2.9 KiB

%B

This strategy was taken from chapter 5 of High Probability ETF Trading (2009) by Larry Connors.

It is based on the %B indicator.

Rules

Long

- The ETF (e.g., SPY) must be above its 200-day moving average.

- If the %B closes < 0.2 for 3 days in a row, enter a long trade.

- (Optional Aggressive Version) If the %B closes < 0.2 again during the initial trade, enter a second long trade.

- Exit the trade when the %B closes > 0.8.

Short

- The ETF (e.g., SPY) must be below its 200-day moving average.

- If the %B closes > 0.8 for 3 days in a row, enter a short trade.

- (Optional Aggressive Version) If the %B closes > 0.8 again during the initial trade, enter a second short trade.

- Exit the trade when the %B closes < 0.2.

Parameters

Long-Term Trend Period: The period of the long-term trend as measured by a simple moving average. (Default: 200)

%B Period: The period to use in the %B calculation. (Default: 5)

%B Standard Deviations: The standard deviation to use in the %B calculation. (Default: 1.0)

Consecutive Days: The number of days in a row that the %B must be above / below the threshold in order to trade. (Default: 3)

Enable Long Trades: Whether to enable taking long trades. (Default: true)

Long %B Entry: The %B threshold under which to enter a long trade. (Default: 0.2)

Long %B Exit: The %B threshold above which to exit a long trade. (Default: 0.8)

Enable Short Trades: Whether to enable taking short trades. (Default: true)

Short %B Entry: The %B threshold above which to enter a short trade. (Default: 0.8)

Short %B Exit: The %B threshold below which to exit a short trade. (Default: 0.2)

Enable Aggressive Entries: Whether to enable taking aggressive second entries when conditions are met. (Default: true)

