| .. | ||

| backtest-results | ||

| README.md | ||

| TwoPeriodRSIHighs.cs | ||

| TwoPeriodRSILows.cs | ||

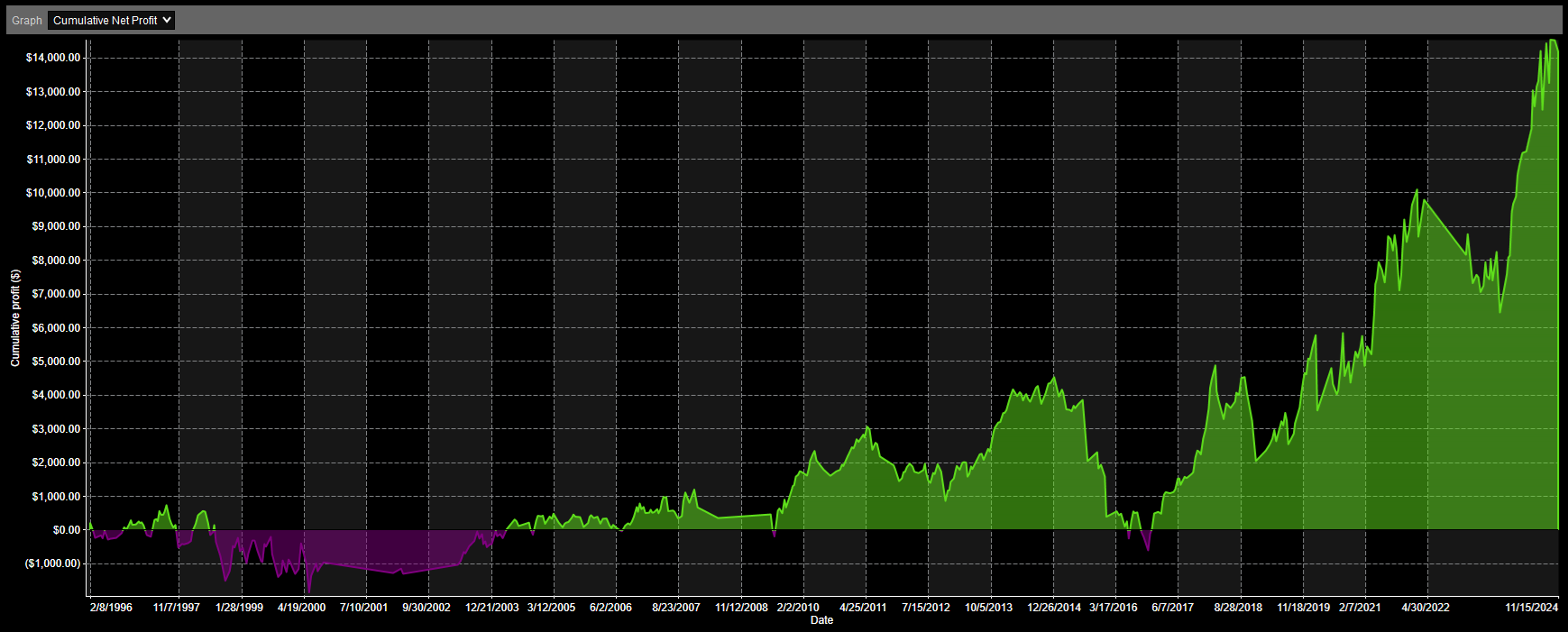

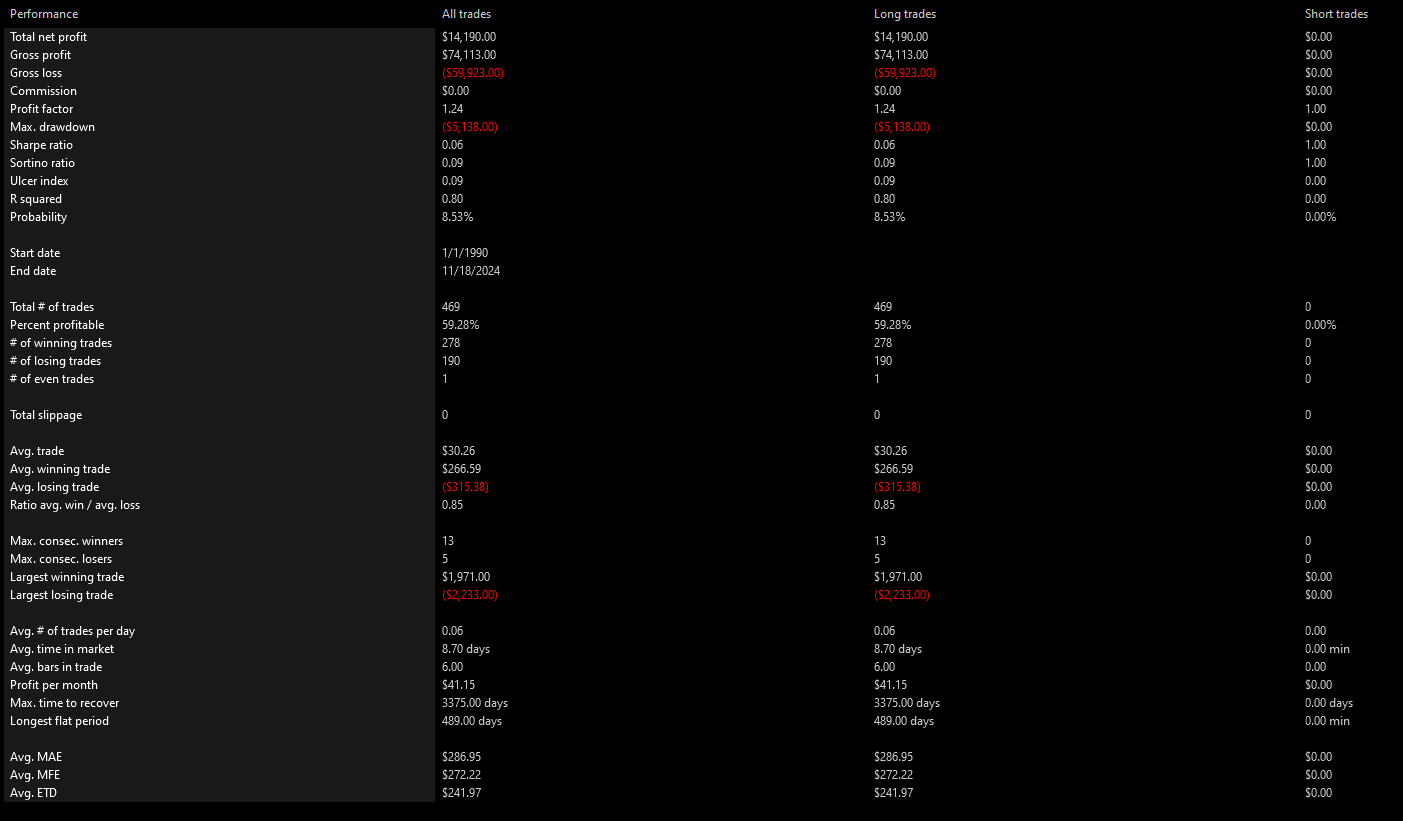

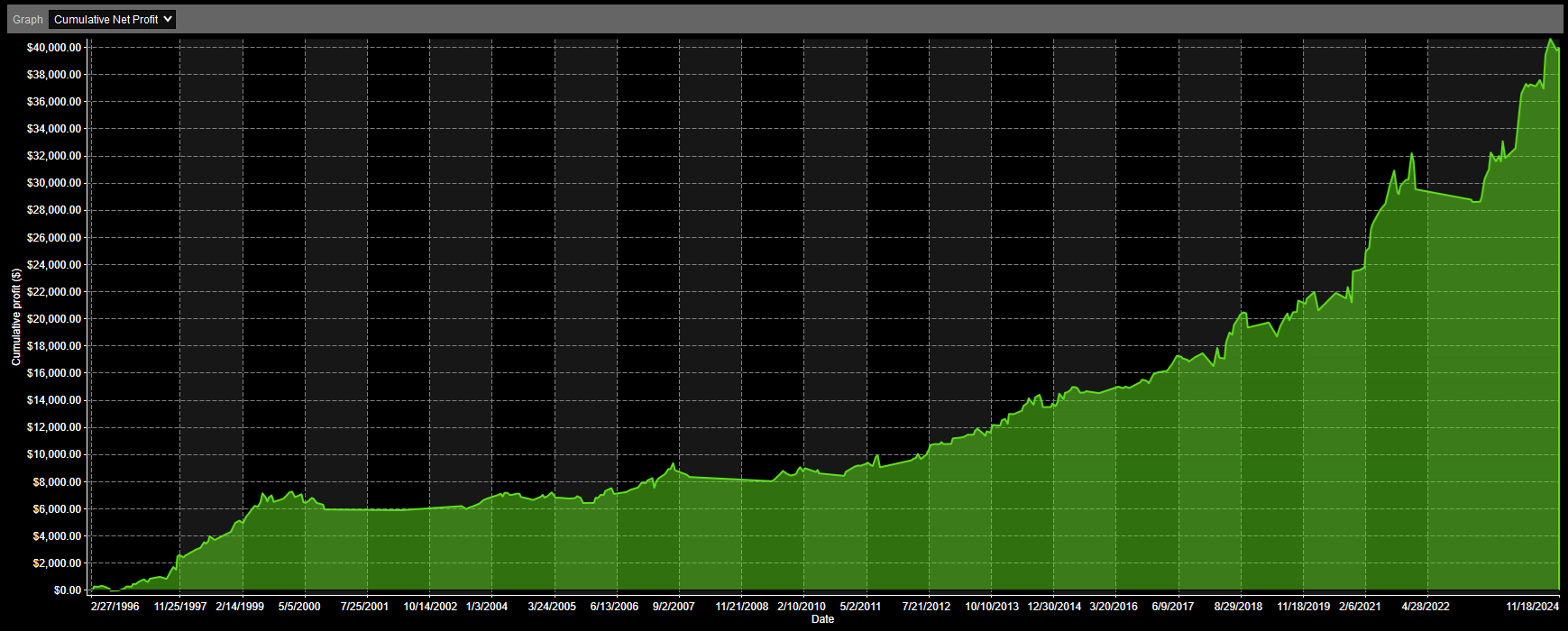

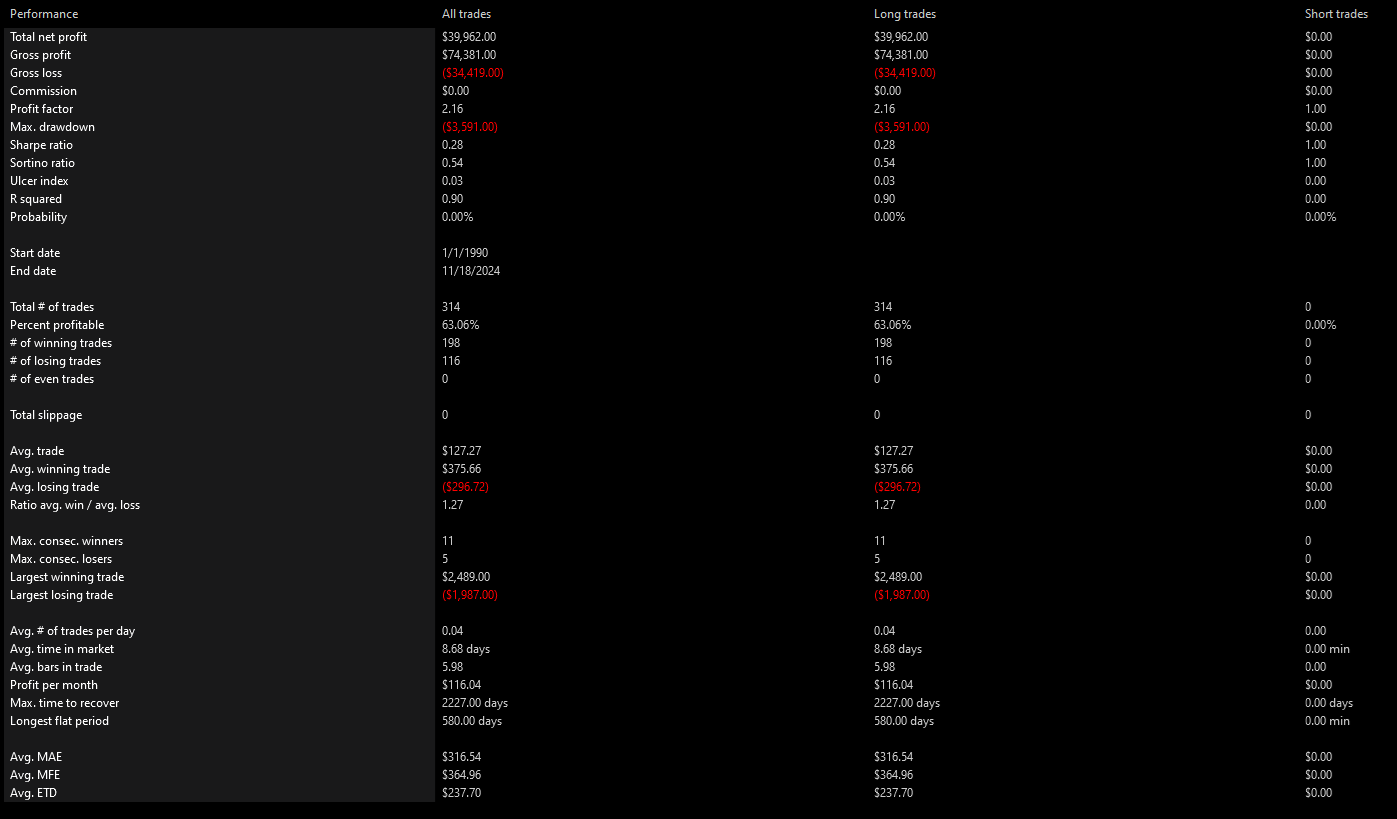

2-Period RSI Highs and Lows

The idea for these strategies comes from chapter 11 of How Markets Really Work (2012) by Larry Connors.

As with most of the strategies from this book, they are meant to illustrate certain characteristics of the market rather than be traded directly.

Rules

2-Period RSI Highs

- The asset (e.g., SPY) must be above its 200-day moving average.

- If the 2-period RSI closes above 85 (95 in the book), enter a long trade.

- Exit the trade after 5 trading days (~1 week).

2-Period RSI Lows

- The asset (e.g., SPY) must be above its 200-day moving average.

- If the 2-period RSI closes below 15 (5 in the book), enter a long trade.

- Exit the trade after 5 trading days (~1 week).

The 2-period RSI entry thresholds differ from the book as they led to improved backtest results.

I also wanted to avoid overlap with the 2-Period RSI strategy from Short Term Trading Strategies That Work.

Parameters

RSI Period: The period to use in the RSI calculation. (Default: 2)

RSI Smoothing: The smoothing to use in the RSI calculation. (Default: 1)

RSI Entry: The RSI entry threshold value. (Default: 85 for highs, 15 for lows)

Long-Term Trend Period: The period of the long-term trend as measured using a simple moving average. (Default: 200)

Days to Exit: The number of days to wait before exiting a trade. (Default: 5)