|

…

|

||

|---|---|---|

| .. | ||

| backtest-results | ||

| README.md | ||

| RSITwentyFiveBot.cs | ||

RSI 25 / 75

This strategy was taken from chapter 3 of High Probability ETF Trading (2009) by Larry Connors.

Rules

Long

- The ETF (e.g., SPY) is trading above its 200-day moving average.

- If the 4-period RSI closes under 25, enter a long trade.

- (Optional Aggressive Version) Enter another long trade if at any time while in the first trade the 4-period RSI closes under 20.

- Exit the trade(s) when the 4-period RSI closes above 55.

Short

- The ETF is trading below its 200-day moving average.

- If the 4-period RSI is above 75, enter a short trade.

- (Optional Aggressive Version) Enter another short trade if the 4-period RSI closes above 80.

- Exit the trade(s) when the 4-period RSI closes under 45.

Parameters

Long-Term Trend Period: The period of the long-term trend as measured using a simple moving average. (Default: 200)

RSI Period: The period to use in the RSI calculation. (Default: 4)

RSI Smoothing: The smoothing to use in the RSI calculation. (Default: 1, no smoothing)

Enable Long Trades: Whether to enable taking long trades. (Default: true)

Long RSI Entry: The RSI value below which to allow entering long trades. (Default: 25)

Long RSI Exit: The RSI value above which to exit any open long trades. (Default: 55)

Enable Short Trades: Whether to enable taking short trades. (Default: true)

Short RSI Entry: The RSI value above which to allow entering short trades. (Default: 75)

Short RSI Exit: The RSI value below which to exit any open short trades. (Default: 45)

Enable Aggressive Entries: Whether to enable taking another more aggressive trade after the initial one. (Default: true)

Aggressive Long RSI Entry: The RSI value below which to allow taking an aggressive long trade. (Default: 20)

Aggressive Short RSI Entry: The RSI value above which to allow taking an aggressive short trade. (Default: 80)