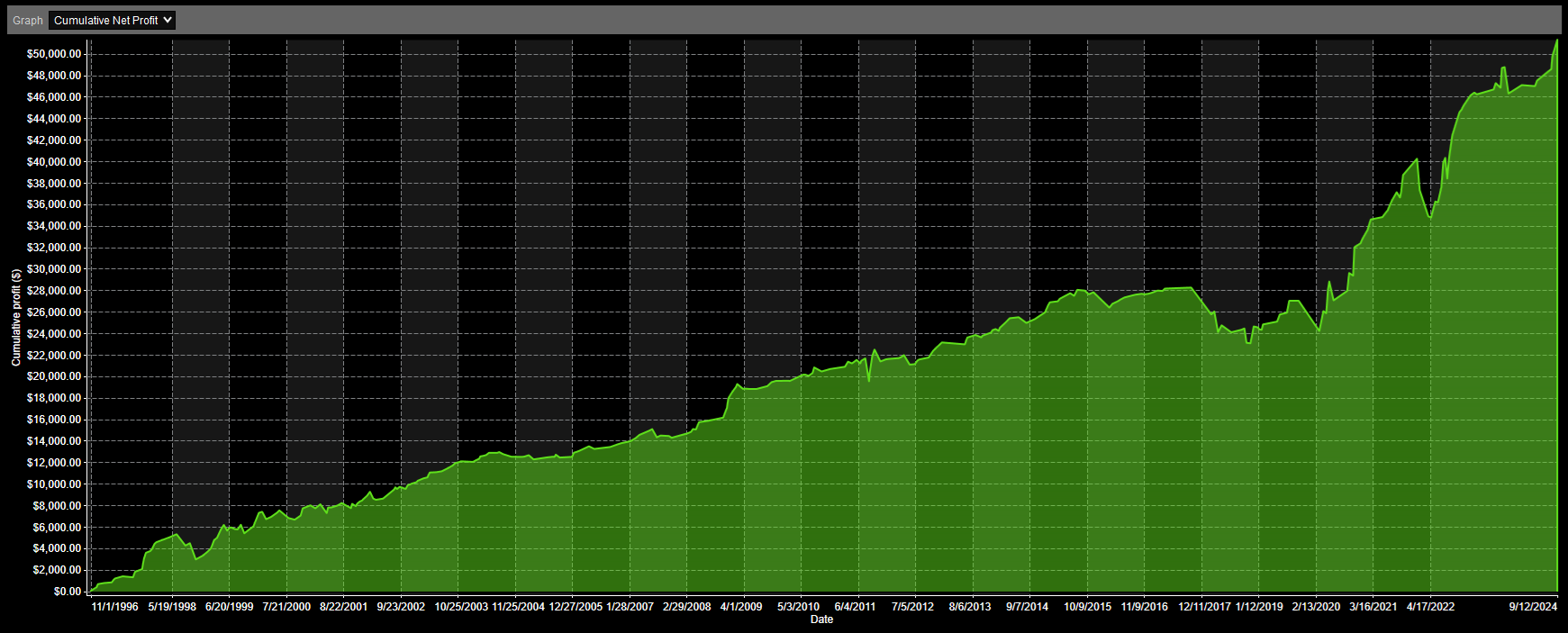

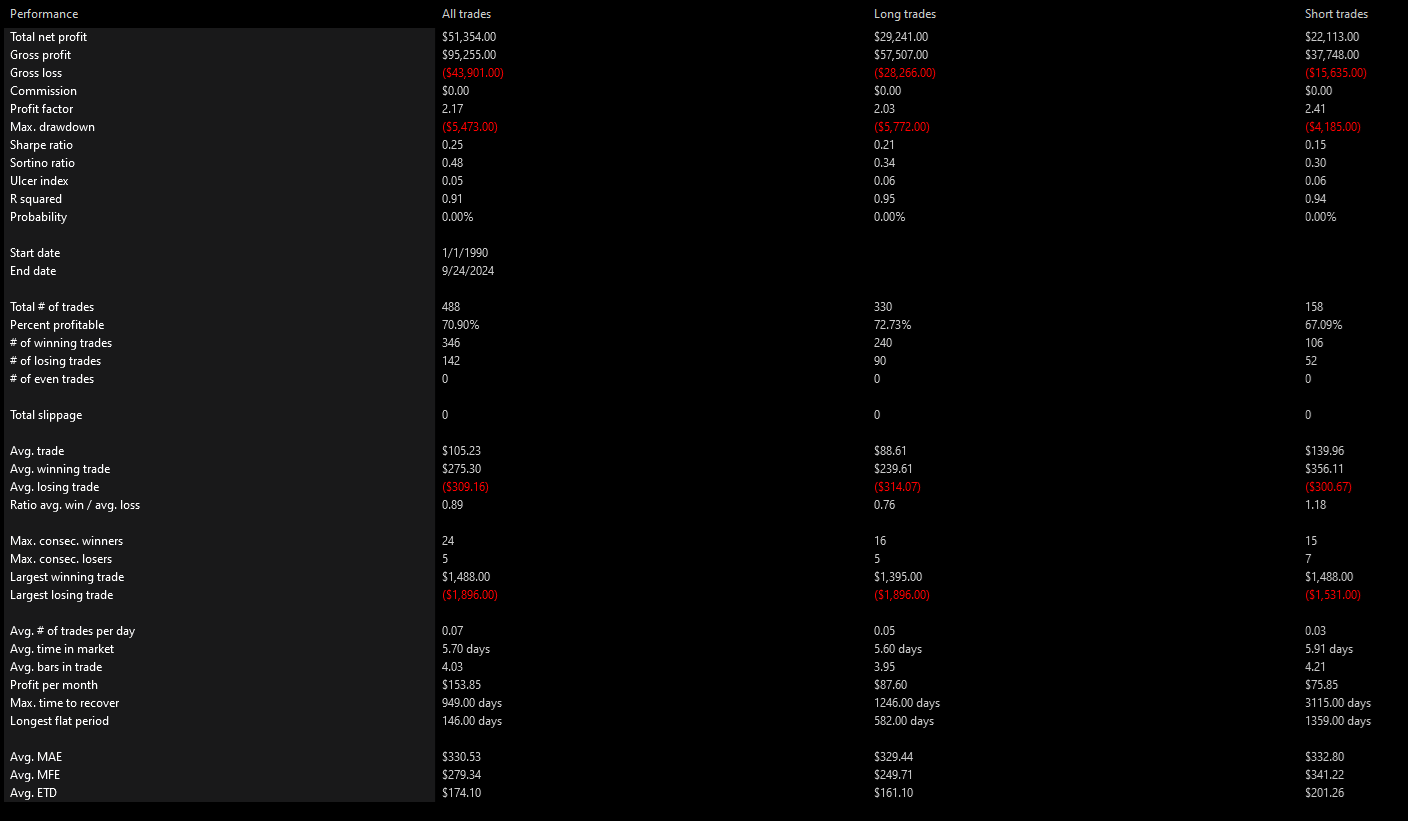

