| .. | ||

| backtest-results | ||

| README.md | ||

| VolPanicsBot235.cs | ||

| VolPanicsBot.cs | ||

Vol Panics

This strategy was taken from chapter 5 of Buy the Fear, Sell the Greed (2018) by Larry Connors.

Rules

- When VXX is trading above its 5-period moving average and its 4-period RSI is > 70, enter a short trade.

- (Optional Aggressive Entry) If VXX closes higher than the initial entry price at any point during the trade, enter a second short trade.

- Exit the trade if VXX closes under its 5-period moving average.

2-3-5 Scale-In Version

This version of the strategy enters up to 3 trades:

- The initial entry according to the original rules but with 20% of the total position size.

- An entry with 30% of the total position size if VXX closes higher than the initial entry price at any point during the trade.

- A final entry with 50% of the total position size if VXX closes higher than the second entry price at any point during the trade.

The exit condition remains the same as in the original version of the strategy.

1-2-3-4 Scale-In Version

This version of the strategy enters up to 4 trades:

- The initial entry according to the original rules but with 10% of the total position size.

- An entry with 20% of the total position size if VXX closes higher than the initial entry price at any point during the trade.

- Another entry with 30% of the total position size if VXX closes higher than the second entry price at any point during the trade.

- Finally, an entry with 40% of the total position size if VXX closes higher than the third entry price at any point during the trade.

The exit condition remains the same as in the original version of the strategy.

Parameters

Moving Average Period: The period used in the simple moving average calculation. (Default: 5)

RSI Period: The period used in the RSI calculation. (Default: 4)

RSI Smoothing: The smoothing used in the RSI calculation. (Default: 1)

Entry Threshold: The RSI value above which to enter the short trade. (Default: 70)

Enable Aggressive Entries: Whether to enter an additional aggressive trade if conditions are met. (Default: true)

Backtest Results

/VX

Note that these backtests were performed on /VX (VIX futures) rather than on the VXX etf.

This is because the data feed I am using had very limited data available for VXX.