Backtest Results

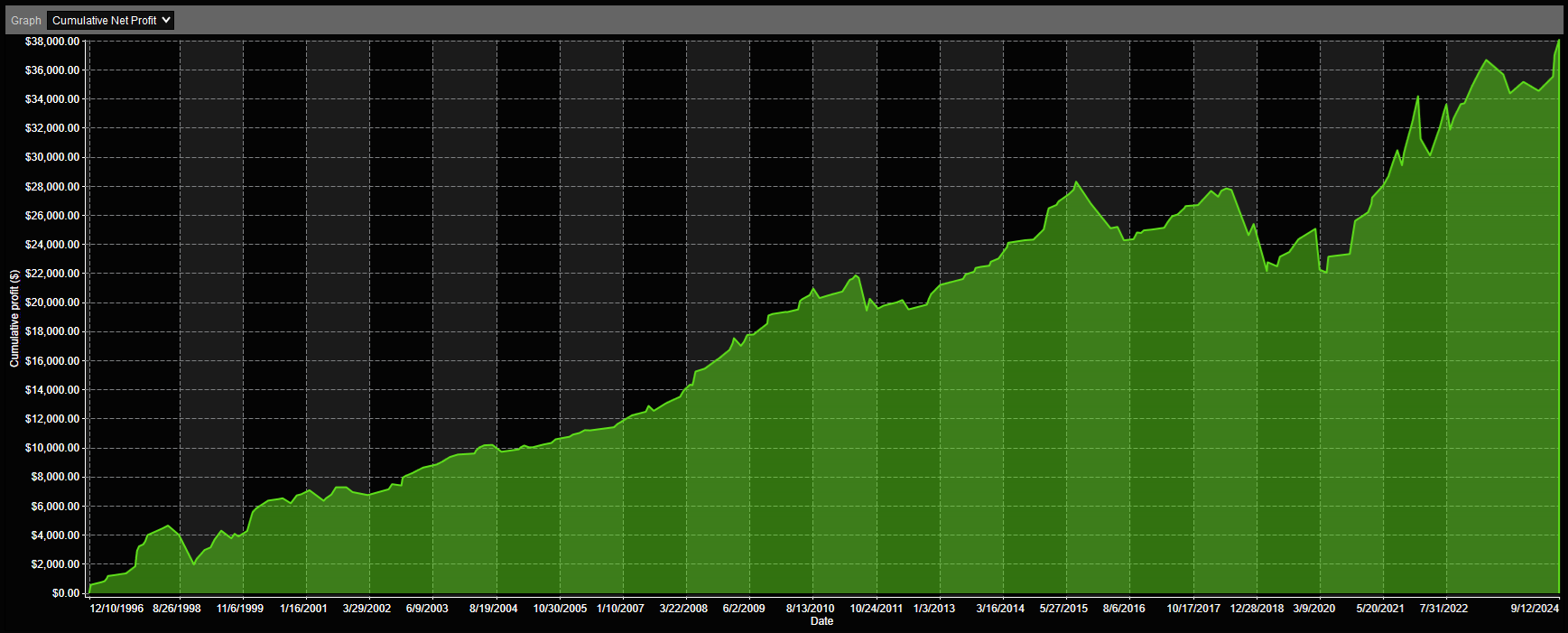