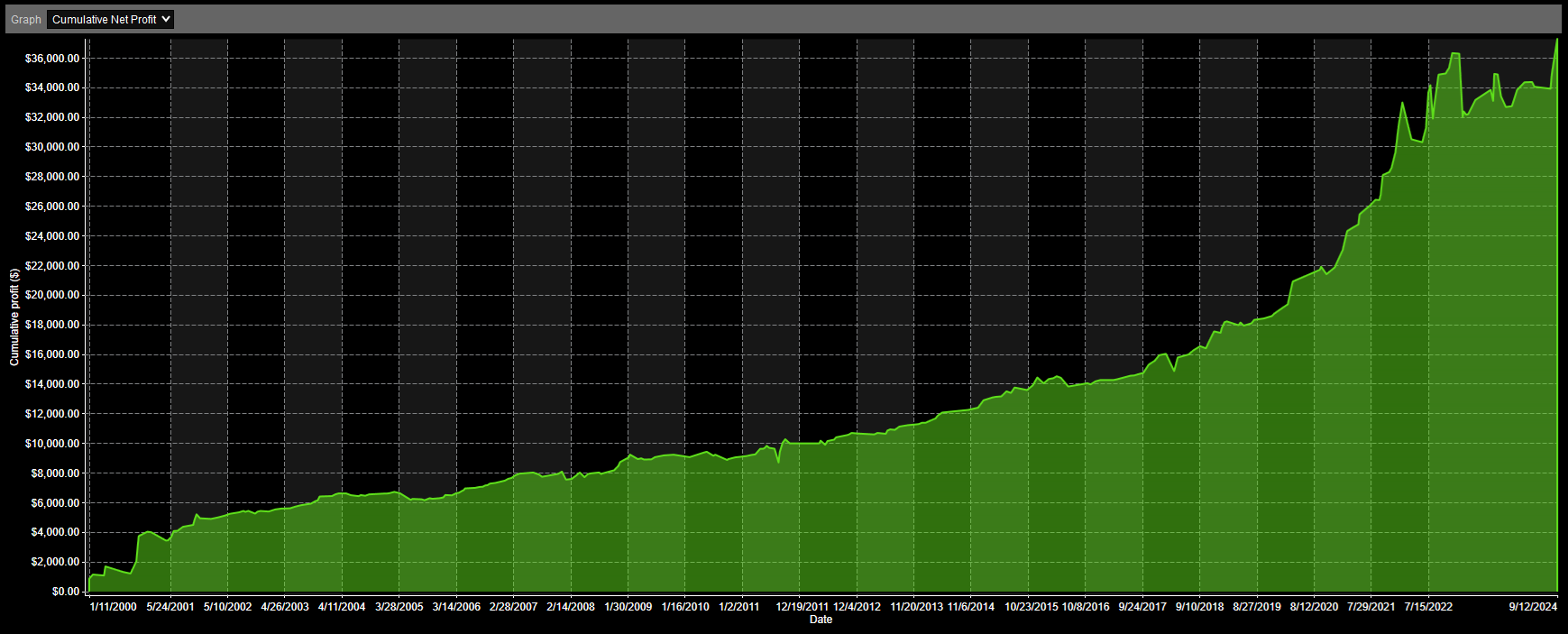

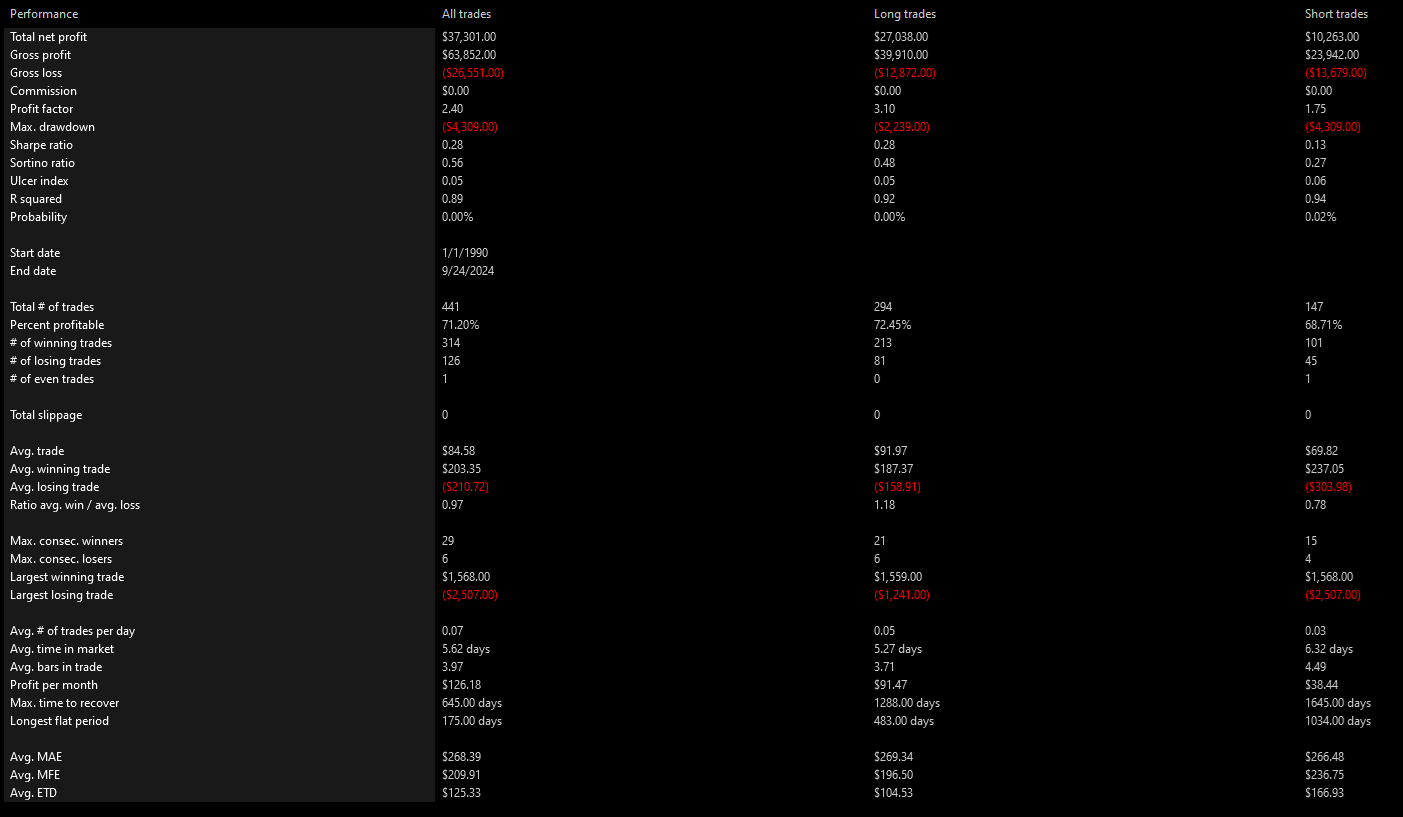

