1.8 KiB

1.8 KiB

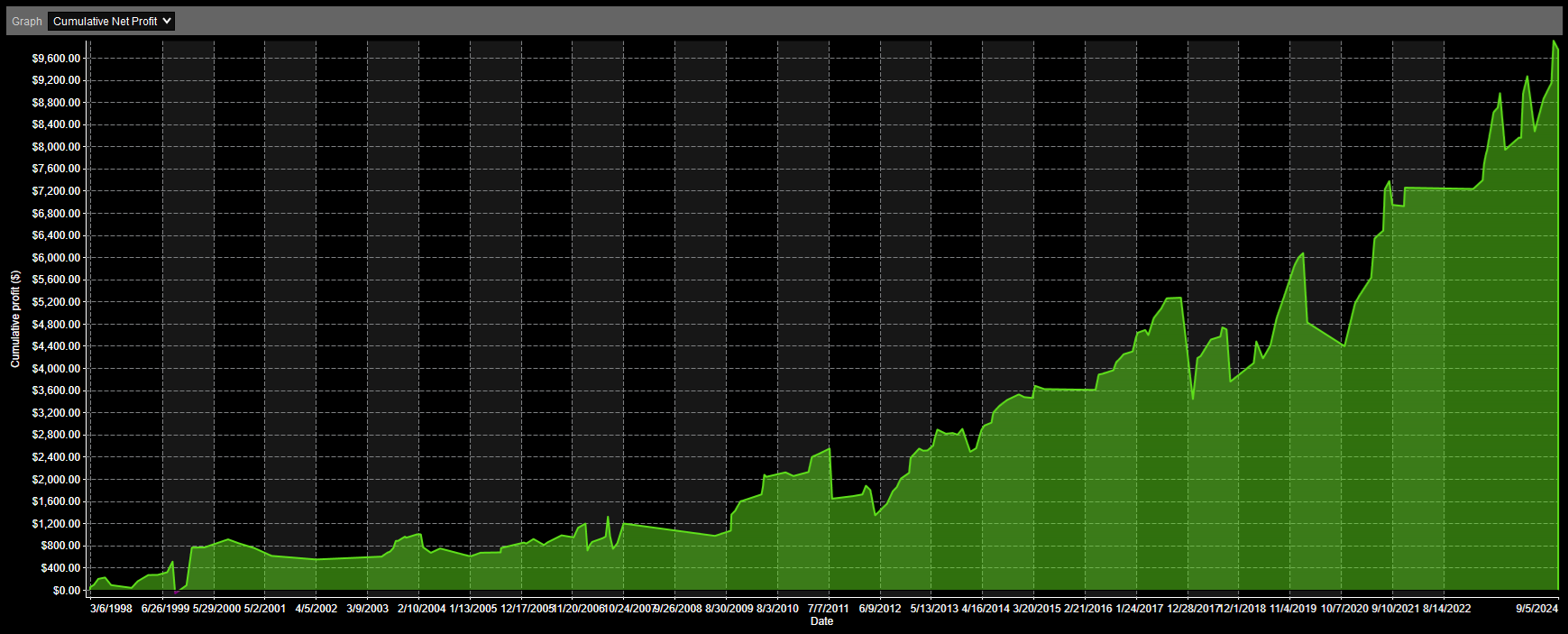

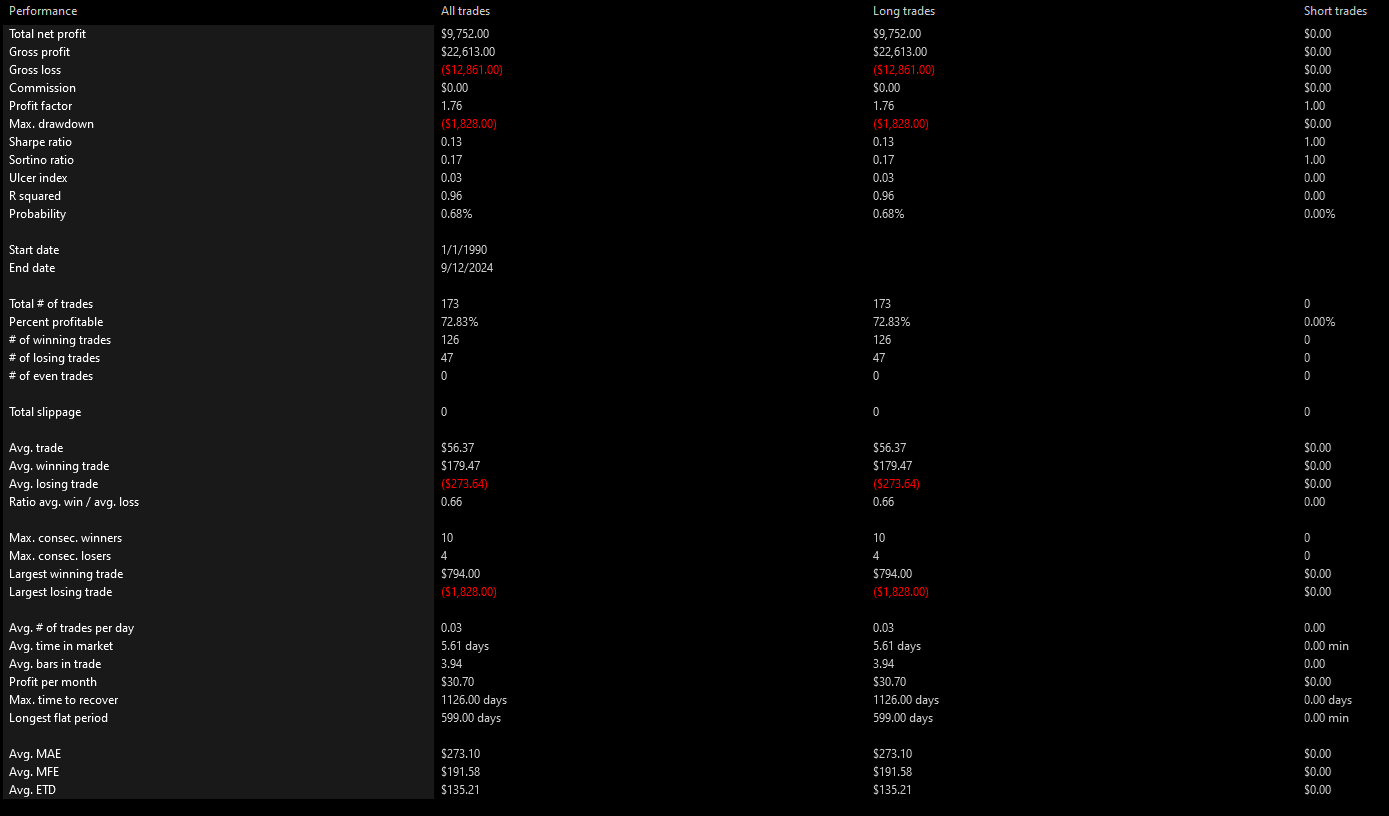

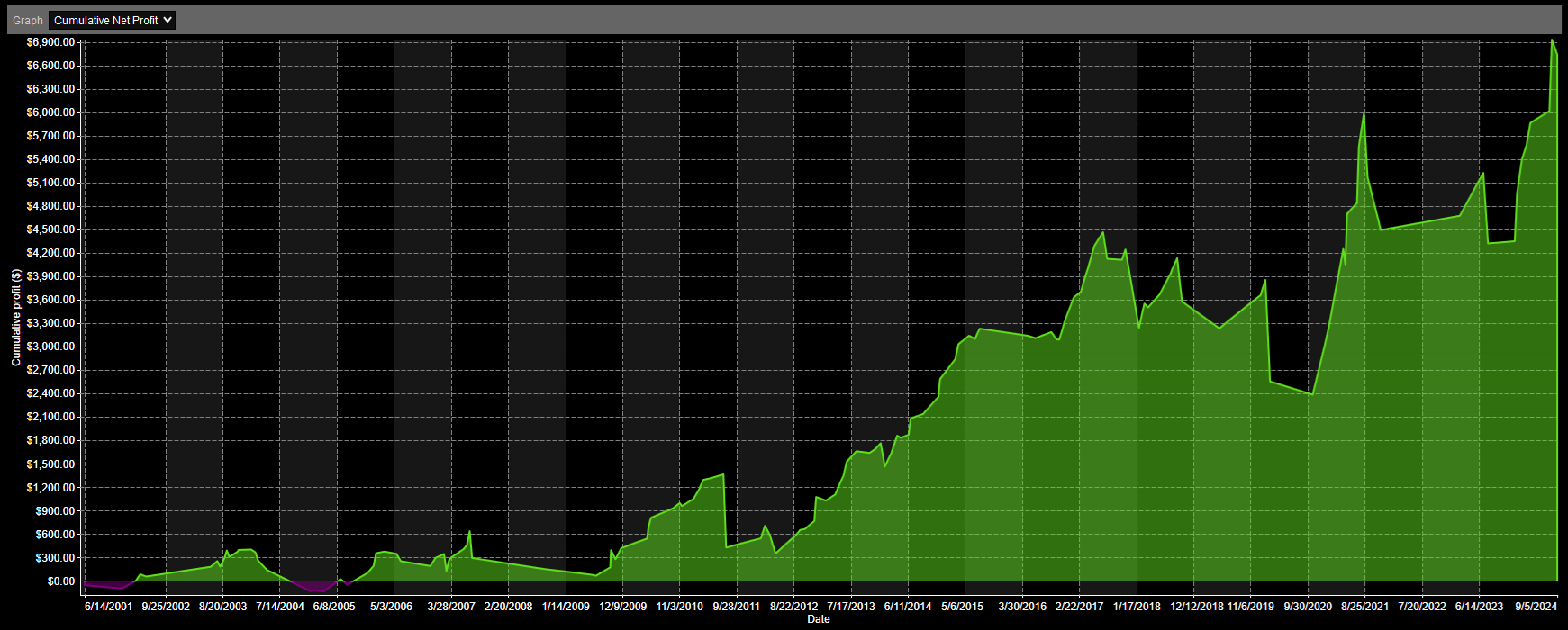

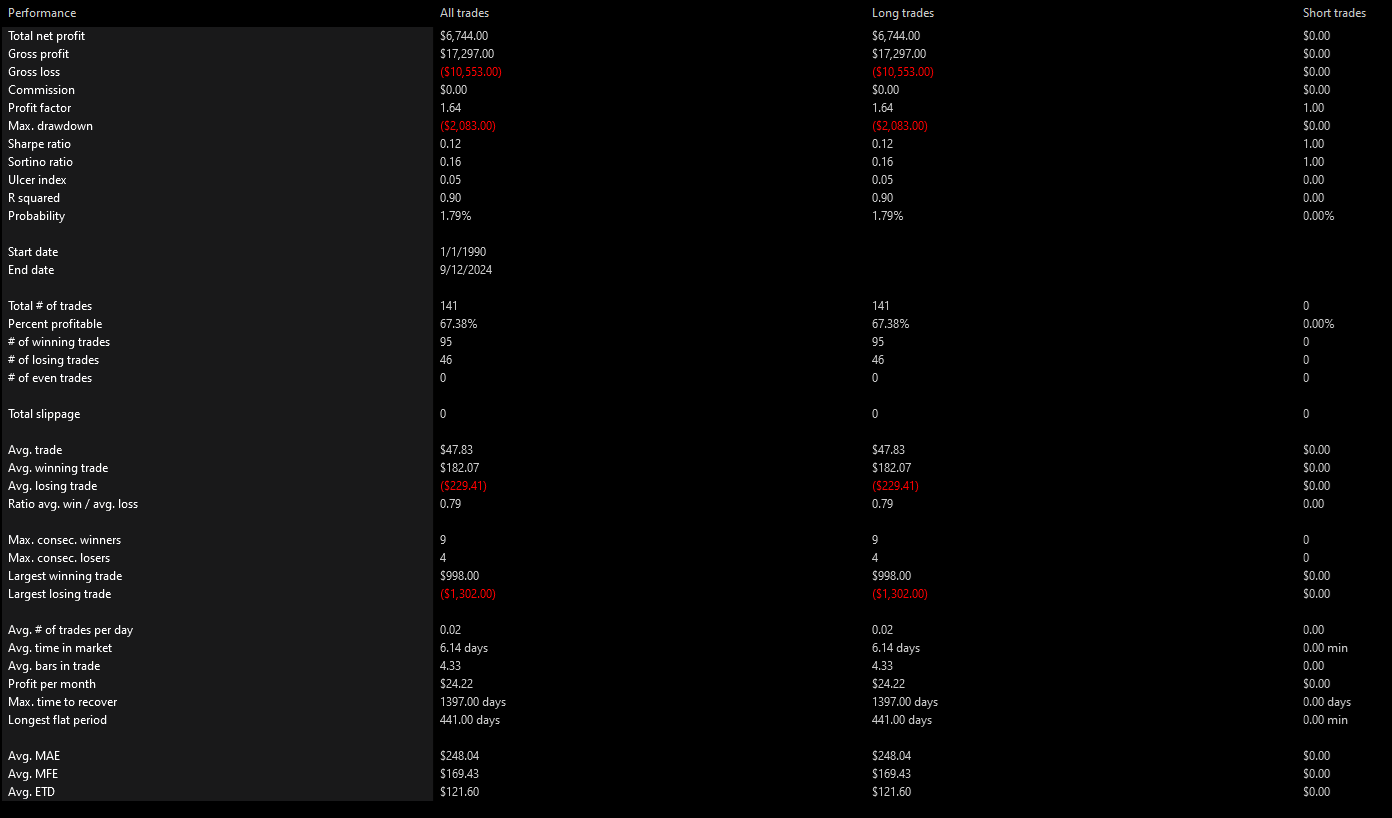

VIX RSI

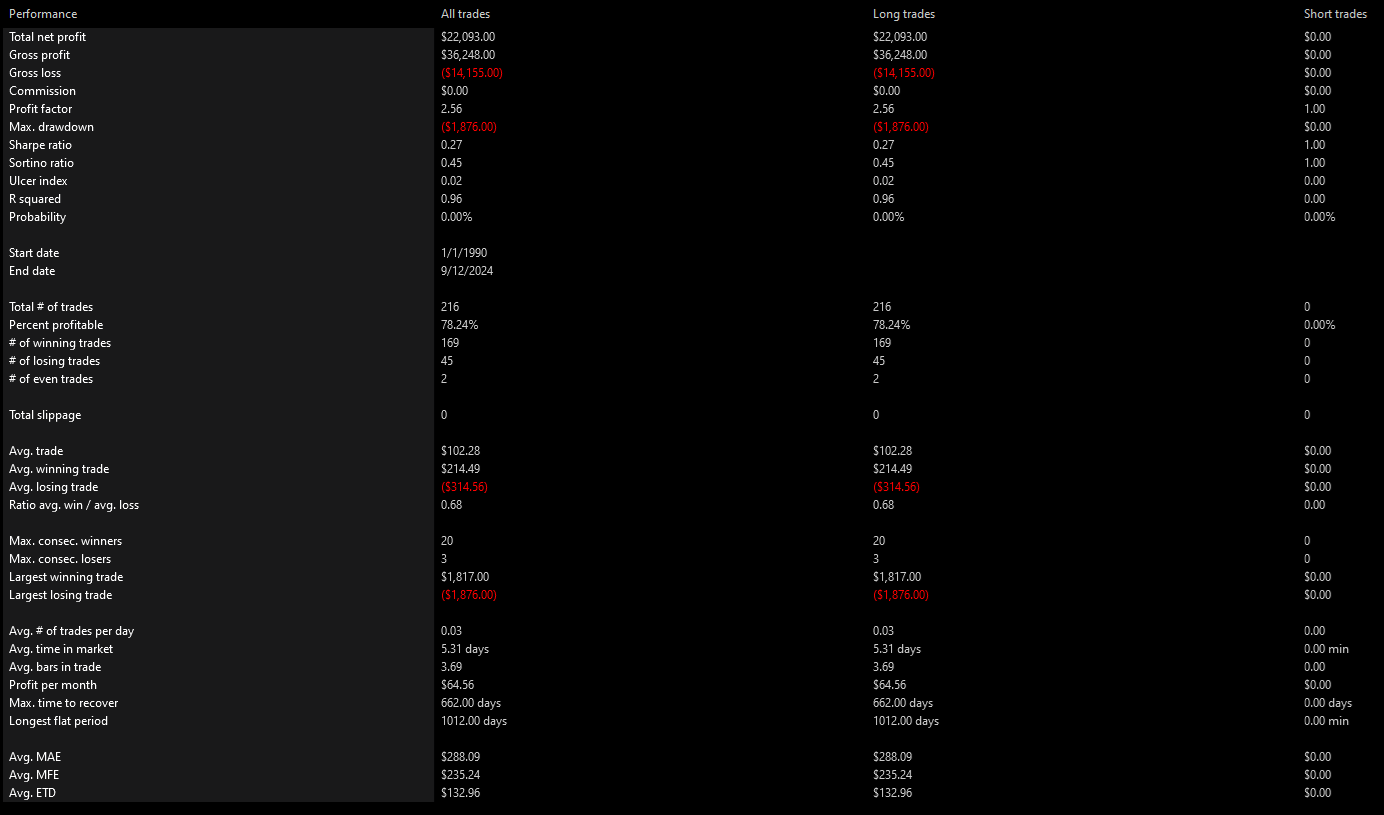