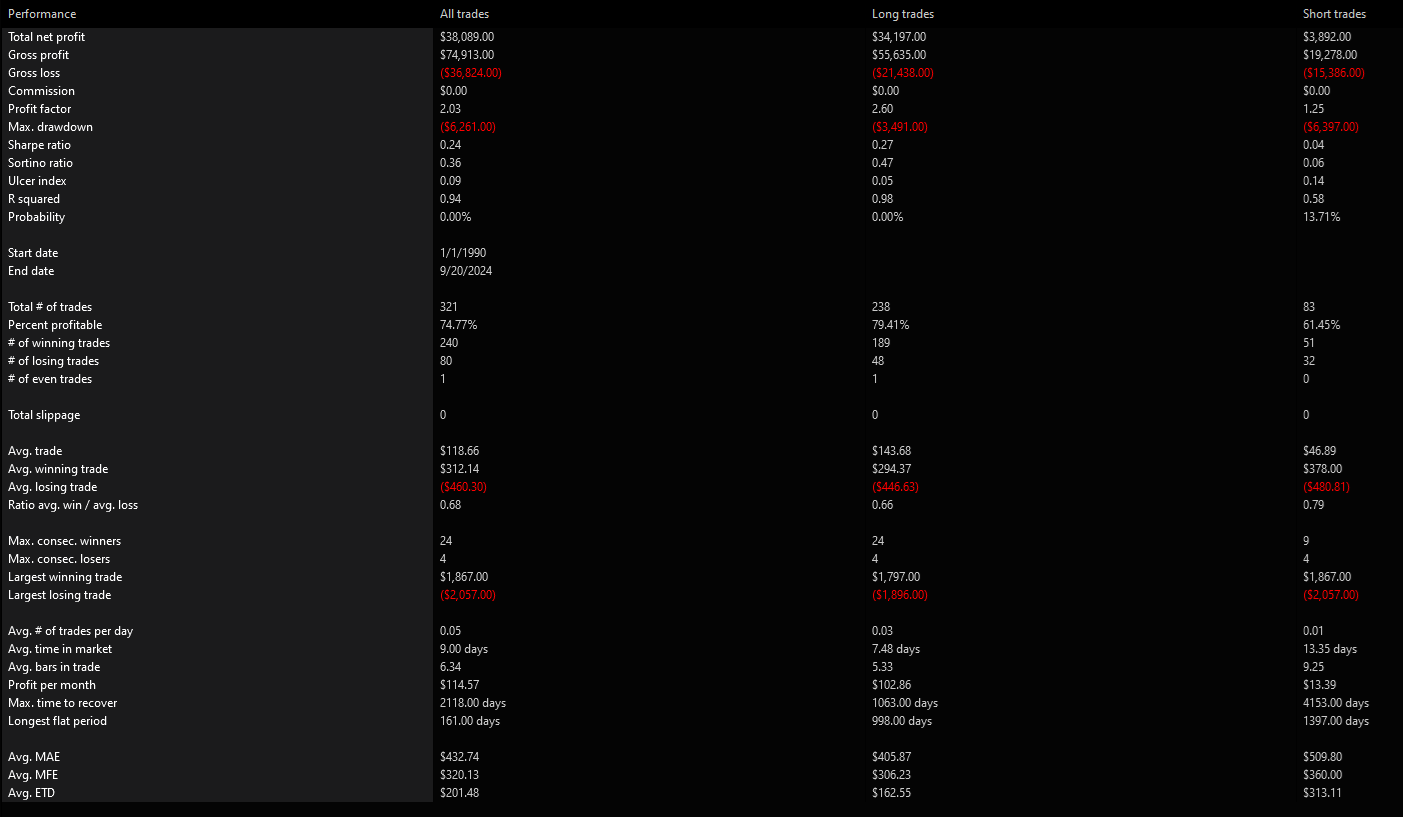

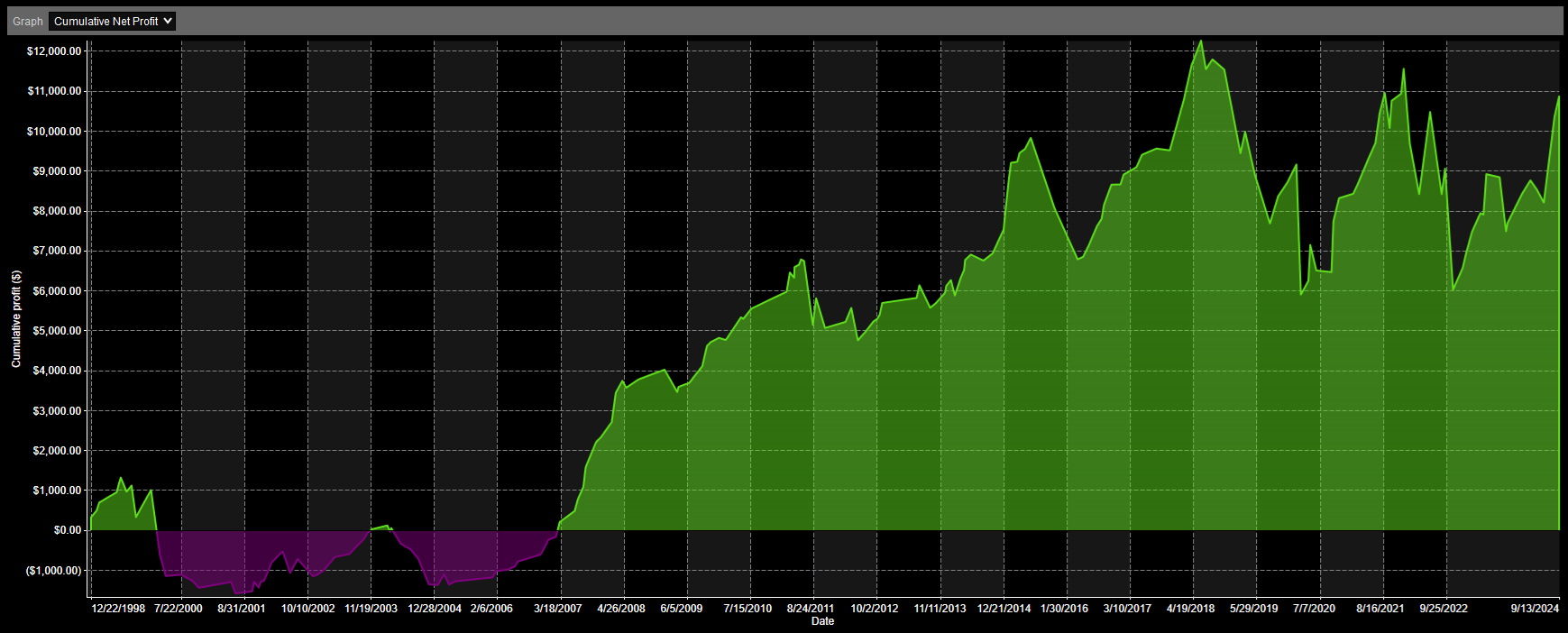

