| .. | ||

| connors_rsi_parameters.png | ||

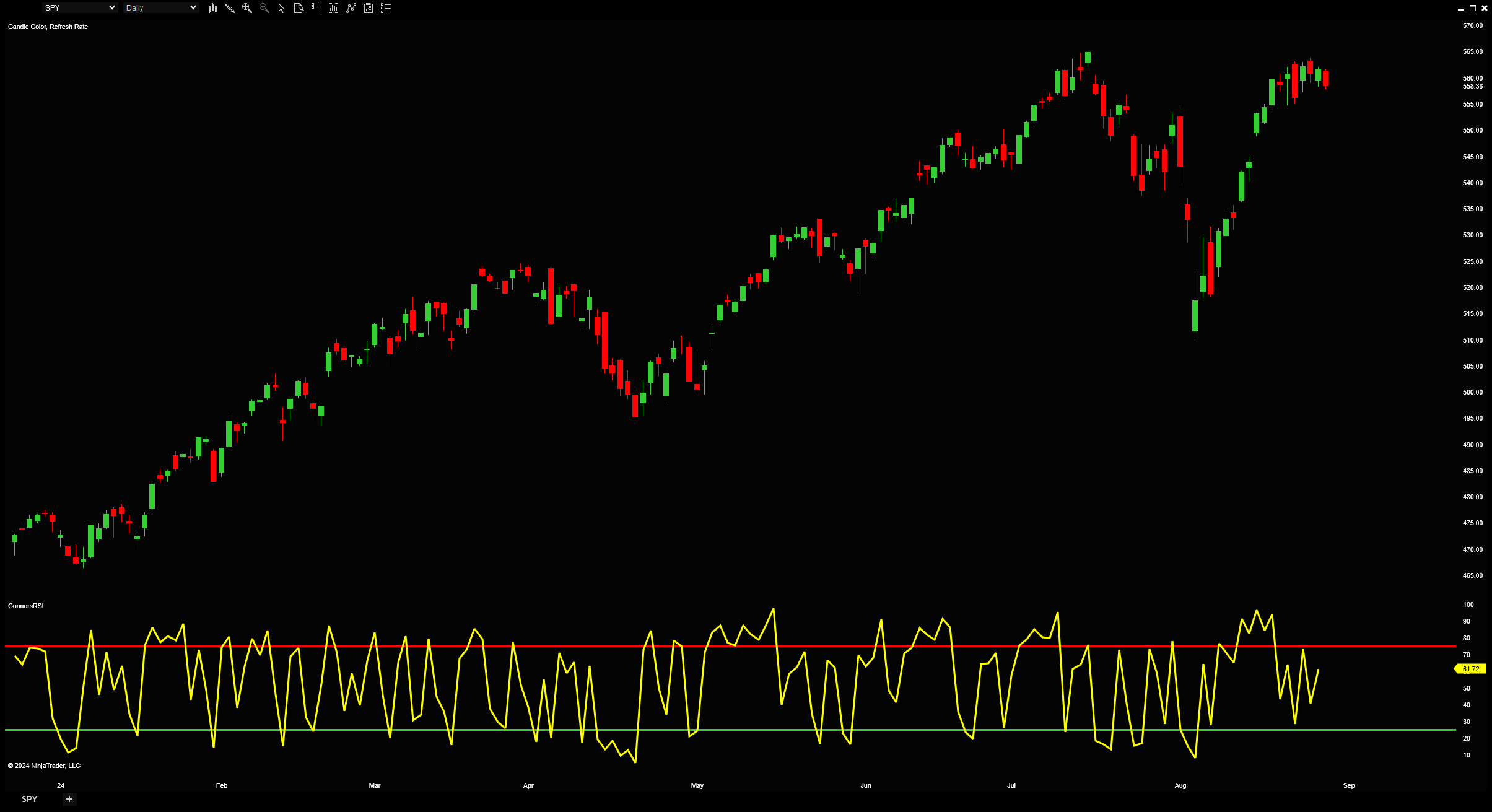

| connors_rsi.png | ||

| ConnorsRSI.cs | ||

| README.md | ||

ConnorsRSI

Overview

This is an implementation of the ConnorsRSI indicator developed by Larry Connors.

It was based on a description of the indicator in his book Buy the Fear, Sell the Greed.

The formula given in the book is as follows:

ConnorsRSI(3, 2, 100) = (RSI(Close, 3) + RSI(Streak, 2) + PercentRank(Close, 100)) / 3

The first component is a standard RSI calculation on the Close price.

The Streak "price" is measured in terms of how many bars in a row the closing price has increased / decreased, and the second RSI component is calculated on that.

Any time the price goes from decreasing to increasing (or vice versa), the streak is set to 1 (or -1) and then incremented (or decremented) from there.

If there is no change in price, the streak is set to 0.

The third and final component is a percent rank computed on the Close price.

The indicator parameters default to the values used in the above formula.

The only additional parameters introduced in this implementation are for smoothing the RSI calculations, though they both default to 1 (i.e., no smoothing).

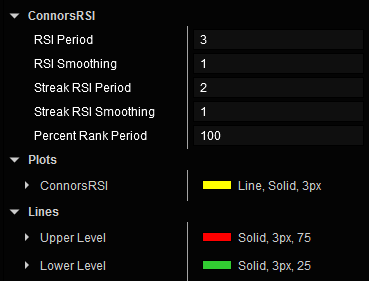

Parameters

RSI Period: The period used in the first component RSI calculation. (Default: 3)

RSI Smoothing The smoothing period used in the first component RSI calculation. (Default: 1)

Streak RSI Period: The period used in the second component RSI calculation. (Default 2)

Streak RSI Smoothing: The smoothing period used in the second component RSI calculation. (Default: 1)

Percent Rank Period: The period over which to rank prices in the percent rank calculation. (Default: 100)