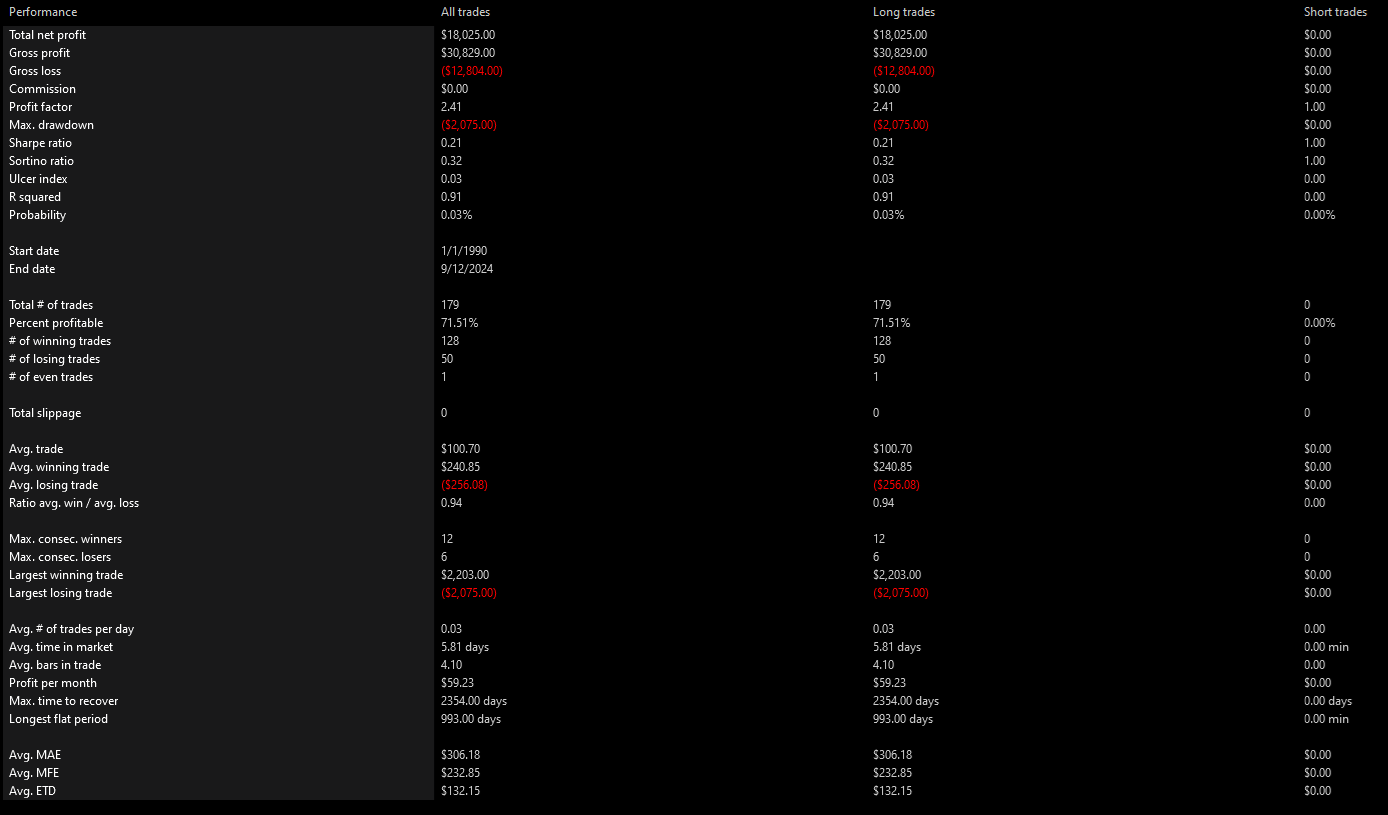

This strategy was taken from chapter 12 of Short Term Trading Strategies That Work (2008) by Larry Connors.

Rules

- The asset (e.g., SPY) is above its 200-day moving average.

- 2-period RSI of VIX is greater than 90.

- The current day's VIX open is greater than the previous day's close.

- If the 2-period RSI of the asset is below 30, enter a long trade.

- Exit the trade when the 2-period RSI closes above 65.

Parameters

Long-Term Trend Period: The period to use in the long-term trend calculation as measured by a simple moving average. (Default: 200)

RSI Period: The period to use in the RSI calculations. (Default: 2)

RSI Smoothing: The smoothing to use in the RSI calculations. (Default: 1)

RSI Entry Threshold: The RSI value below which to allow for entering a trade. (Default: 30)

RSI Exit Threshold: The RSI value above which to exit the trade. (Default: 65)

VIX RSI Entry Threshold: The RSI value of VIX above which to allow for entering a trade. (Default: 90)