34 lines

1.2 KiB

Markdown

34 lines

1.2 KiB

Markdown

# RSI PowerZones

|

|

|

|

This strategy was taken from chapter 2 of [*Buy the Fear, Sell the Greed*](https://moshferatu.dev/moshferatu/buy-the-fear-sell-the-greed) (2018) by Larry Connors.

|

|

|

|

## Rules

|

|

|

|

1. The ETF (e.g., SPY) is trading above its 200-day simple moving average.

|

|

2. If the 4-period RSI closes < 30, enter a long trade.

|

|

3. Enter a second long trade if the 4-period RSI closes < 25.

|

|

4. Exit the trade when the 4-period RSI closes > 55.

|

|

|

|

## Parameters

|

|

|

|

**RSI Period**: The period used in the RSI calculation. (Default: 4)

|

|

|

|

**RSI Smoothing**: The smoothing used in the RSI calculation. (Default: 1)

|

|

|

|

**First Entry Threshold**: The RSI value below which the first trade is entered. (Default: 30)

|

|

|

|

**Second Entry Threshold**: The RSI value below which the second trade is entered. (Default: 25)

|

|

|

|

**Exit Threshold**: The RSI value above which any trades are exited. (Default: 55)

|

|

|

|

**Long-Term Trend Period**: The period of the long-term trend as measured using a simple moving average. (Default: 200)

|

|

|

|

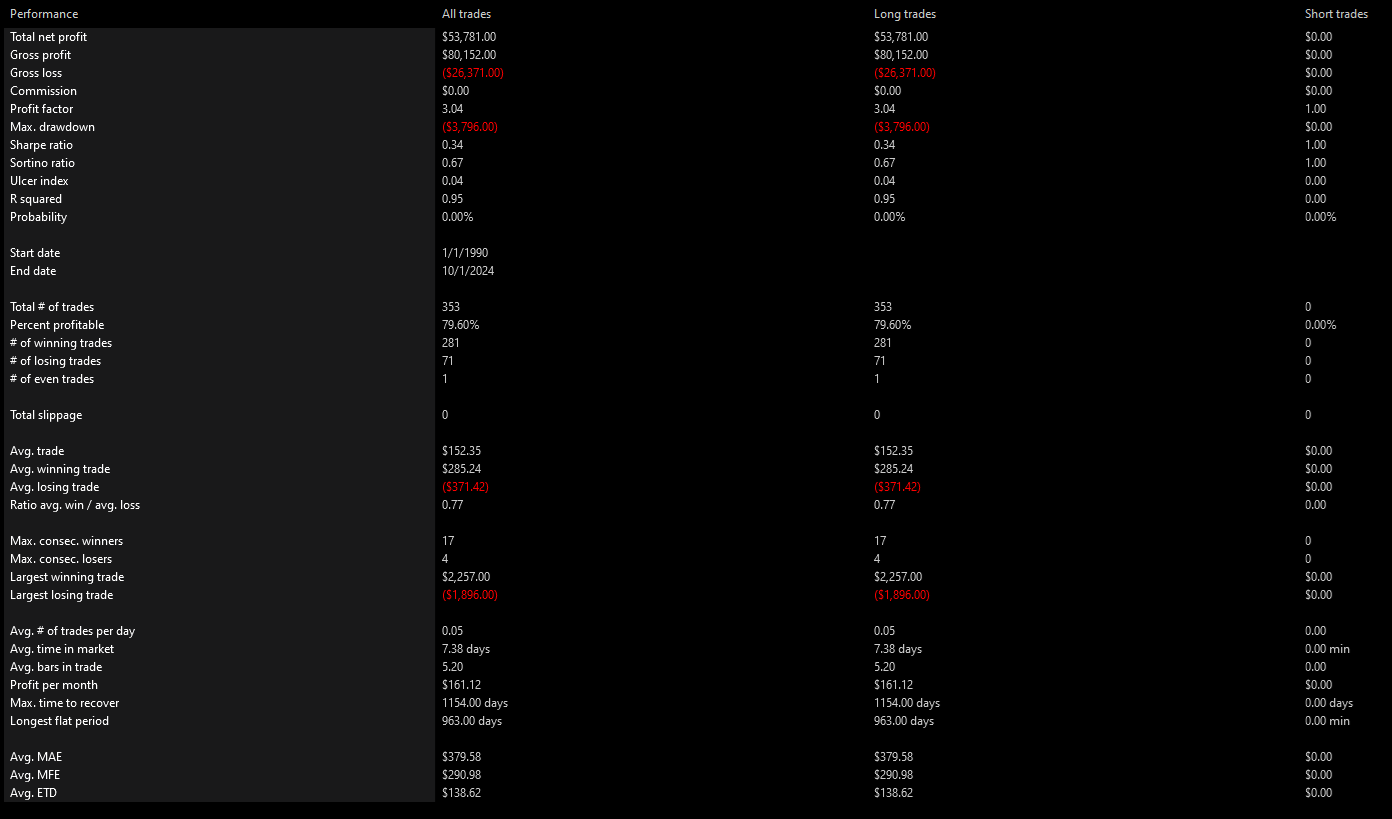

## Backtest Results

|

|

|

|

### SPY

|

|

|

|

|

|

|

|

|

|

|

|

--- |