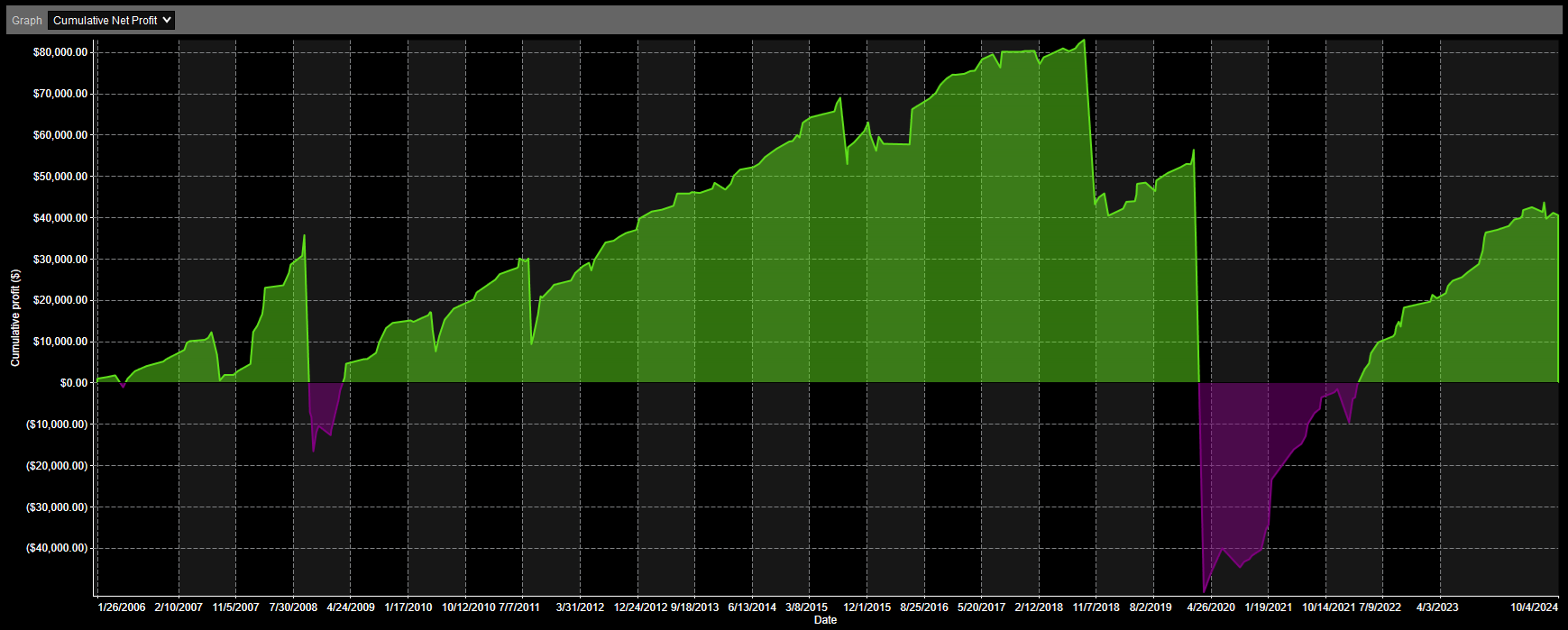

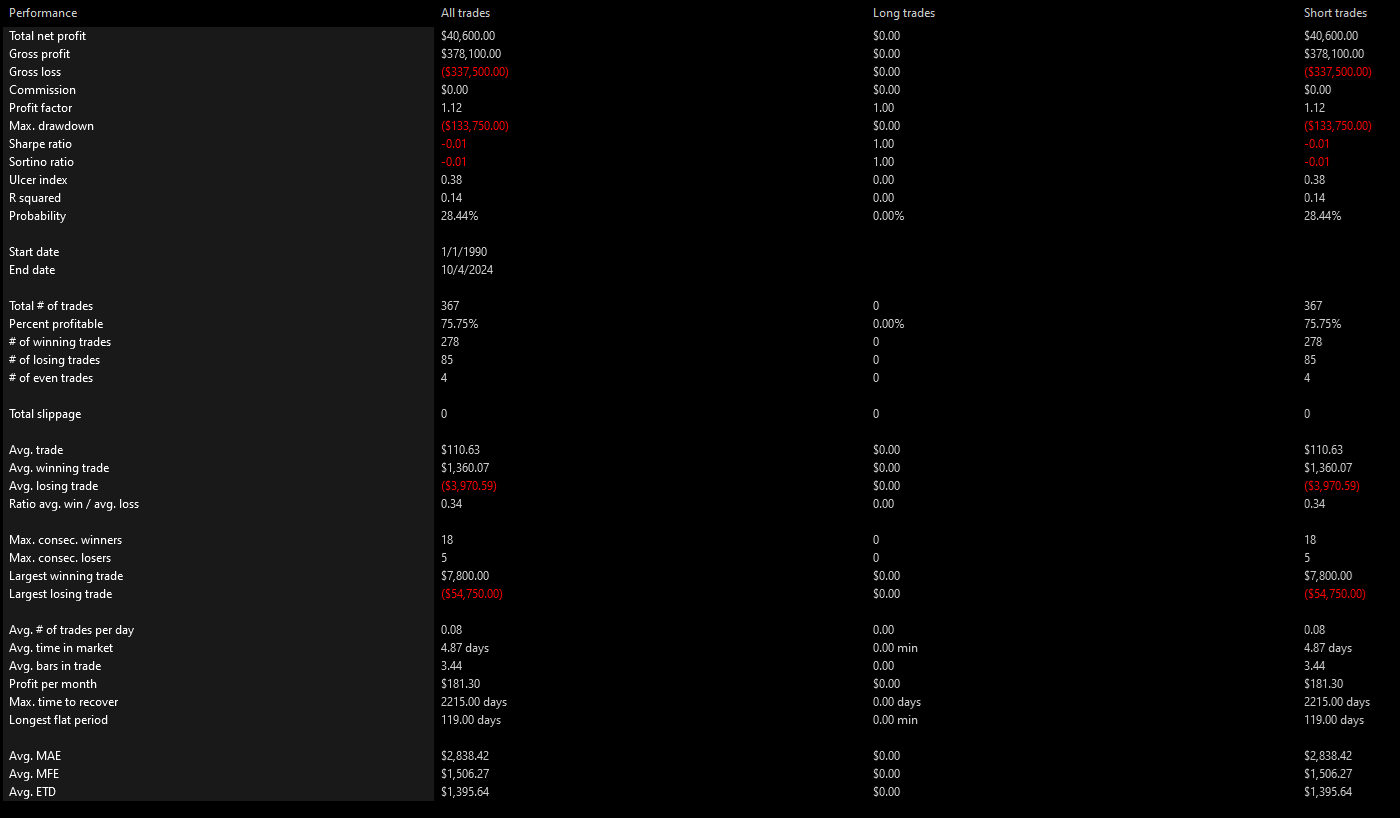

Original Strategy

