35 lines

1.3 KiB

Markdown

35 lines

1.3 KiB

Markdown

# Vol Panics

|

|

|

|

This strategy was taken from chapter 5 of [*Buy the Fear, Sell the Greed*](https://moshferatu.dev/moshferatu/buy-the-fear-sell-the-greed) (2018) by Larry Connors.

|

|

|

|

## Rules

|

|

|

|

1. When VXX is trading above its 5-period moving average and its 4-period RSI is > 70, enter a short trade.

|

|

2. (Optional Aggressive Entry) If VXX closes higher than the initial entry price at any point during the trade, enter a second short trade.

|

|

3. Exit the trade if VXX closes under its 5-period moving average.

|

|

|

|

## Parameters

|

|

|

|

**Moving Average Period**: The period used in the simple moving average calculation. (Default: 5)

|

|

|

|

**RSI Period**: The period used in the RSI calculation. (Default: 4)

|

|

|

|

**RSI Smoothing**: The smoothing used in the RSI calculation. (Default: 1)

|

|

|

|

**Entry Threshold**: The RSI value above which to enter the short trade. (Default: 70)

|

|

|

|

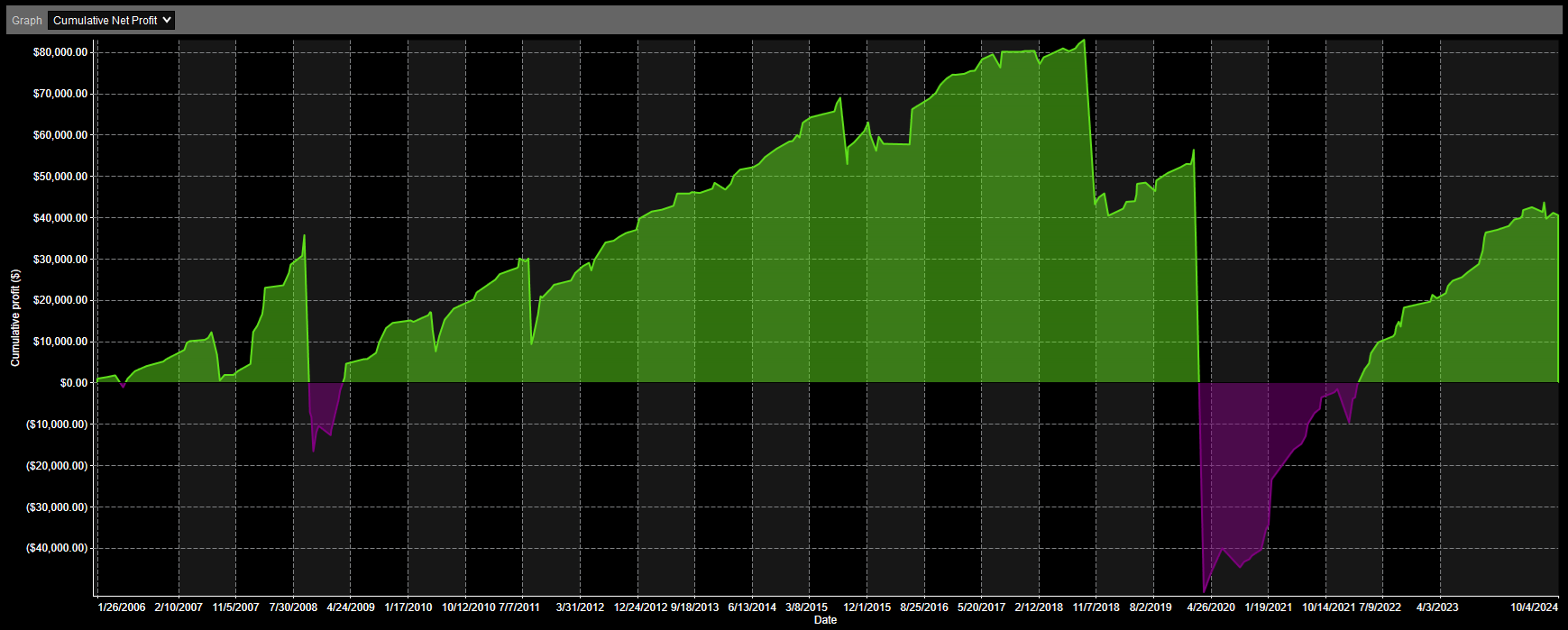

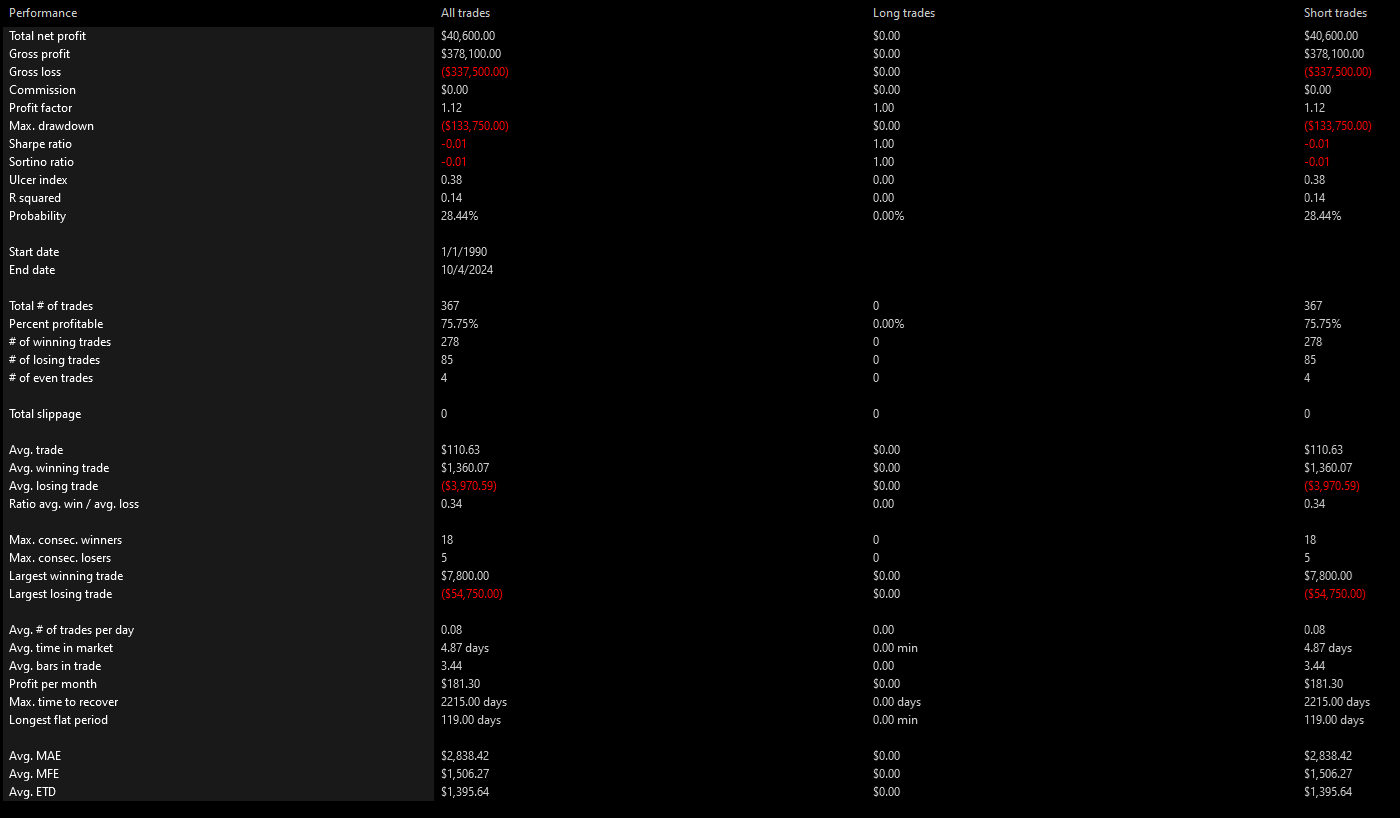

## Backtest Results

|

|

|

|

### /VX

|

|

|

|

Note that these backtests were performed on /VX (VIX futures) rather than on the VXX etf.

|

|

|

|

This is because the data feed I am using had very limited data available for VXX.

|

|

|

|

|

|

|

|

|

|

|

|

Hopefully these results demonstrate why you must be extremely careful when shorting volatility.

|

|

|

|

--- |