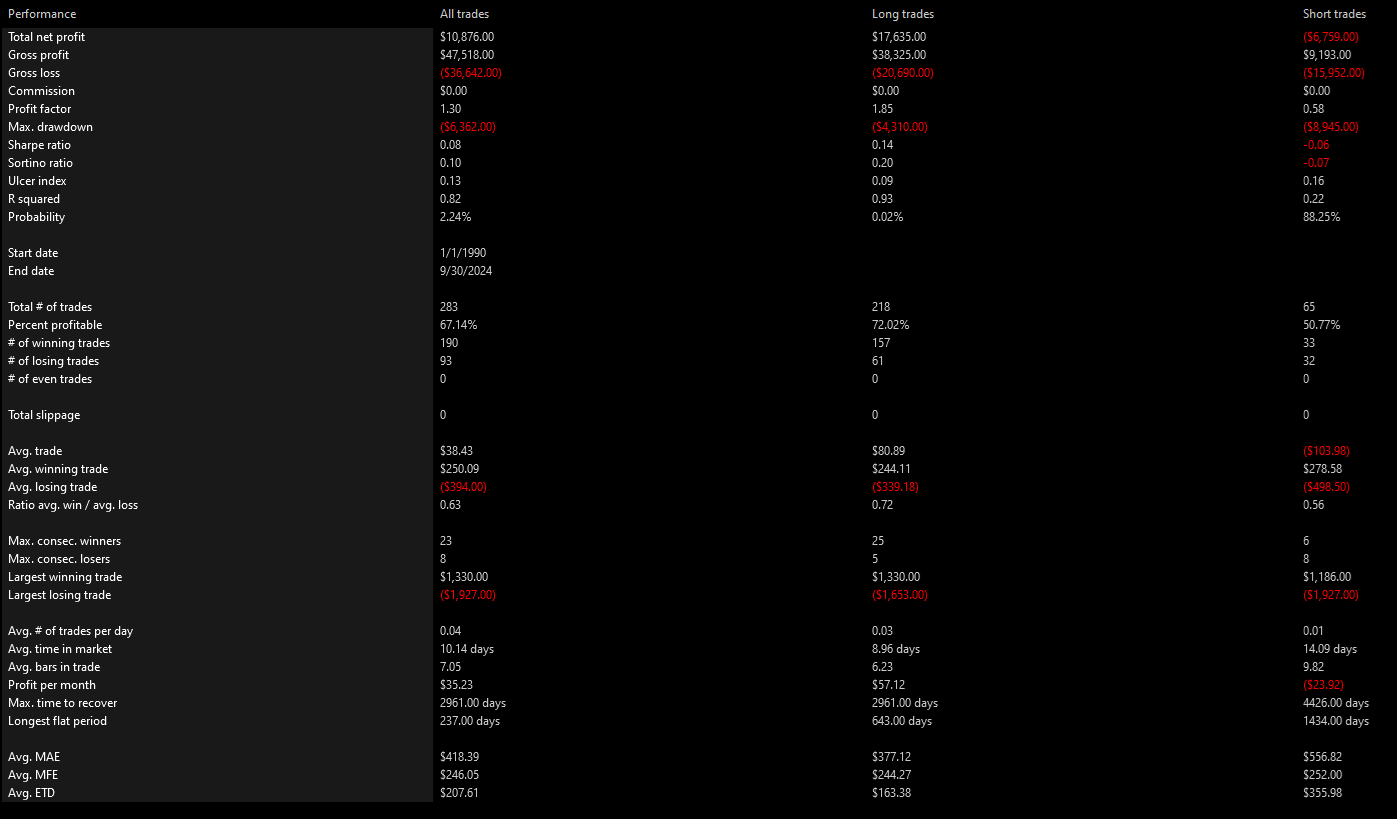

SPY

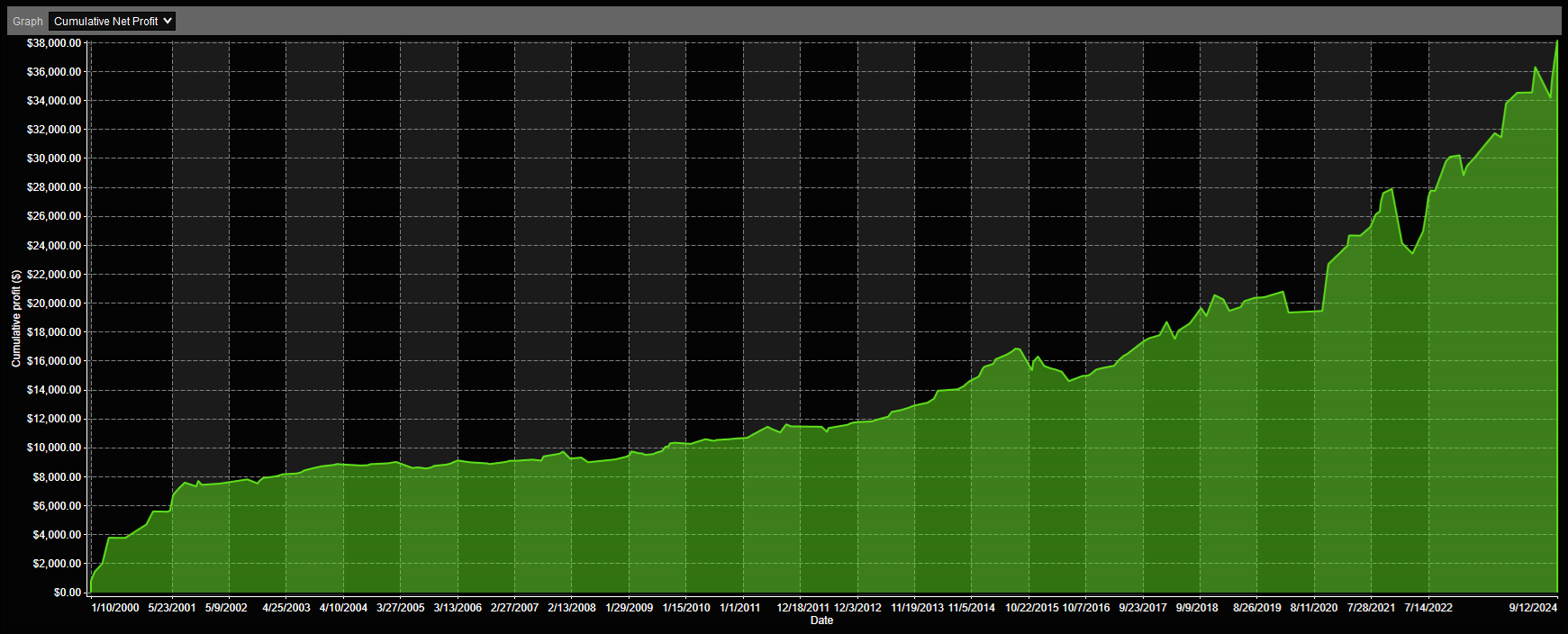

