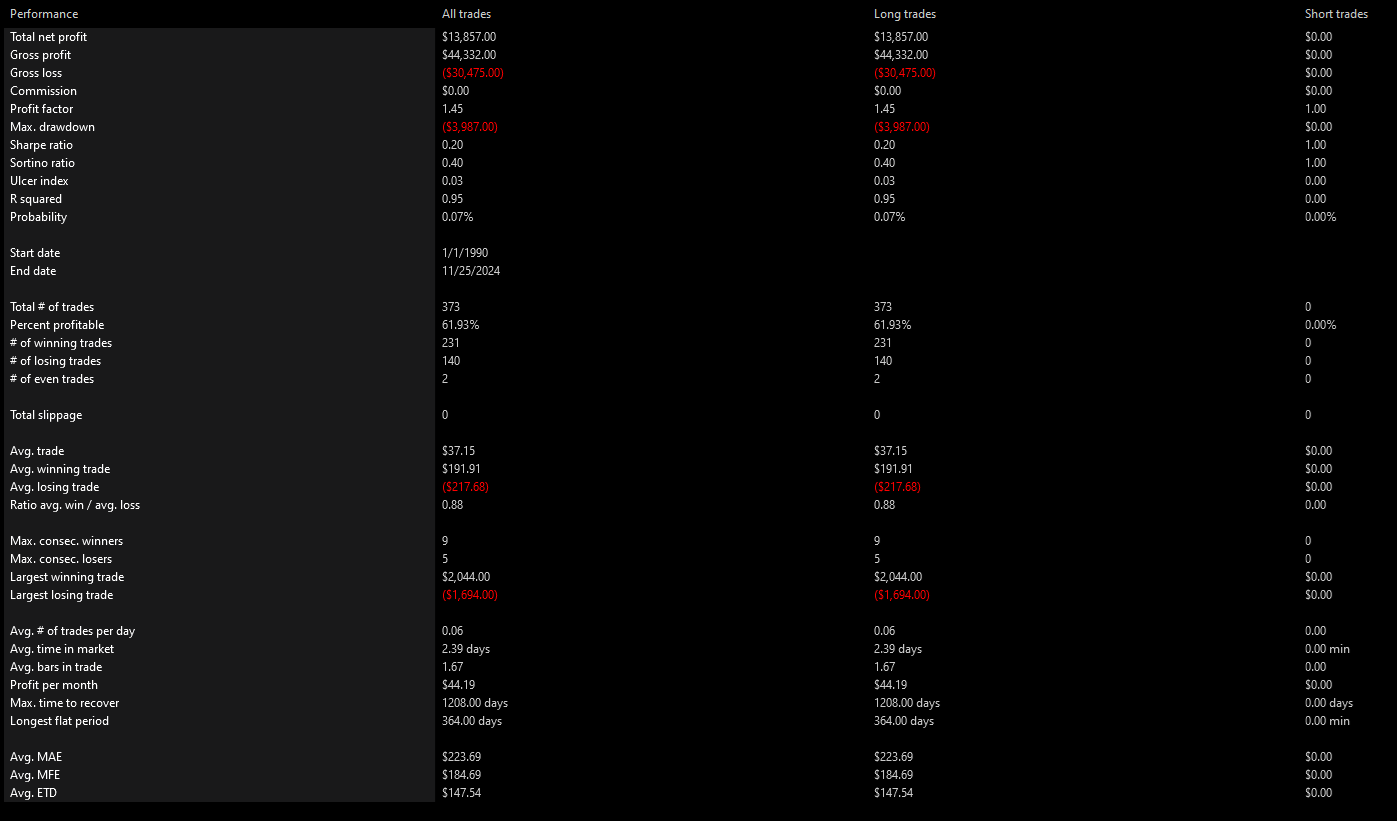

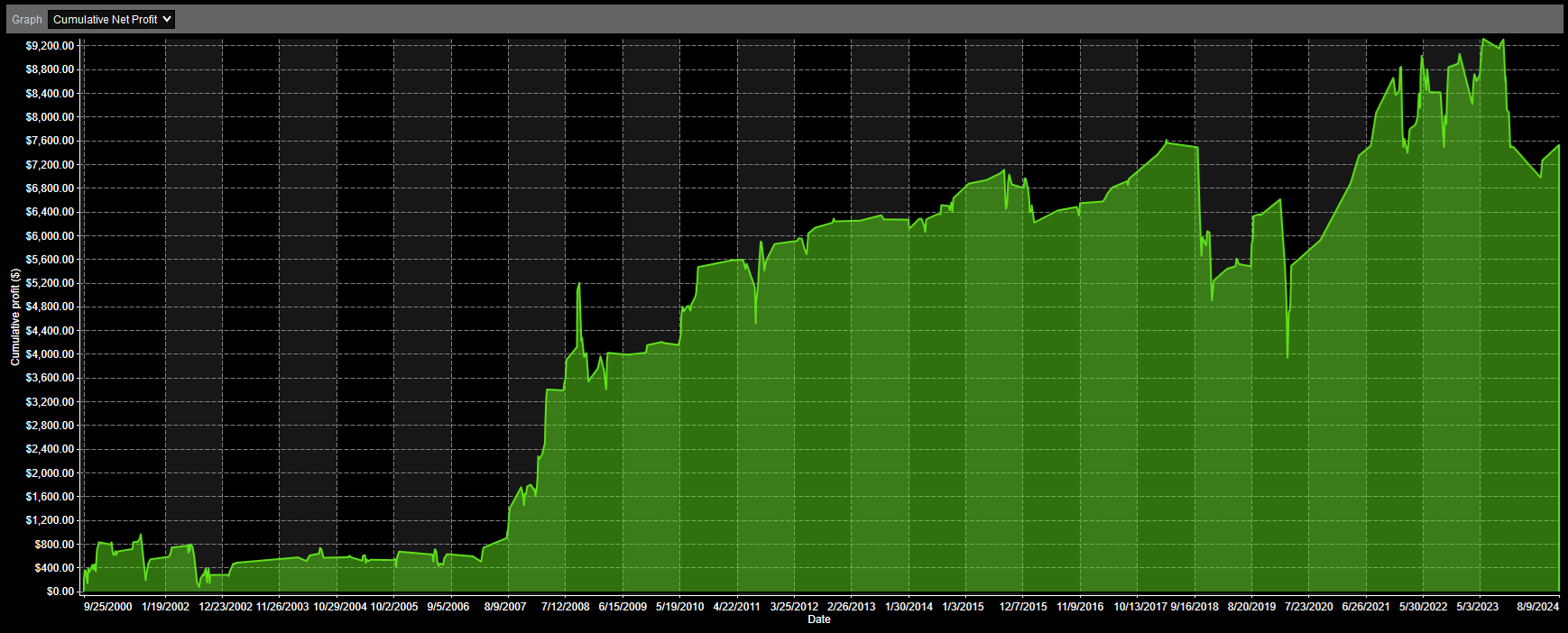

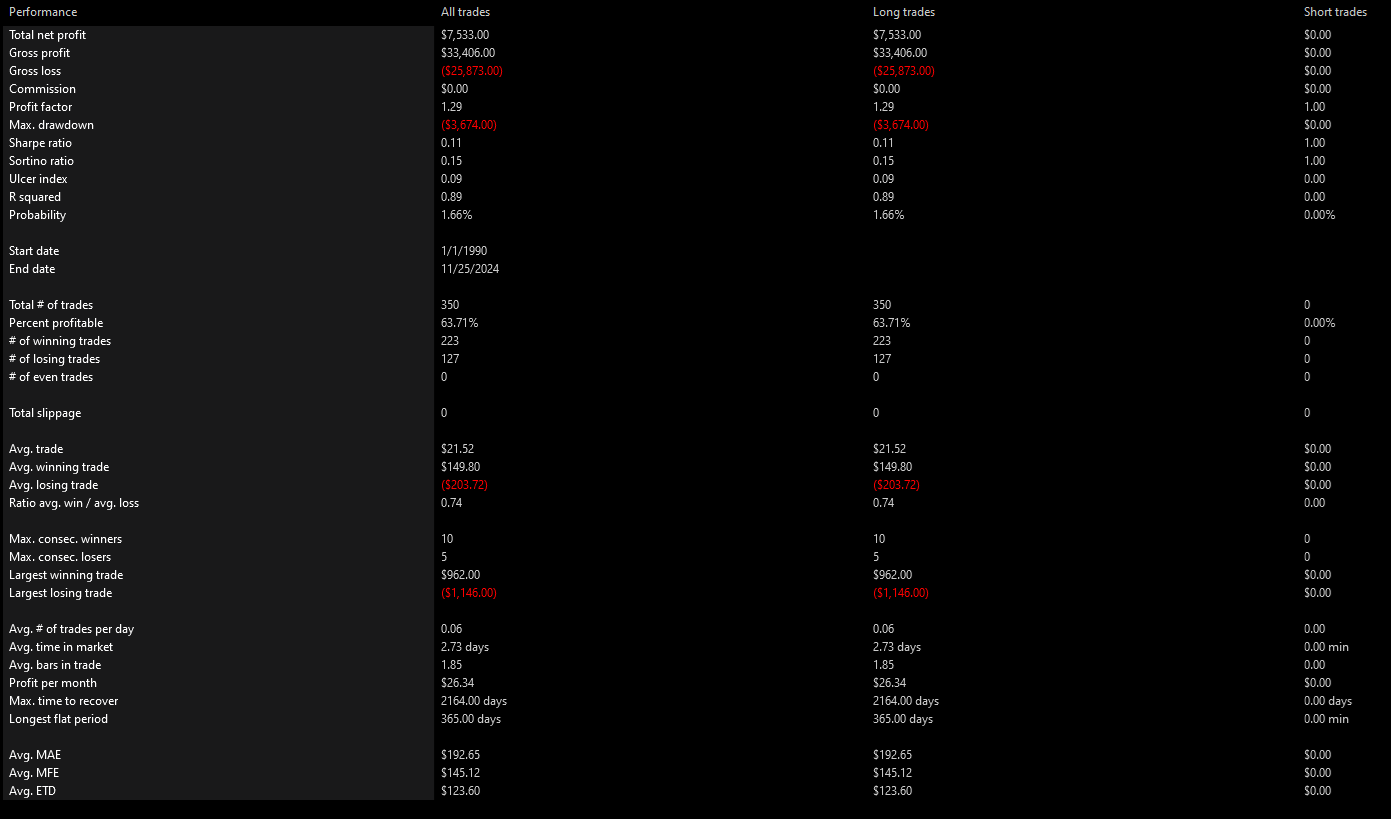

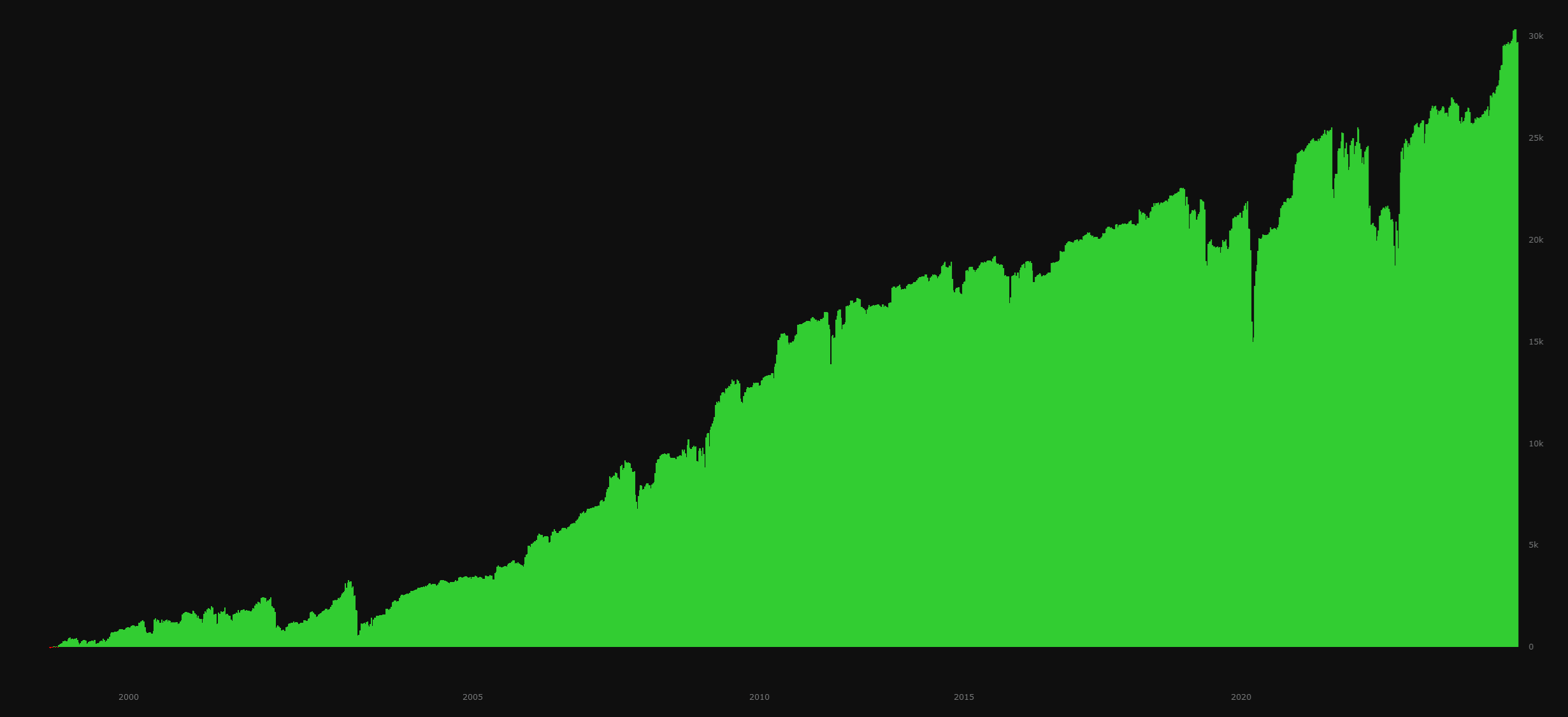