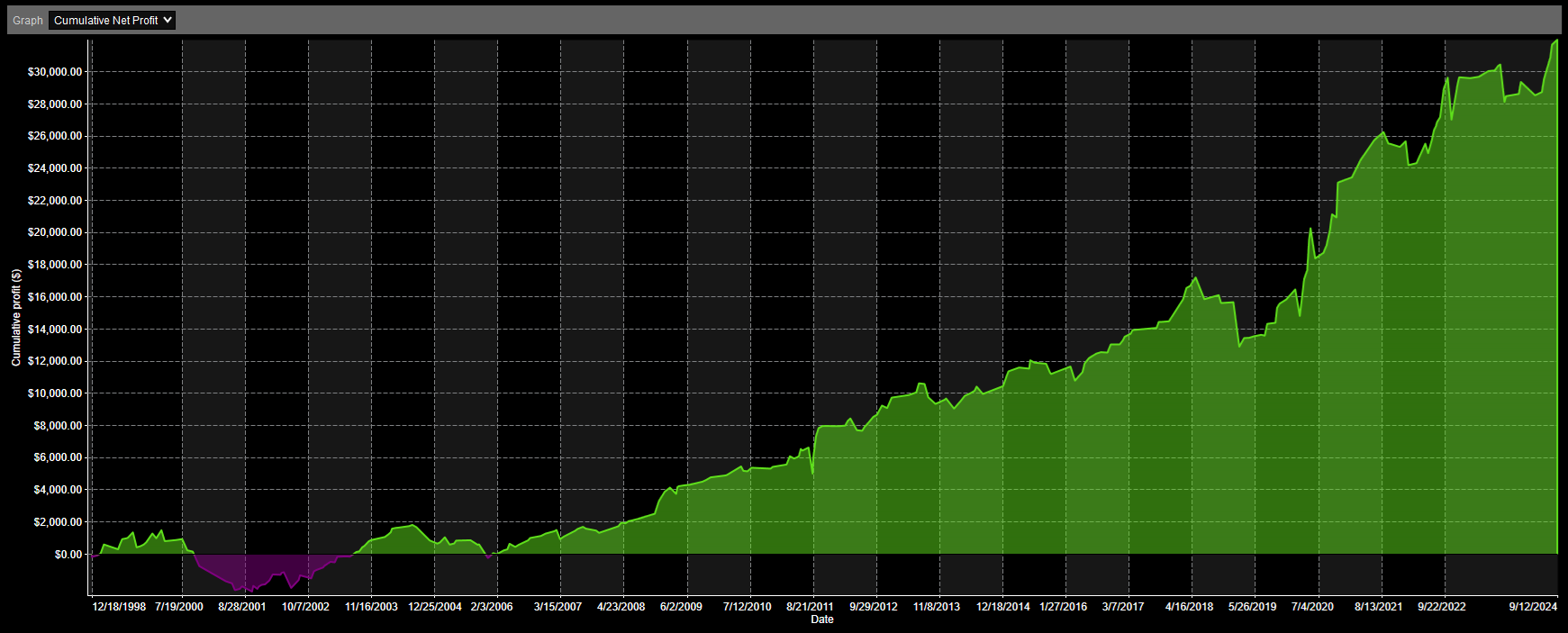

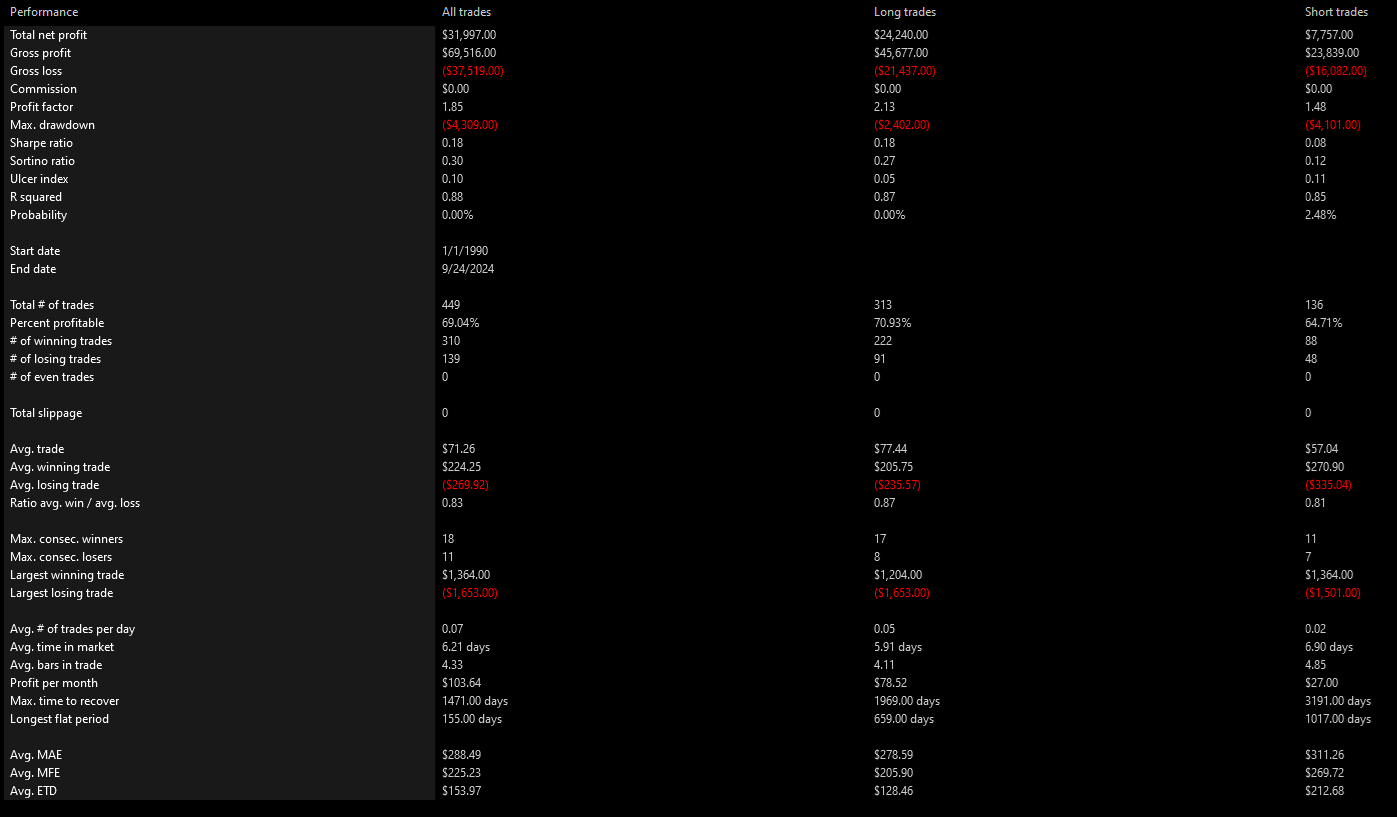