QQQ

DIA

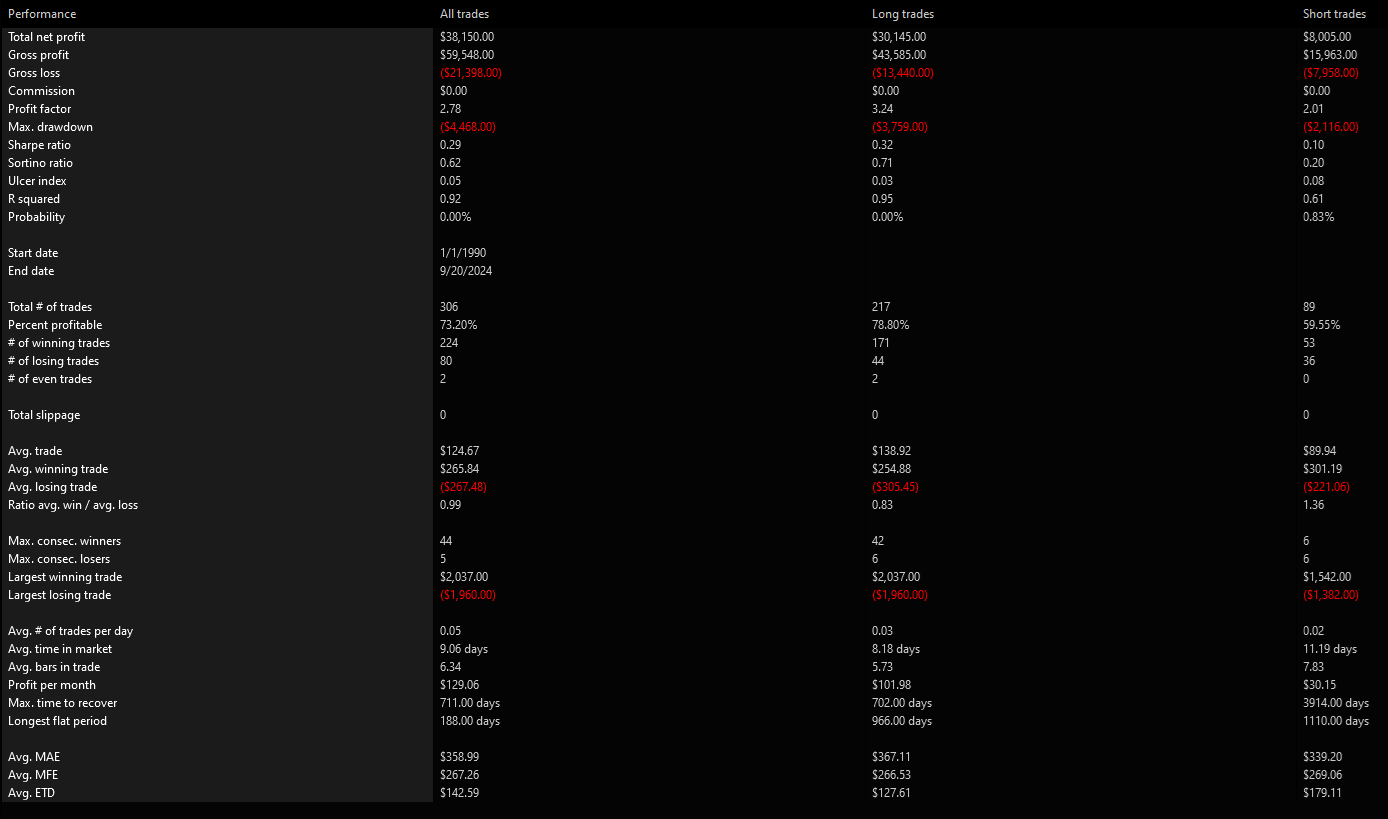

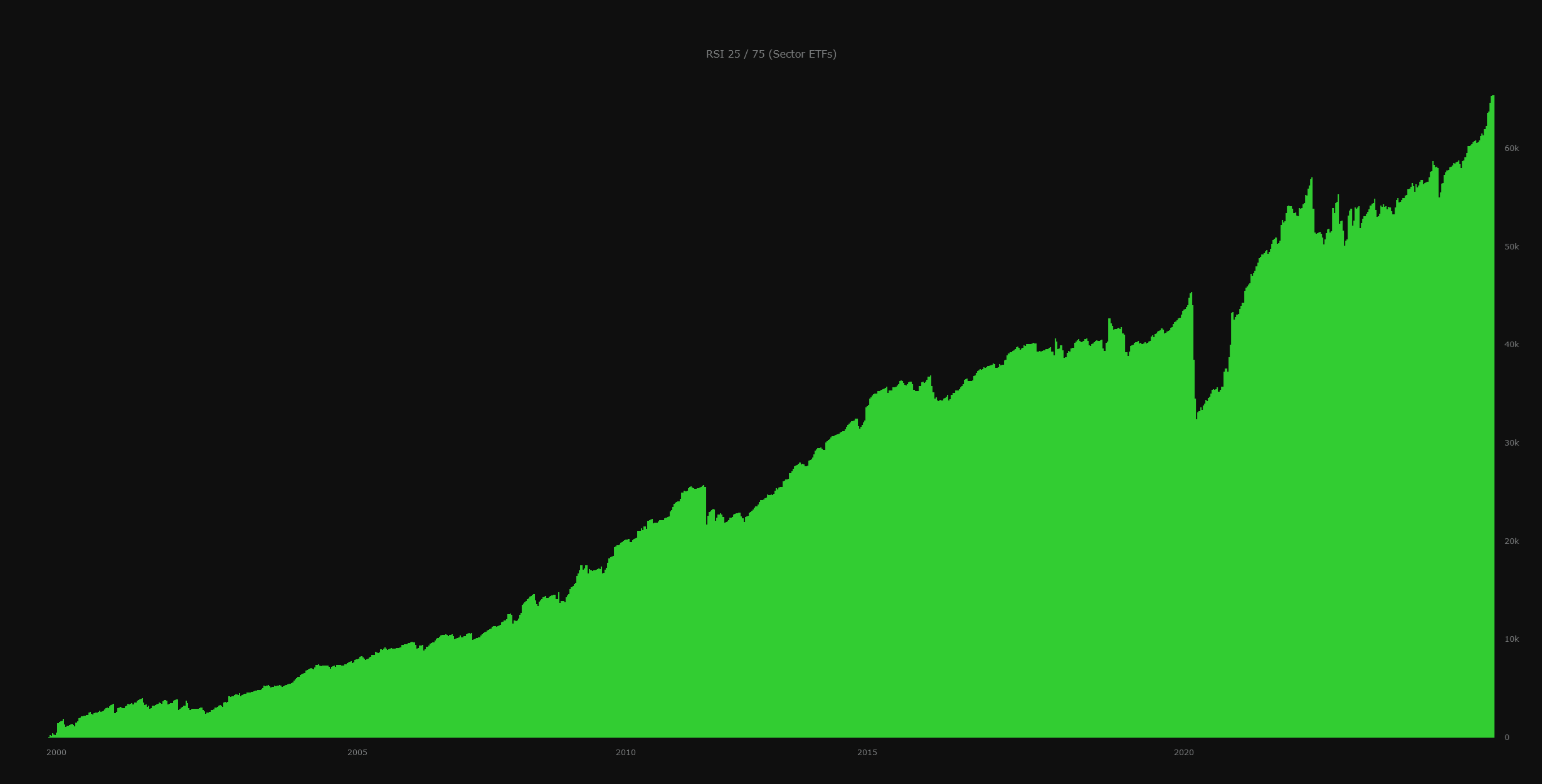

Sector ETFs

This backtest is an aggregation of the results of the following sector ETFs:

XLB, XLC, XLE, XLF, XLI, XLK, XLP, XLU, XLV, XLY