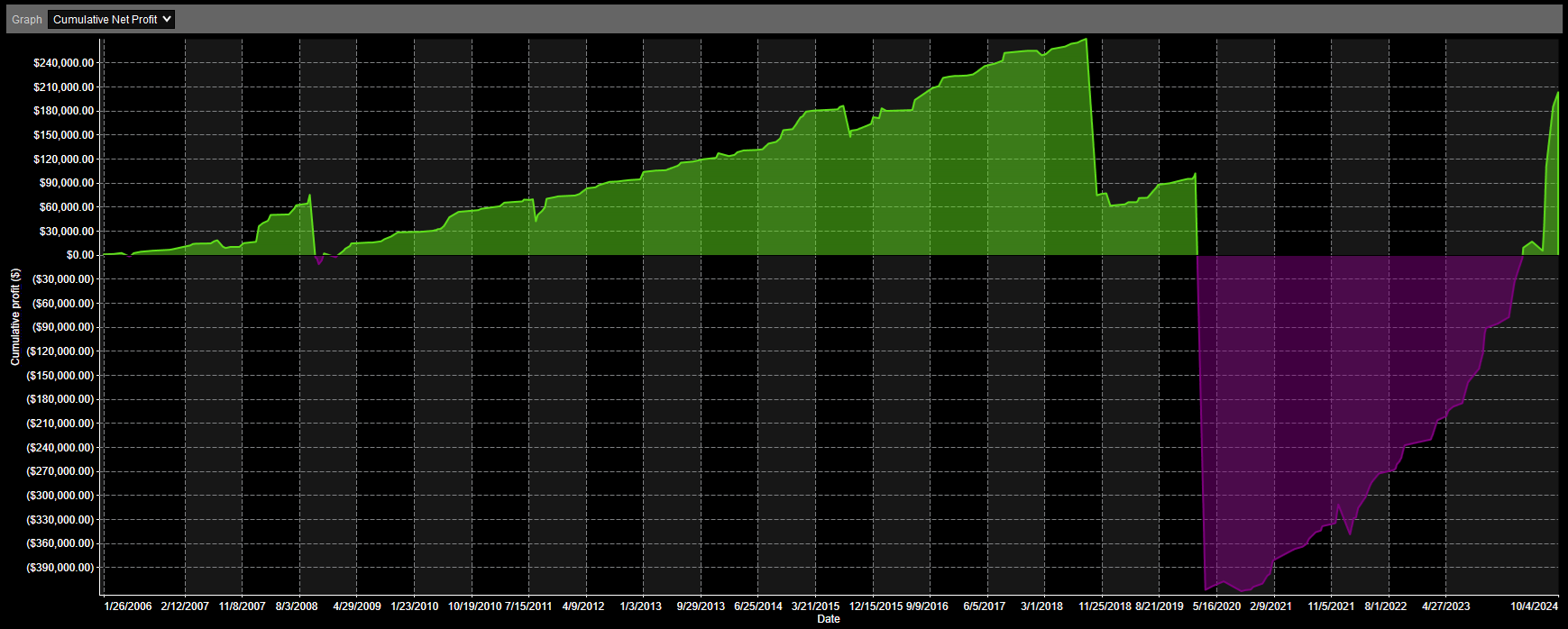

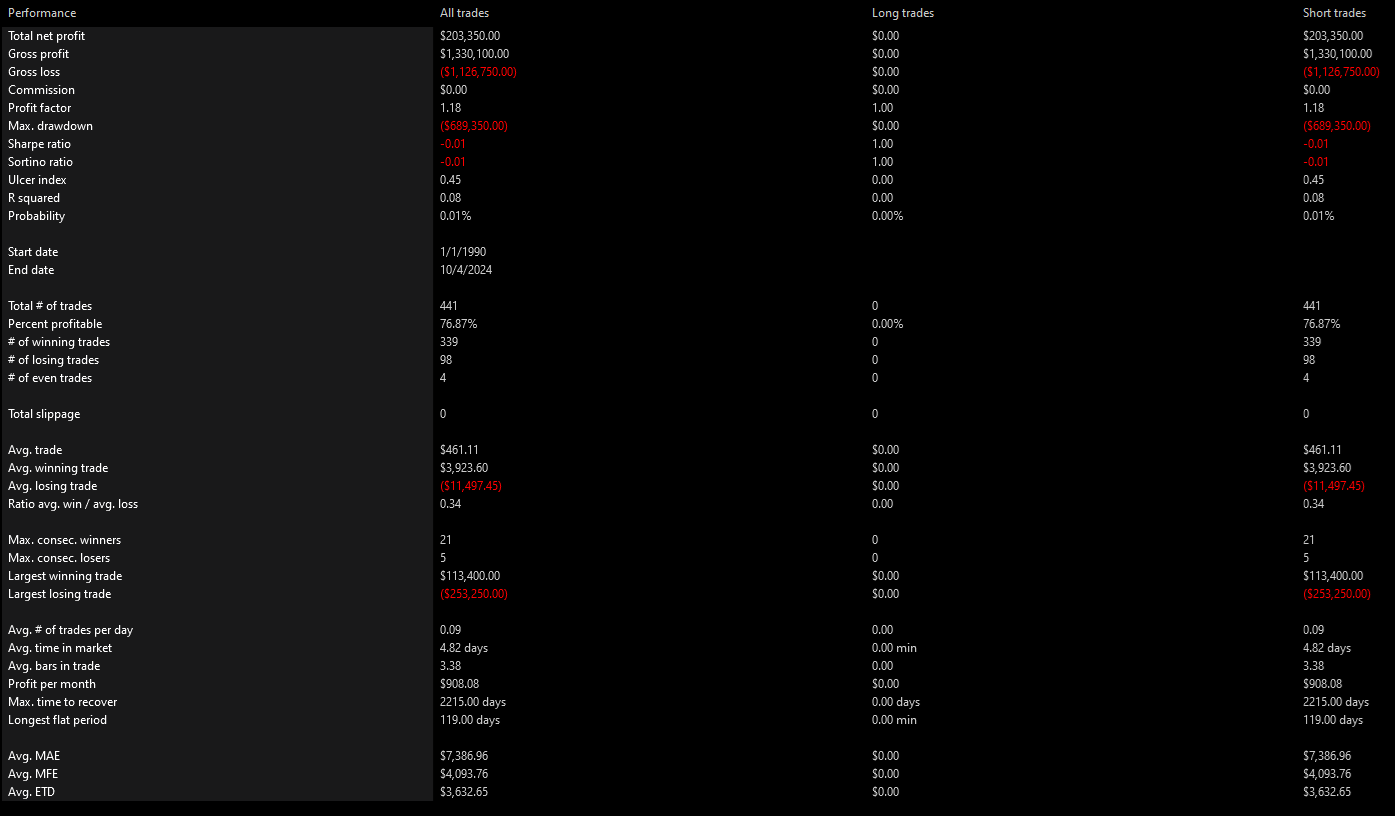

2-3-5 Scale-In

Hopefully these results demonstrate why you must be extremely careful when shorting volatility.