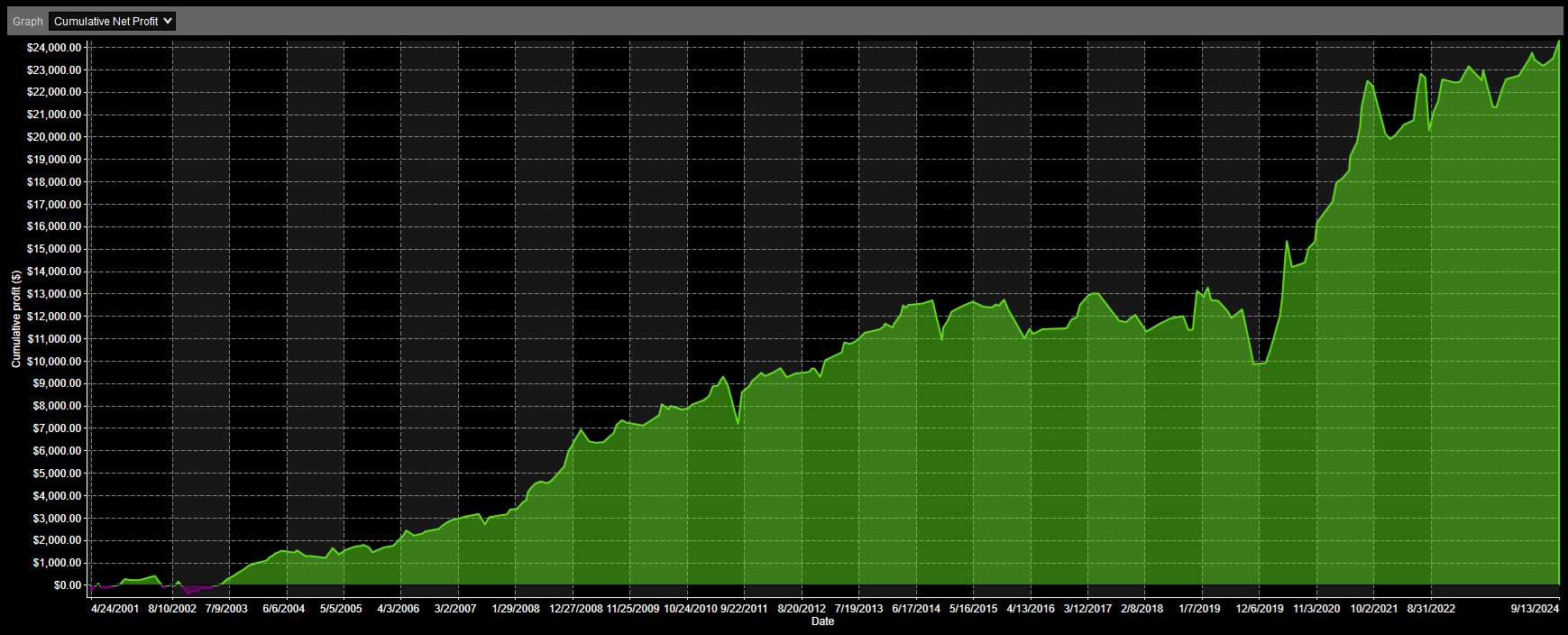

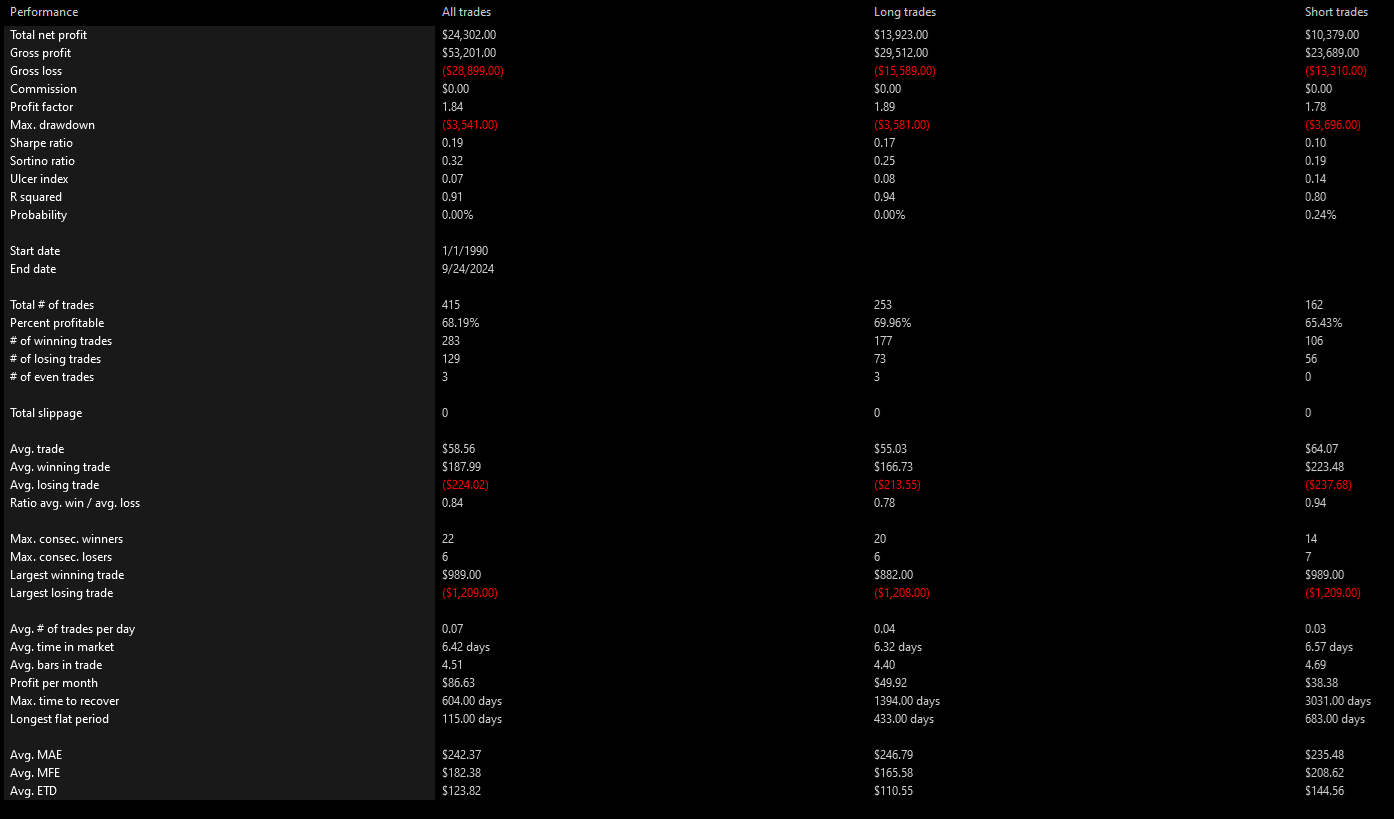