## Backtest Results

|

|

|

|

### SPY

|

|

|

|

|

|

|

|

|

|

|

|

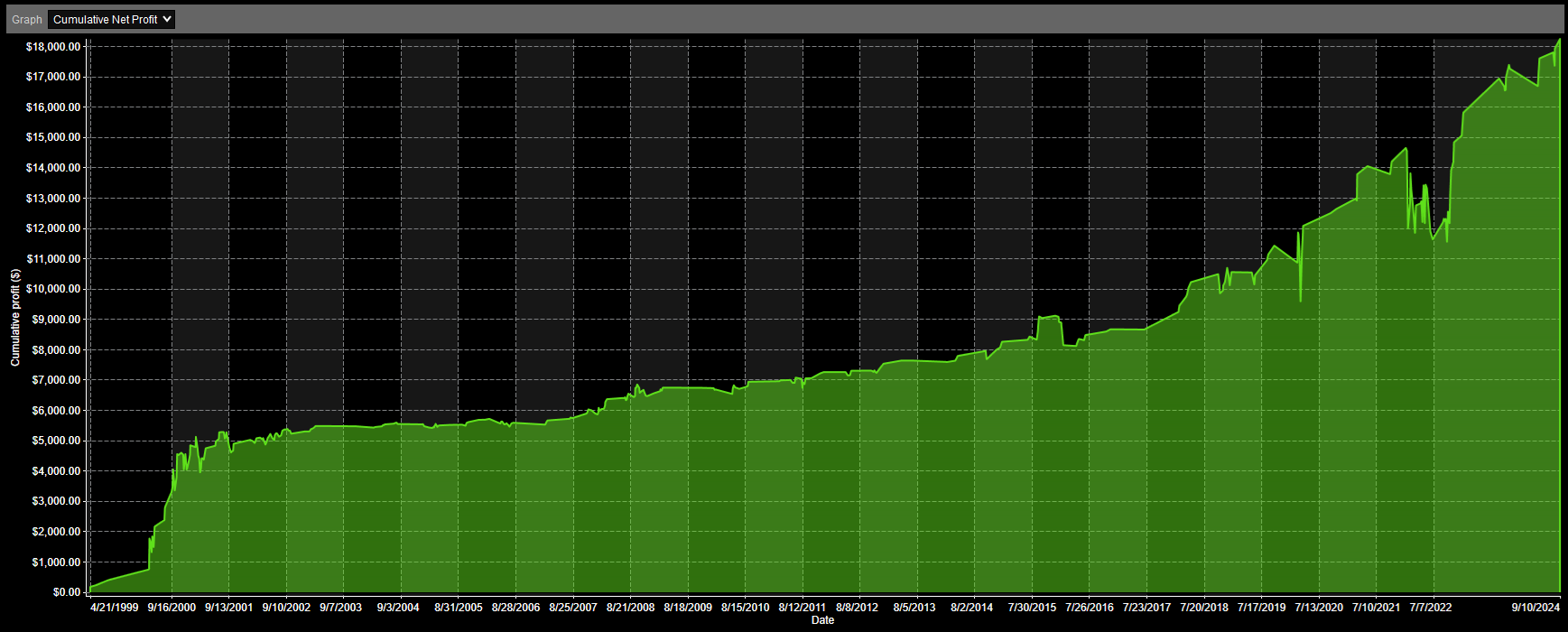

### QQQ

|

|

|

|

|

|

|

|

|

|

|

|

### DIA

|

|

|

|

|

|

|

|

|

|

|

|

### IWM

|

|

|

|

|

|

|

|

|

|

|

|

### Sector ETFs

|

|

|

|

This backtest is an aggregation of the results of the following sector ETFs:

|

|

|

|

XLB, XLC, XLE, XLF, XLI, XLK, XLP, XLU, XLV, XLY

|

|

|

|

|

|

|

|

--- |