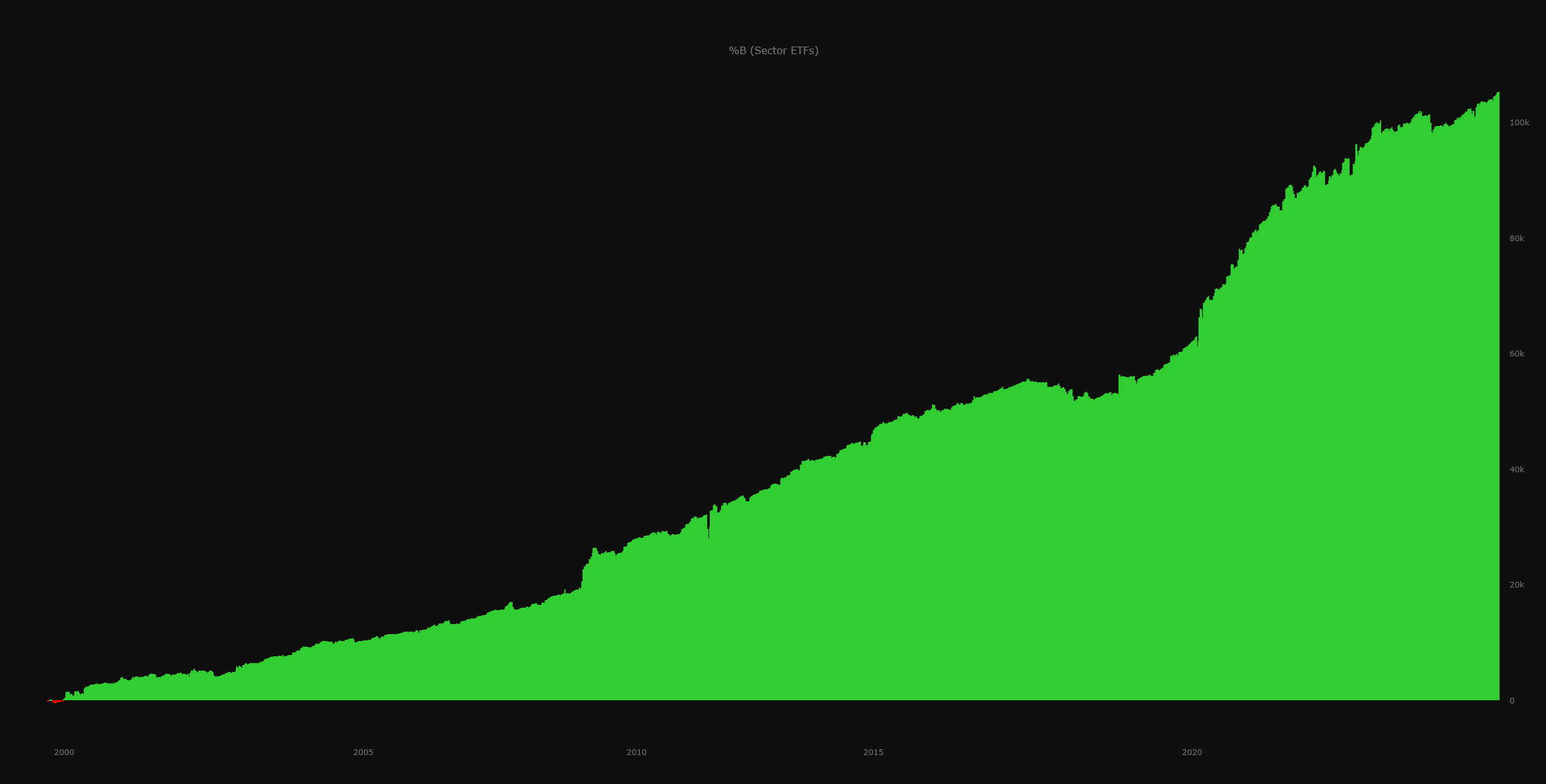

Backtest Results

SPY

QQQ

DIA

IWM

Sector ETFs

This backtest is an aggregation of the results of the following sector ETFs:

XLB, XLC, XLE, XLF, XLI, XLK, XLP, XLU, XLV, XLY